Comparative Analysis of Monthly Reports on the Oil Market

1. International Policy and Market Context

The US makes historic investments in clean energy

- On 7 August 2022, the US Senate passed the Inflation Reduction Act, a package to combat climate change, lower health-care costs, raise taxes on corporations, and reduce the federal deficit. The package authorizes the largest spending in U.S. history to tackle climate change — about $370 billion to reduce greenhouse gas emissions to 40 percent below their 2005 levels by the end of this decade. The bill includes support for growing renewable energy infrastructure, low-carbon hydrogen, and builds upon the carbon capture 45Q tax credit by providing bigger incentives and extending the deadline for infrastructure credits that begin construction prior to January 1, 2033. The provision includes increased credit values for direct air capture technologies at $180 per metric ton for those projects seeking to securely store captured CO2 in secure geologic formations, $130 per metric ton for carbon utilization and $130 per metric ton for CO2 stored in oil and gas fields.

OPEC+ countries increase production after new OPEC Secretary General takes office

- On 3 August, OPEC and non-OPEC countries agreed to adjust upward by 100 kb/d the monthly overall production for the month of September 2022 after reconfirming the production adjustment plan and the monthly production adjustment mechanism approved at the 19th and 29th OPEC and non-OPEC Ministerial Meetings. This was the first OPEC meeting after HE Haitham Al Ghais of Kuwait took office as Secretary General of OPEC on 1 August and US President Joe Biden visited Saudi Arabia last month.

Prices spike as Russia deepens cuts to natural gas flows to Europe

- On 27 July 2022, Gazprom cut gas deliveries to Europe via the Nord Stream pipeline to about 20 percent of its capacity. Natural gas prices rose by nearly 13 percent with the European benchmark TTF contract on reaching a high of over €200 a megawatt hour – a gas price equivalent to an oil price of $380 a barrel. On 30 July, Russia cut off gas to Latvia after supplies were cut to Poland, Bulgaria, Finland, Netherlands, and Denmark earlier in the year. The delivery route to Europe for Russian gas accounts for around a third of all Russian gas exports to Europe.

EU approves natural gas demand reduction measures

- On 26 July, the EU agreed to an emergency plan to use less gas amid uncertain Russian supplies after accepting proposals to “Save gas for a safe winter” that the European Commission’s tabled on 20 July. Energy ministers agreed that all EU countries with few exceptions should voluntarily cut gas use by 15 percent from August to March, compared with their average annual use during 2017-2021. Cuts will become binding in case of a severe gas storage in Europe, or if at least five countries ask for it. The agreement will save at least 30 billion cubic metres of gas – enough to survive an average winter if Russia fully cuts supplies.

Nigeria passes new electricity reforms

- On 20 July 2022, Nigeria passed the Electricity Bill 2022 which allows states to generate and distribute power by allowing state governments to license those who intend to operate mini grids within the states. The bill also aims to improve the use of generated power through increased investments in new technology to enhance transmission and distribution, while stimulating policy and regulatory measures to scale up efficient power generation, transmission, and distribution capabilities of the sector. The passage of the Bill came as the country’s national grid collapsed for the seventh time this year.

2. KEY POINTS

2.1 DEMAND

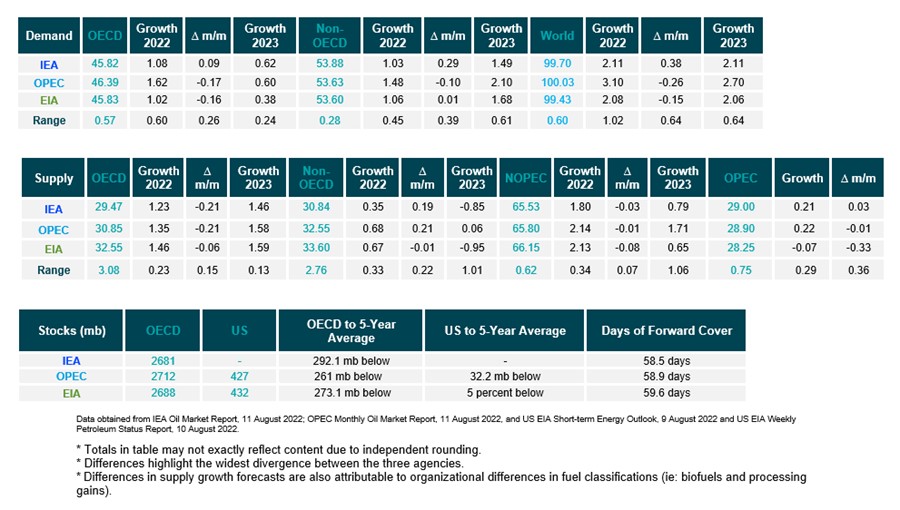

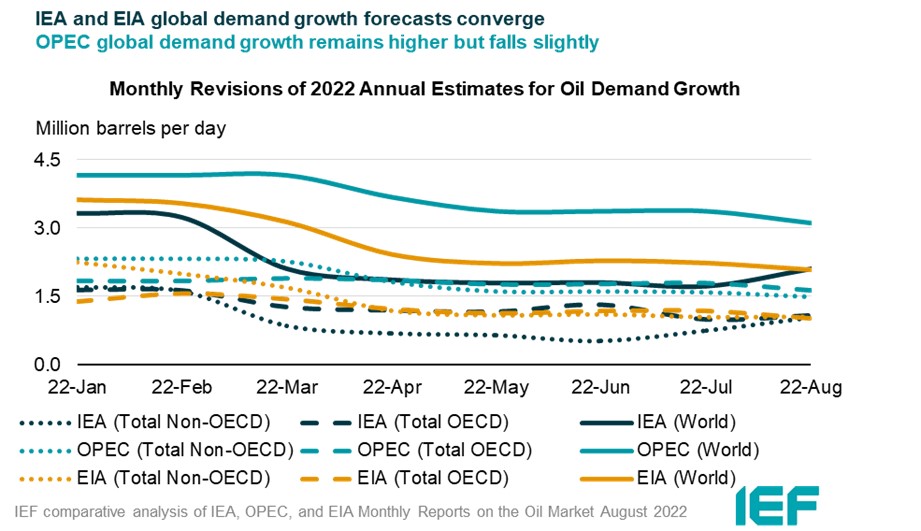

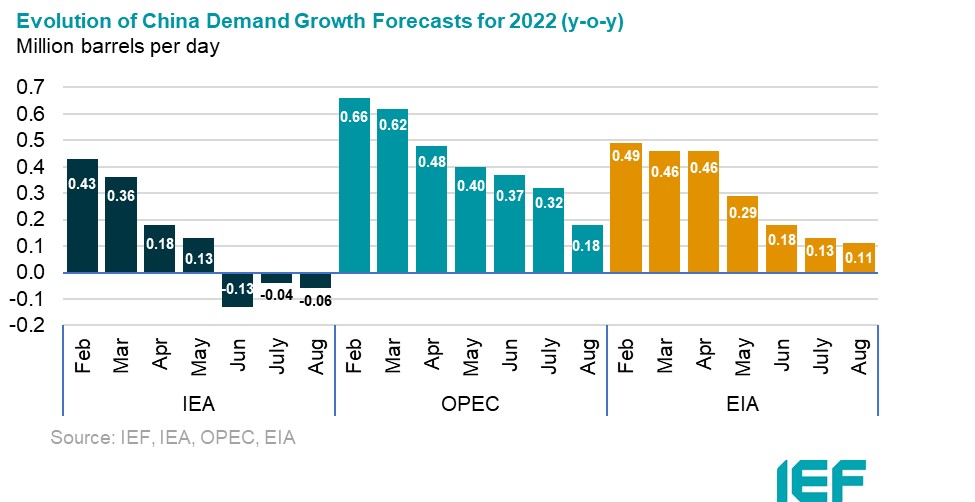

The IEA and EIA expect similar demand growth while OPEC growth remains higher.

- IEA’s demand growth assessment for this year rises by 380 kb/d to 2.11 mb/d year-on-year (y-o-y). Growth remains the same in 2023.

- OPEC’s y-o-y forecast falls by 260 kb/d for a growth of 3.10 mb/d.

- EIA’s assessment falls by 150 kb/d for a growth of 2.08 mb/d this year. The IEA, OPEC, and EIA estimates for absolute world demand are now 99.70 mb/d, 100.03 mb/d, and 99.43 mb/d for 2022, respectively.

OPEC reports greater OECD and non-OECD demand growth compared to the IEA and EIA.

- The IEA's assessment of y-o-y non-OECD demand growth rises by 290 kb/d to 1.03 mb/d, while OPEC’s estimate falls by 100 kb/d to 1.48 mb/d. EIA non-OECD demand growth rises by 10 kb/d to 1.06 mb/d.

- The IEA's estimate for OECD demand growth rises by 90 kb/d to 1.08 mb/d for 2022 while OPEC’s projection falls by 170 kb/d for a growth of 1.62 mb/d. EIA demand growth also falls by 160 kb/d for a growth of 1.02 mb/d.

- The largest divergence in OECD and non-OECD demand growth estimates are between EIA and OPEC at 0.60 mb/d and between IEA and OPEC at 0.45 mb/d, respectively.

2.2 SUPPLY

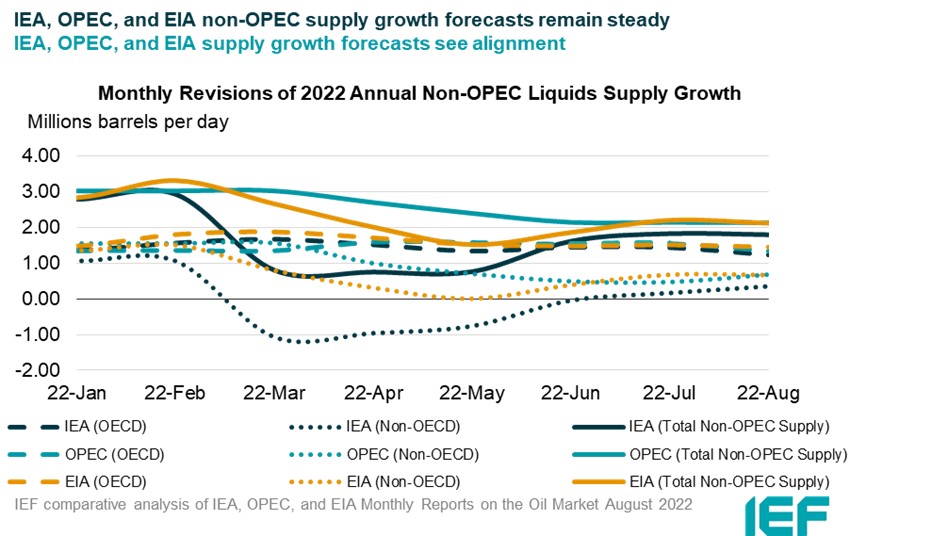

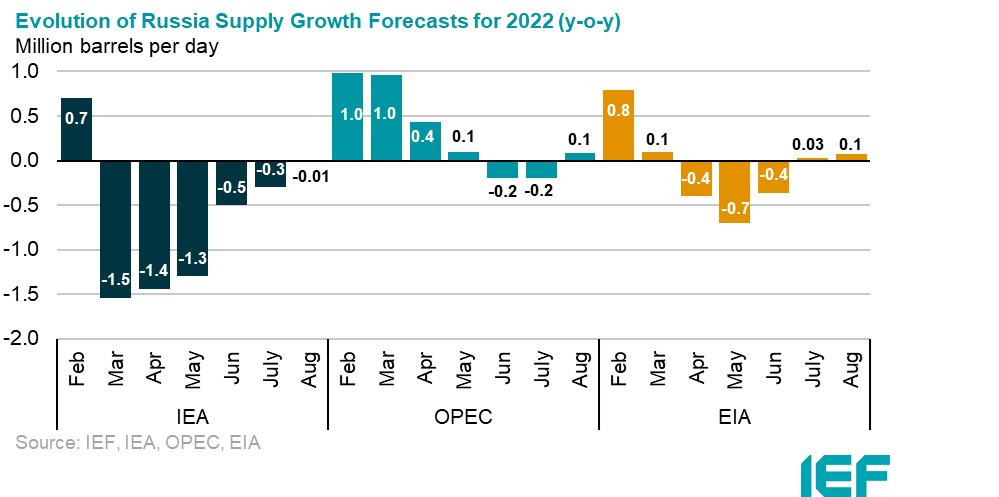

The IEA, OPEC, and the EIA report similar growth in non-OPEC supply.

- The IEA’s August assessment for non-OPEC supply falls by 30 kb/d to reach a growth of 1.80 mb/d while OPEC’s estimate falls by 10 kb/d for a growth of 2.14 mb/d. The EIA’s assessment falls by 80 kb/d for an overall growth of 2.13 mb/d. In absolute values, the IEA, OPEC, and the EIA estimate non-OPEC supply at 65.53 mb/d, 65.80 mb/d, and 66.15 mb/d, respectively for 2022.

- The IEA estimates OECD oil supply growth this year at 1.23 mb/d, OPEC pegs it at 1.35 mb/d, and EIA reports growth at 1.46 mb/d, a decrease of 210 kb/d, 210 kb/d, and 60 kb/d, respectively. In absolute terms, the IEA, OPEC, and the EIA estimate OECD oil supply at 29.47 mb/d, 30.85 mb/d, and 32.55 mb/d, respectively for 2022. The divergence between OECD supply growth estimates of the IEA and EIA is 230 kb/d.

The IEA forecasts less non-OECD supply growth compared to OPEC and EIA in 2022.

- The IEA’s assessment for non-OECD supply rises by 190 kb/d to a total growth of 0.35 mb/d in 2022.

- OPEC revised up its forecast by 210 kb/d to a growth of 0.68 mb/d while the EIA revised its non-OECD growth forecast down by 10 kb/d to a growth of 0.67 mb/d.

- In absolute values, the IEA, OPEC, and the EIA non-OECD supply estimates are 30.84 mb/d, 32.55 mb/d, and 33.60 mb/d, respectively for 2022 with the largest divergence in growth estimates between the IEA and OPEC at 0.33 mb/d.

The IEA, EIA, and OPEC revise OPEC production estimates.

- The IEA increased its OPEC production estimate for July by 210 kb/d month-on-month (m-o-m) to reach total production of 29.00 mb/d.

- OPEC also revised its assessment of OPEC production upward by 216 kb/d to 28.90 mb/d.

- The EIA revised its assessment downward by 70 kb/d with total OPEC crude production reaching 28.25 mb/d.

2.4 Snapshot (mb/d)

3. Global Analysis

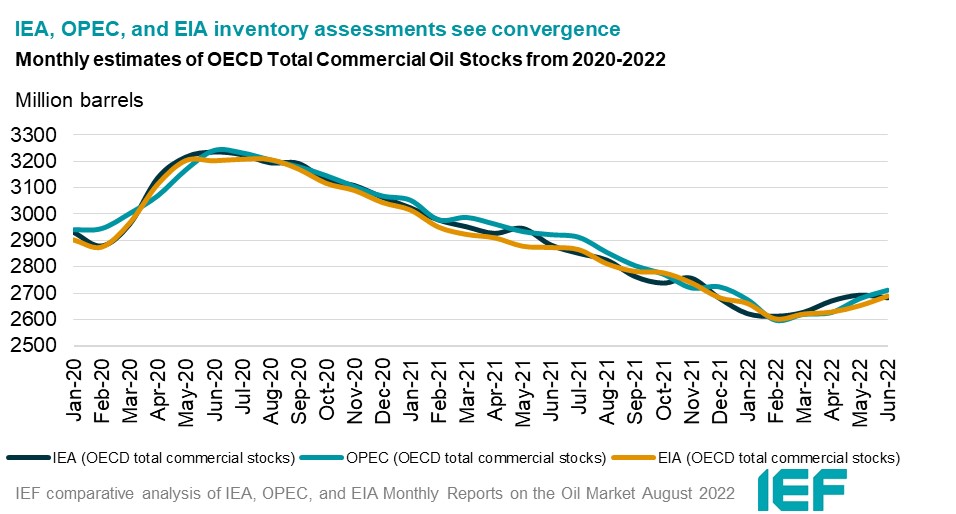

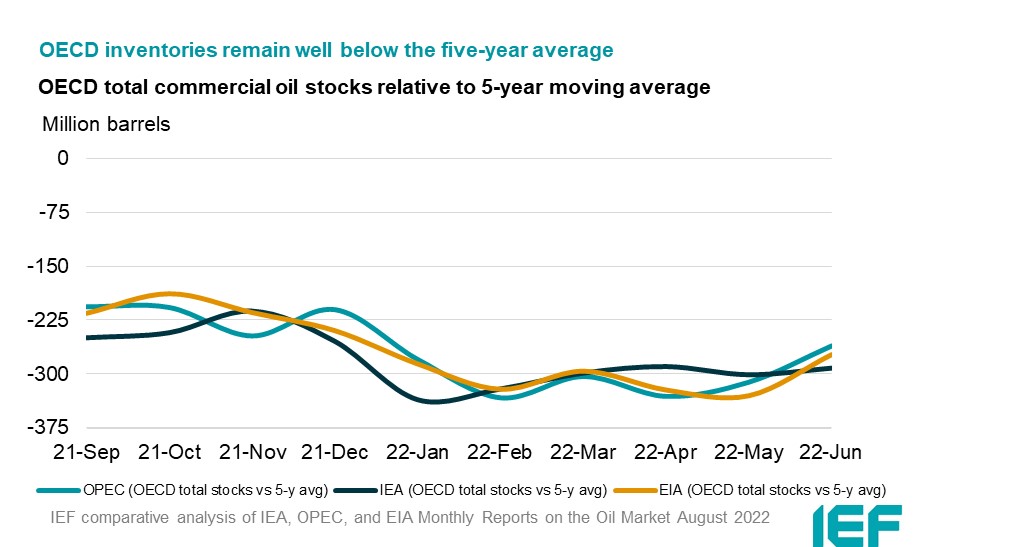

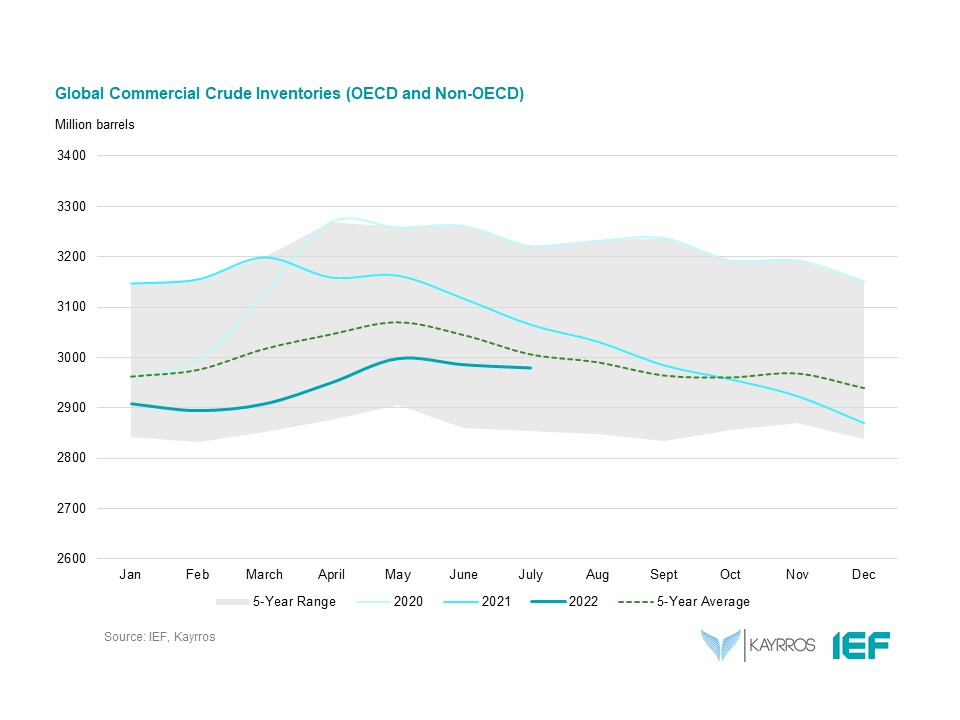

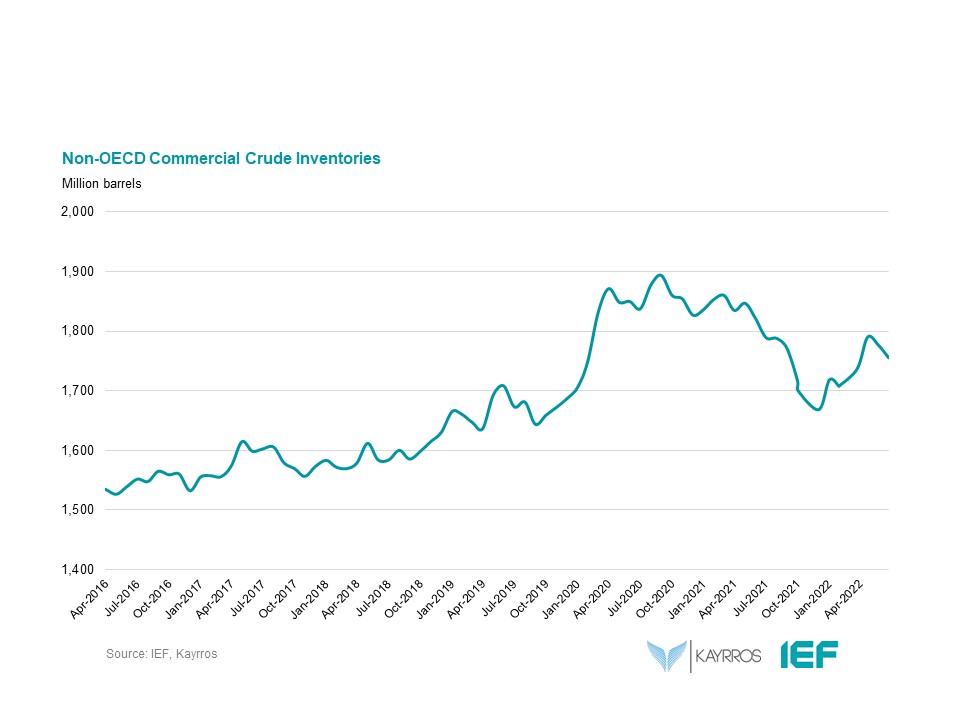

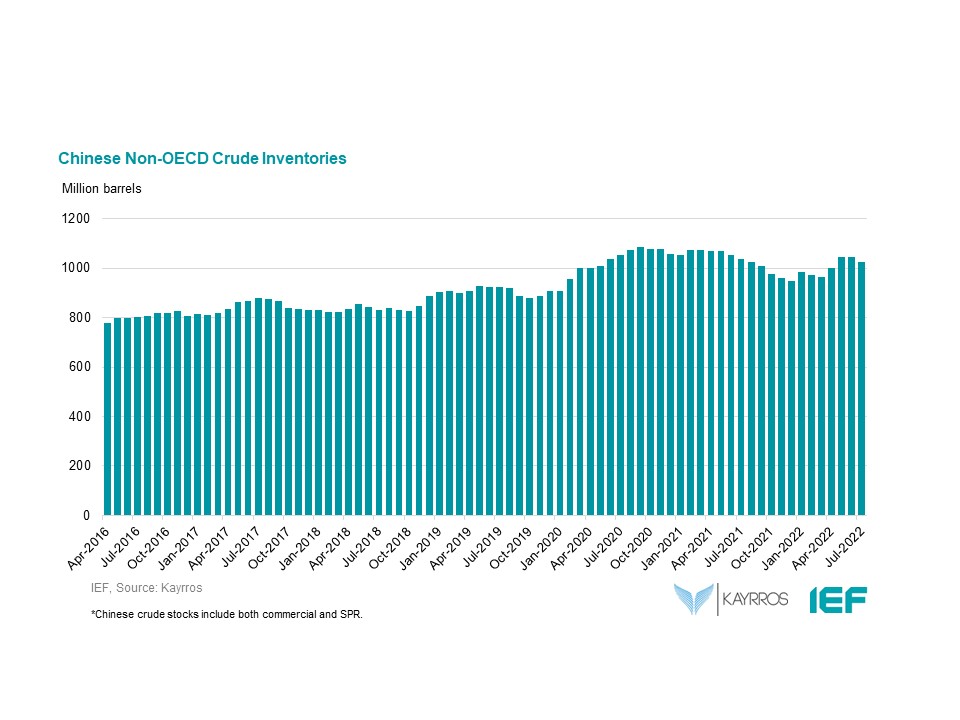

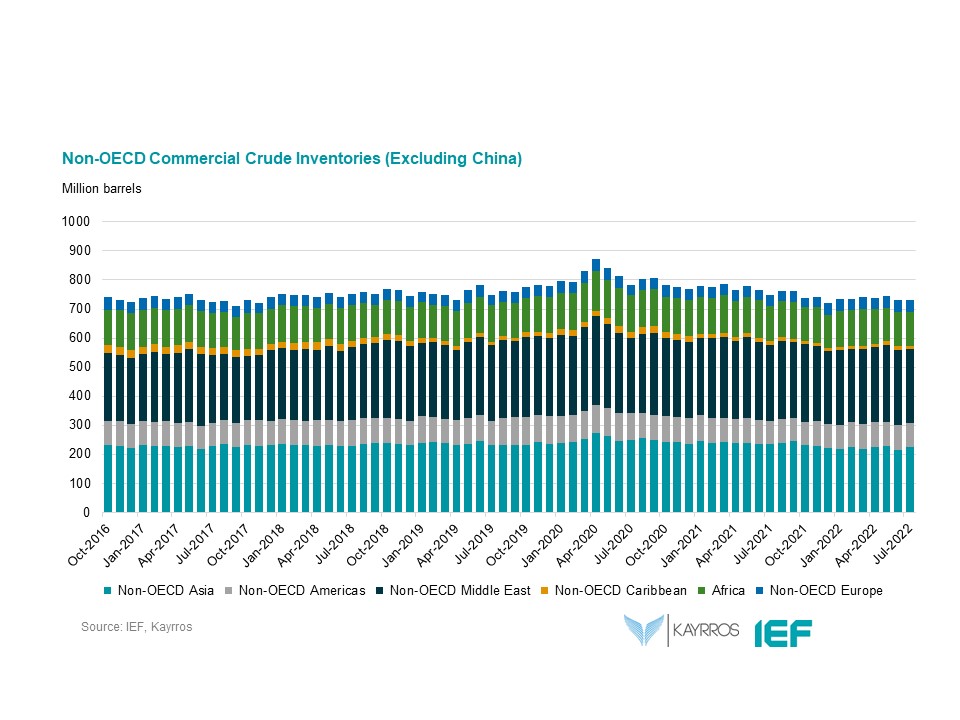

IEF-Kayrros Stock Analysis:

Explanatory Note

The IEF conducts a comprehensive comparative analysis of the short-, medium-, and long-term energy outlooks of the IEA, OPEC, and the EIA to inform the IEA-IEF-OPEC Symposium on Energy Outlooks that the IEF hosts in Riyadh as part of the trilateral work programme on a yearly basis.

To inform IEF stakeholders on how perspectives on the oil market of both organisations evolve over time regularly, this monthly summary provides:

- An overview of key events and initiatives in the international policy and market context.

- Key findings and a snapshot overview of data points gained from comparing basic historical data and short-term forecasts of the IEA Oil Market Report, the OPEC Monthly Oil Market Report, and the EIA Short-term Energy Outlook.

- A comparative analysis of oil inventory data reported by the IEA, OPEC, and EIA, and secondary sources in collaboration with Kayrros (added in an updated report on the IEF website).

The International Energy Forum

The International Energy Forum is the leading global facilitator of dialogue between sovereign energy market participants. It incorporates members of International Energy Agency and the Organization of the Petroleum Exporting Countries, and also key players including China, India, Russia and South Africa. The forum's biennial ministerial meetings are the world's largest gathering of energy ministers, where discussions focus on global energy security and the transition towards a sustainable and inclusive energy future. The forum has a permanent secretariat of international staff based in the Diplomatic Quarter of Riyadh, Saudi Arabia. For more information visit www.ief.org.