Comparative Analysis of Monthly Reports on the Oil Market

1. International Policy and Market Context

Explosions cause leaks on the Nord Stream gas pipeline

- On 26 September, Nord Stream 1 and its parallel pipeline Nord Stream 2 suffered catastrophic failure. Norway and Denmark reported four leaks in both pipelines that run under the Baltic Sea. The Swedish Security Service subsequently concluded that there were detonations at Nord Stream 1 and 2 in the Swedish economic zone. Britain, America, and the EU have all declared the incident an act of sabotage, as has Russia. The Nord Stream 1 pipeline has not transported any gas since late August when Russia closed it down for maintenance. Nord Stream 2 was never put into operation after its construction.

OPEC+ countries make production adjustment

- On 5 October, OPEC and non-OPEC countries agreed to adjust downward the overall production quotas by 2 mb/d from the August 2022 required production levels, starting November 2022 for OPEC and non-OPEC Participating Countries. The meeting noted the uncertainty surrounding the global economic and oil market outlooks, and the need to enhance the long-term guidance for the oil market. OPEC and non-OPEC countries will grant the Joint Ministerial Monitoring Committee the authority to hold additional meetings, or to request an OPEC and non-OPEC Ministerial Meeting at any time to address market developments if necessary.

International Monetary Fund forecasts economic slowdown

- The IMF’s latest World Economic Outlook forecasts the global economy to slow from 6 percent in 2021 to 3.2 percent in 2022 and 2.7 percent in 2023. Most notably, the forecast concludes that this is the weakest growth profile since 2001 except for the global financial crisis and the acute phase of the COVID-19 pandemic. Global inflation is forecast to rise from 4.7 percent in 2021 to 8.8 percent in 2022 but to decline to 6.5 percent in 2023 and to 4.1 percent by 2024.

Germany introduces price caps on electricity and natural gas

- On 29 September, Germany unveiled price caps on energy to protect businesses and consumers from skyrocketing energy costs. The 200-billion-euro ($194 billion) initiative will set a limit for natural gas prices and pay the difference between that cap and what gas importers pay on the world market based on a given consumption level. On 10 October, the government approved a plan to pay December’s natural gas bill for every household and small-to-medium business in the country. This would be followed by a subsidy scheme from March 2023 onwards that will provide relief from high prices but still incentivize citizens to save energy.

Chinese imports of Russian coal hit five-year high

- Imports of Russian coal reached 8.54 million tons in September amid soaring energy demand in China. This is up from the previous peak of 7.42 million tons in July and 57 percent higher than the same period last year, according to Chinese customs data. The monthly figure is the highest on record since comparable statistics began in 2017.

2. KEY POINTS

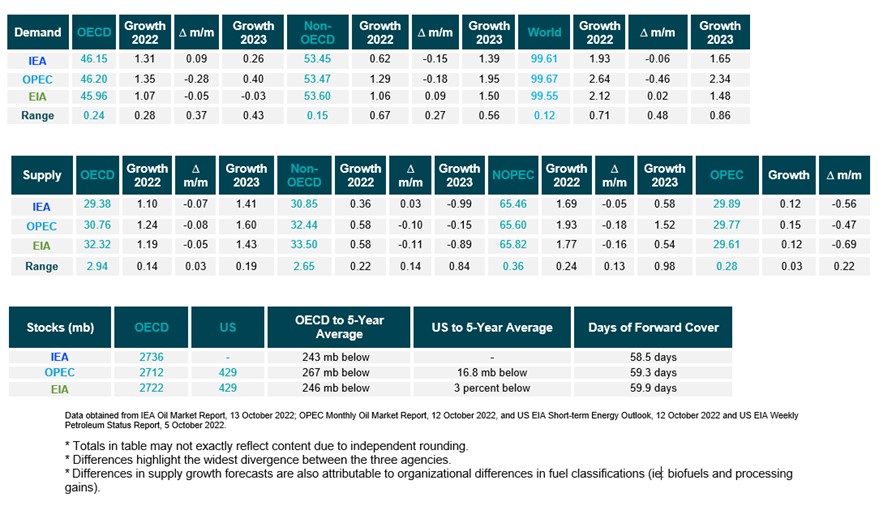

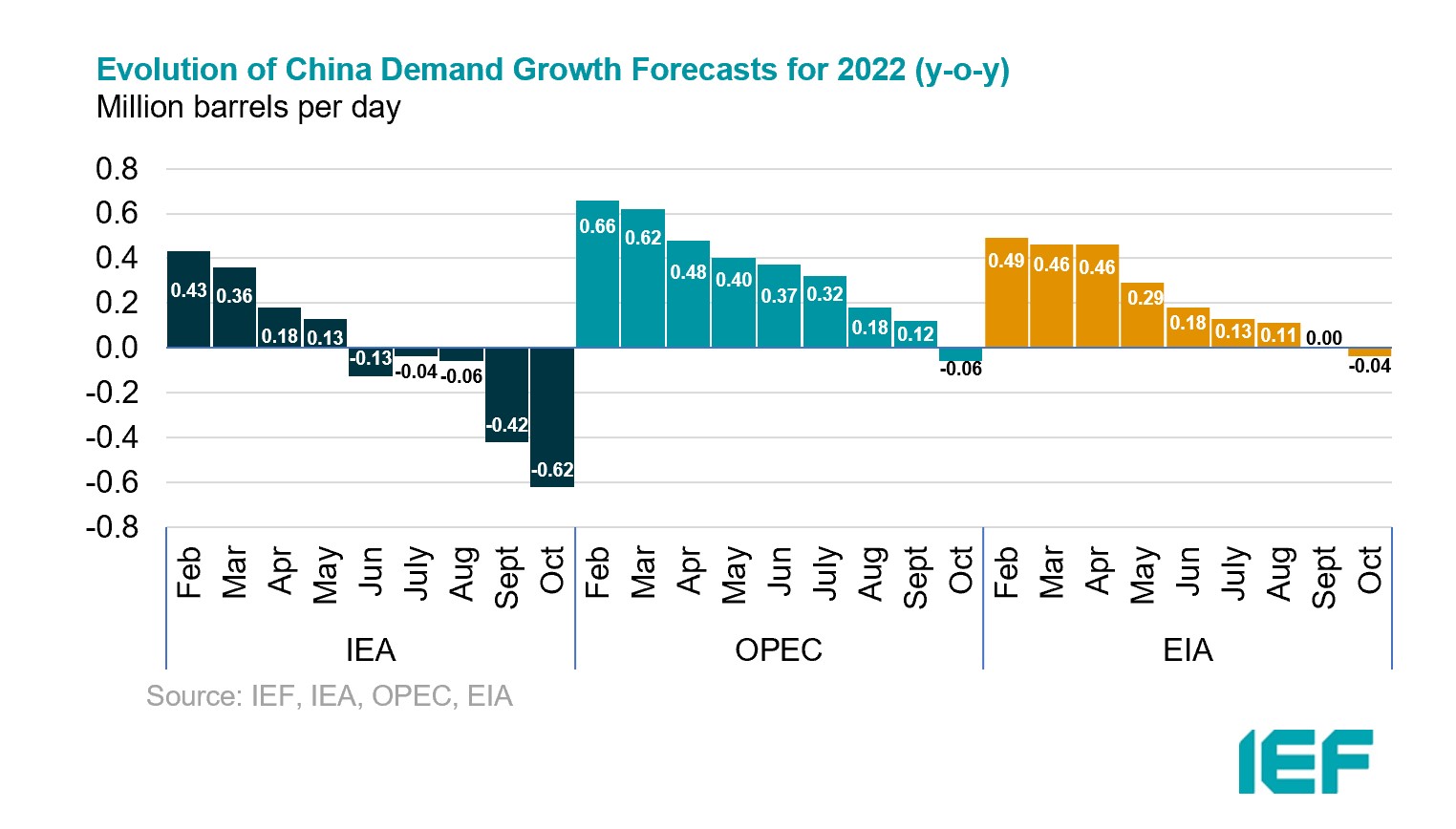

2.1 DEMAND

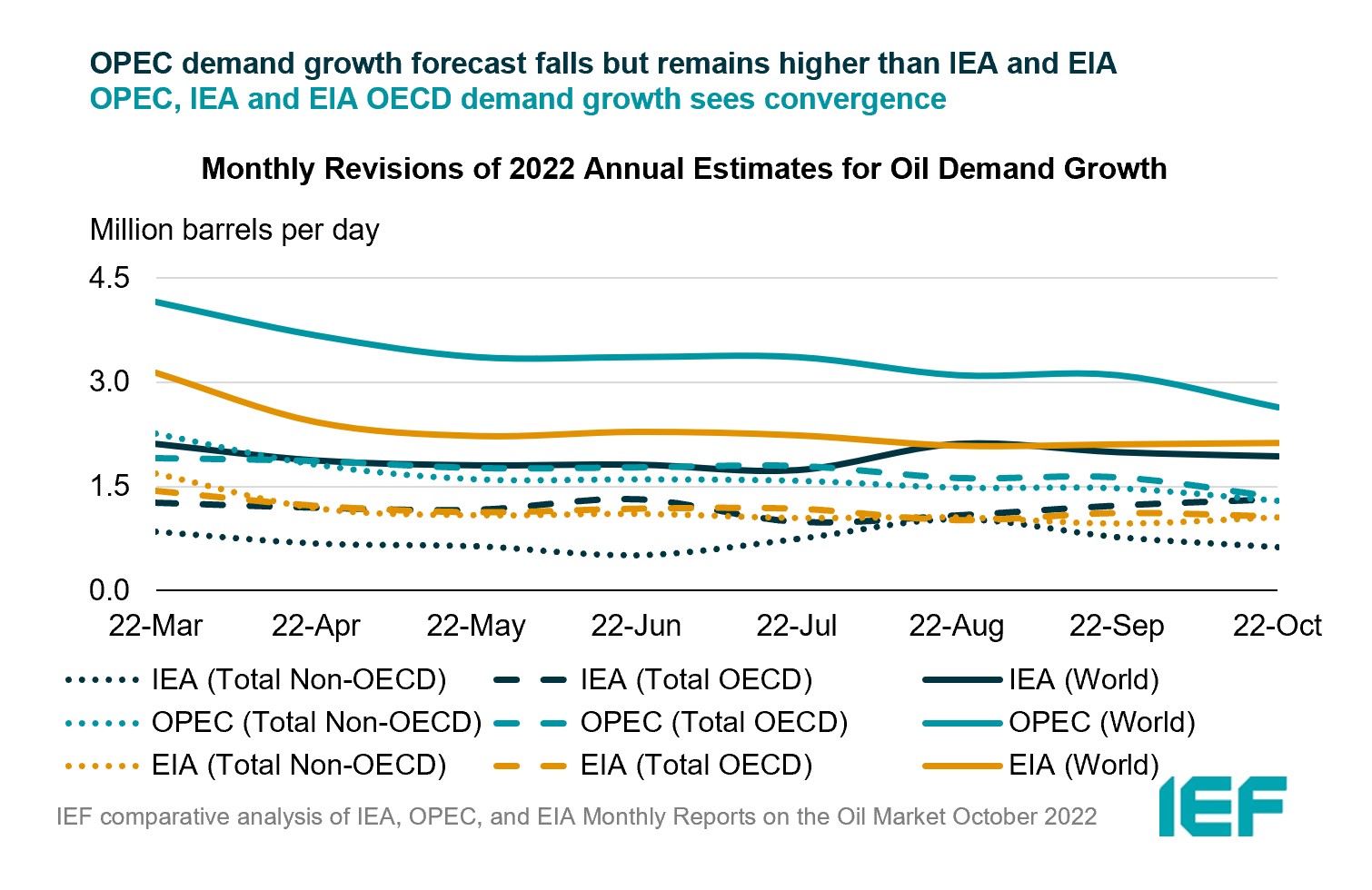

OPEC’s demand growth estimate falls but remains higher than IEA and EIA.

- IEA’s demand growth assessment for this year falls by 60 kb/d to 1.93 mb/d year-on-year (y-o-y) due to reduced Chinese demand. Growth falls to 1.65 mb/d in 2023.

- OPEC’s y-o-y forecast falls by a substantial 460 kb/d for a growth of 2.64 mb/d.

- EIA’s assessment rises by 20 kb/d for a growth of 2.12 mb/d this year. The IEA, OPEC, and EIA estimates for absolute world demand are now 99.61mb/d, 99.67 mb/d, and 99.55 mb/d for 2022, respectively.

IEA non-OECD demand growth falls further while OPEC and EIA converge

- The IEA's assessment of y-o-y non-OECD demand growth falls by 150 kb/d to 0.62 mb/d, while OPEC’s estimate falls by 180 kb/d to 1.29 mb/d. EIA non-OECD demand growth rises by 90 kb/d to 1.06 mb/d.

- The IEA's estimate for OECD demand growth rises by 90 kb/d to 1.31 mb/d for 2022 while OPEC’s projection falls by 280 kb/d for a growth of 1.35 mb/d. EIA demand growth also falls by 50 kb/d for a growth of 1.07 mb/d.

- The largest divergence in OECD and non-OECD demand growth estimates are between EIA and OPEC at 0.28 mb/d and between IEA and OPEC at 0.67 mb/d, respectively.

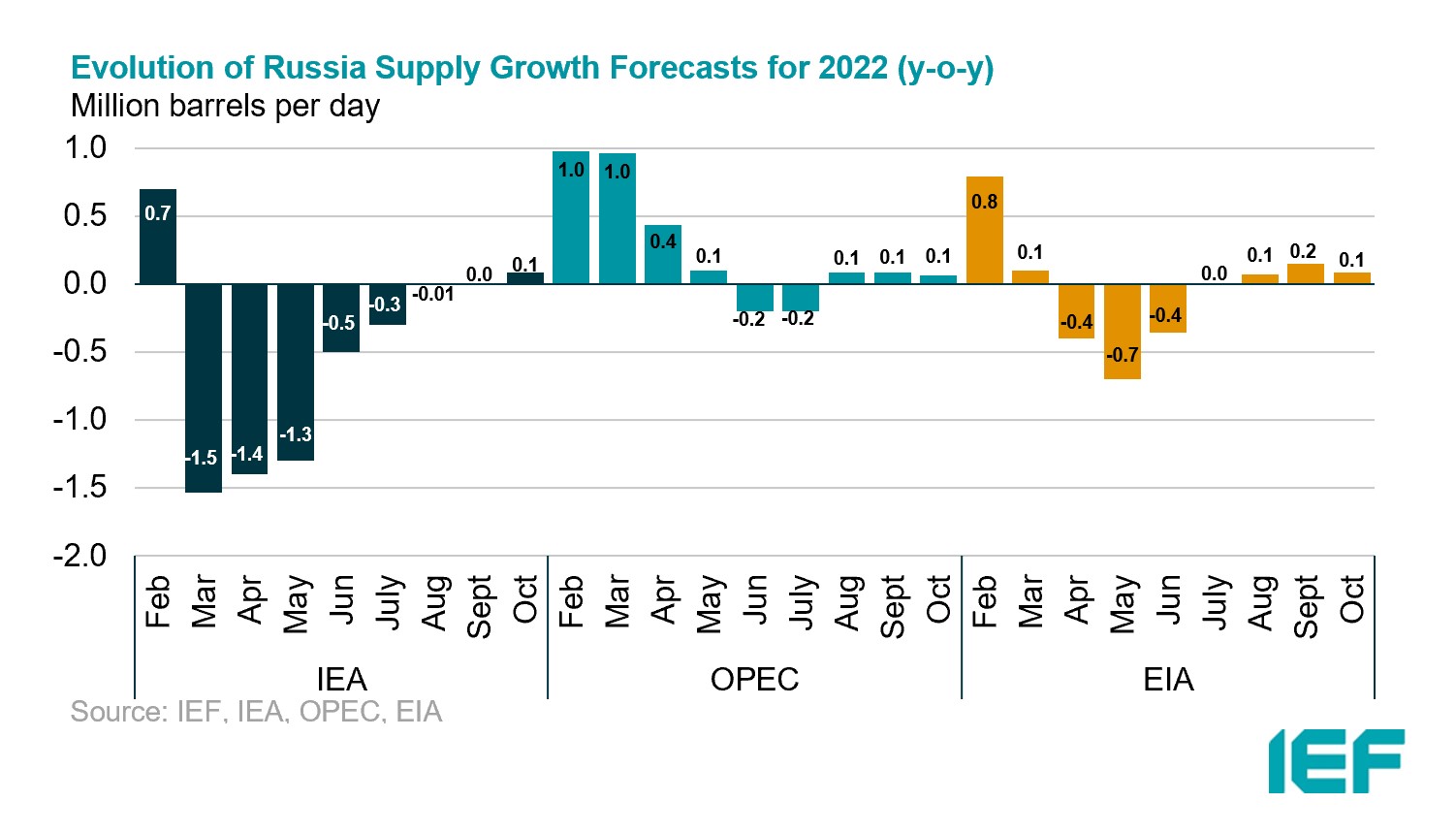

2.2 SUPPLY

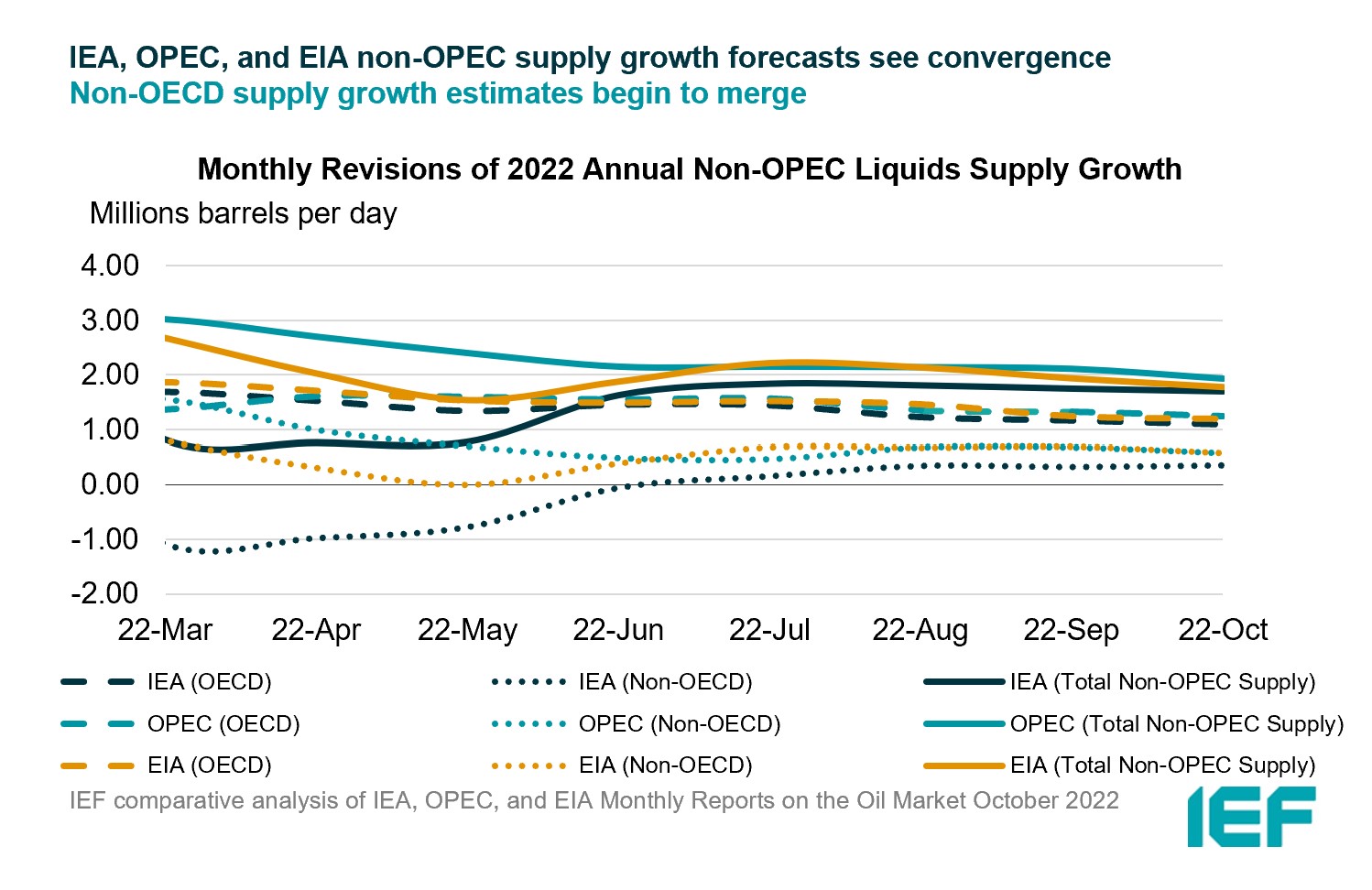

The IEA, OPEC, and the EIA report similar growth in non-OPEC supply.

- The IEA’s October assessment for non-OPEC supply falls by 50 kb/d to reach a growth of 1.69 mb/d while OPEC’s estimate falls by 180 kb/d for a growth of 1.93 mb/d. The EIA’s assessment falls by 160 kb/d for an overall growth of 1.77 mb/d. In absolute values, the IEA, OPEC, and the EIA estimate non-OPEC supply at 65.46 mb/d, 65.60 mb/d, and 65.82 mb/d, respectively for 2022.

- The IEA estimates OECD oil supply growth this year at 1.10 mb/d, OPEC pegs it at 1.24 mb/d, and EIA reports growth at 1.19 mb/d, a decrease of 70 kb/d, 80 kb/d, and 50 kb/d, respectively. In absolute terms, the IEA, OPEC, and the EIA estimate OECD oil supply at 29.38 mb/d, 30.76 mb/d, and 32.32 mb/d, respectively for 2022. The largest divergence of OECD supply growth estimates is between IEA and OPEC at 140 kb/d.

The IEA, OPEC, and EIA non-OECD supply growth forecasts move closer.

- The IEA’s assessment for non-OECD supply rises by 30 kb/d to a total growth of 0.36 mb/d in 2022.

- OPEC’s forecast falls by 100 kb/d to 0.58 mb/d while the EIA revised its non-OECD growth forecast down by 110 kb/d to a growth of 0.58 mb/d.

- In absolute values, the IEA, OPEC, and the EIA non-OECD supply estimates are 30.85 mb/d, 32.44 mb/d, and 33.50 mb/d, respectively for 2022 with the divergence in growth estimates between the IEA and EIA/OPEC at 0.22 mb/d.

The IEA, EIA, and OPEC revise OPEC production estimates.

- The IEA increased its OPEC production estimate for September by 120 kb/d month-on-month (m-o-m) to reach total production of 29.89 mb/d.

- OPEC also revised its assessment of OPEC production upward by 150 kb/d to 29.77 mb/d.

- The EIA revised its assessment upward by 120 kb/d with total OPEC crude production reaching 29.61 mb/d.

2.3 STOCKS

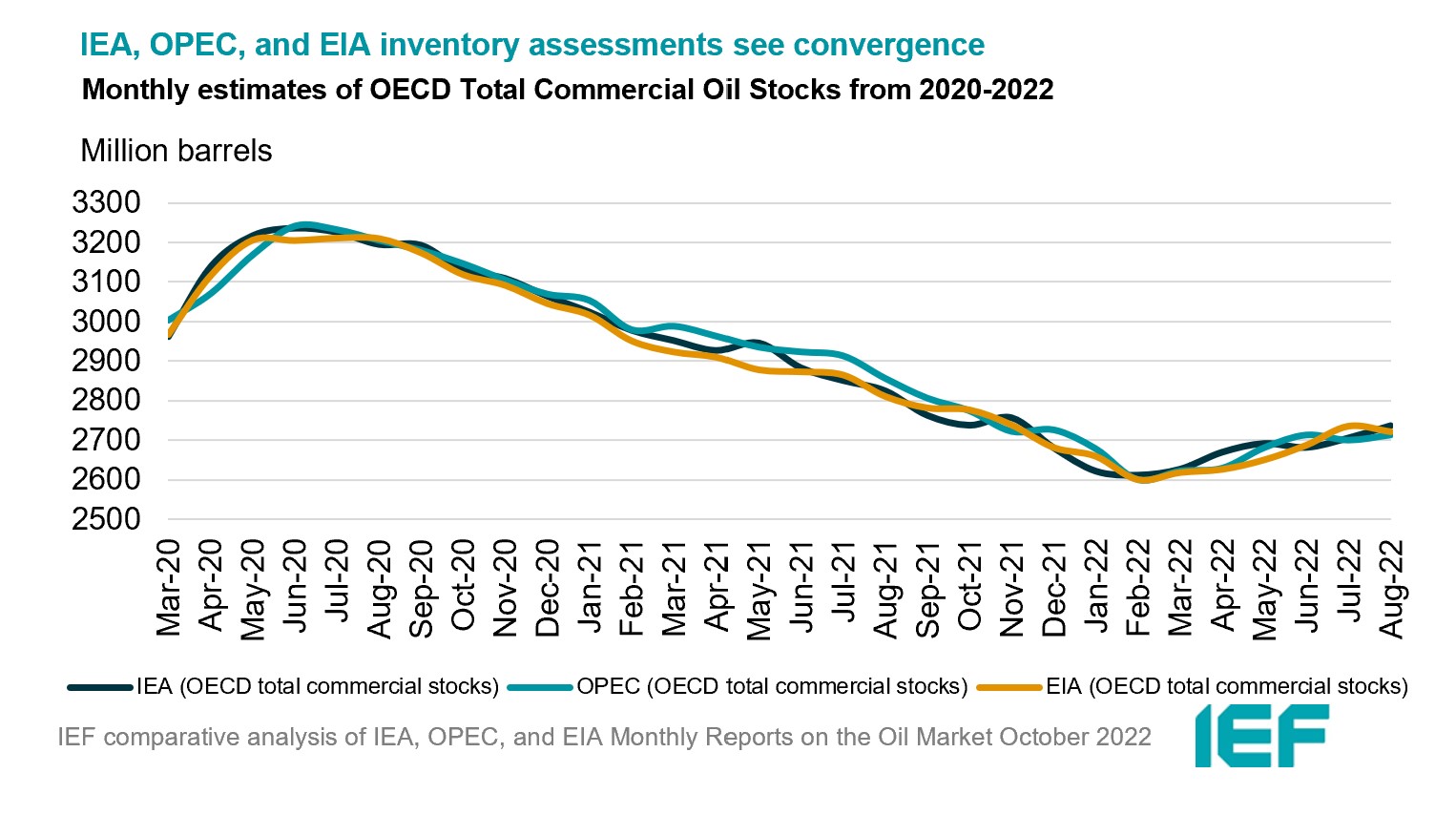

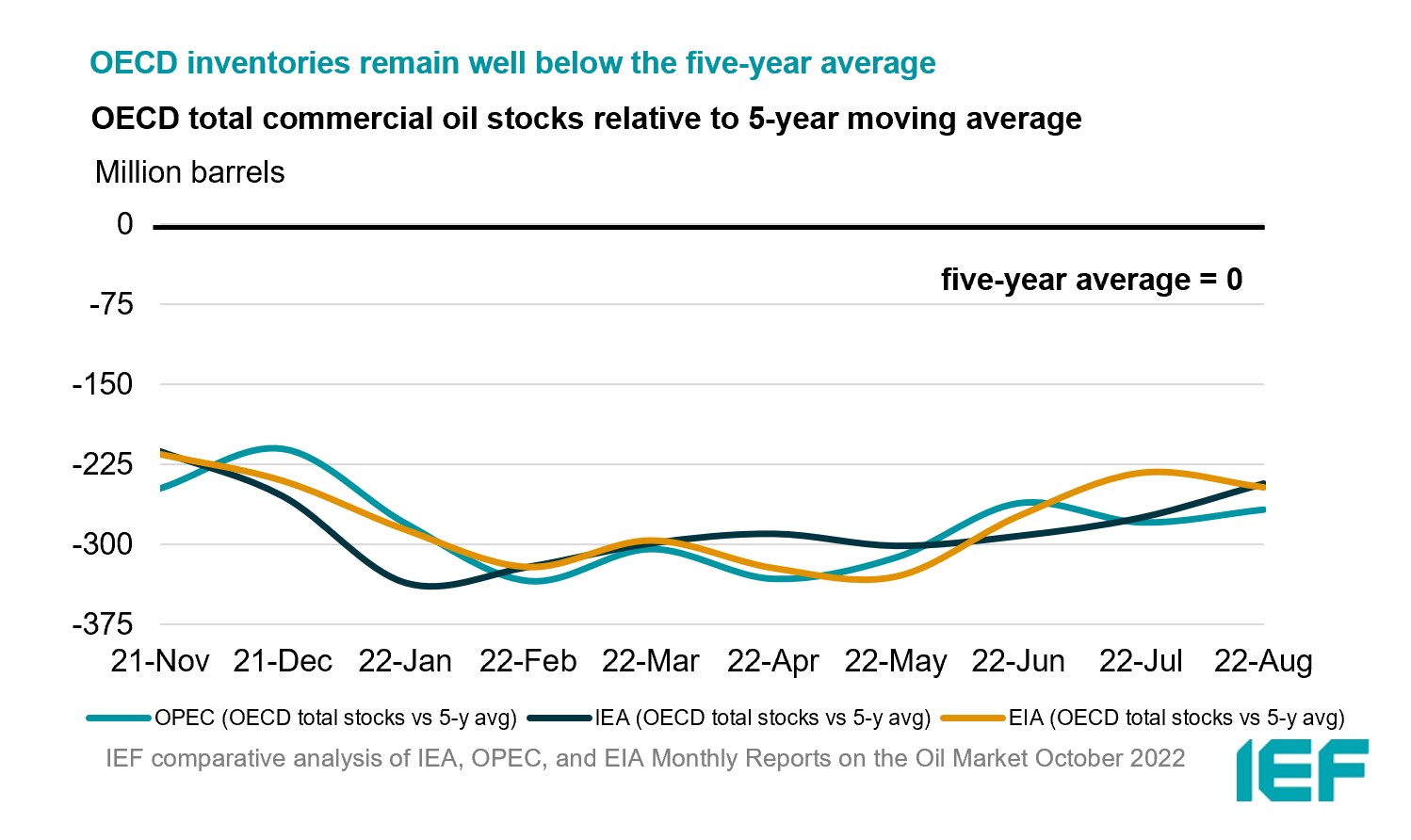

The IEA, OPEC, and EIA continue to display strong alignment on stock figures which are below the five-year average and close to 60 days forward cover.

- The IEA reports OECD stock levels at 2736 mb, which is close to OPEC’s assessment of 2712 mb and EIA’s assessment of 2722 mb. These are around 243 mb, 267 mb, and 246 mb below the five-year average, respectively.

- According to the IEA, crude oil inventories built by 7.5 mb while product stocks built by 4.7 mb. Other oils, including NGLs and feedstocks built by 4.7 mb. According to OPEC, crude oil stocks built by 6.8 mb while products built by 1 mb.

- The EIA estimates OECD inventories fell by 31 mb in August to 2722 mb – 246 mb below the five-year average.

- The widest divergence in inventories is between the EIA and OPEC at 24 mb. Total US crude inventories (excluding SPR) amount to about 429 mb, according to the EIA, which is 3 percent below the five-year average for this time of year.

2.4 Snapshot (mb/d)

3. Global Analysis

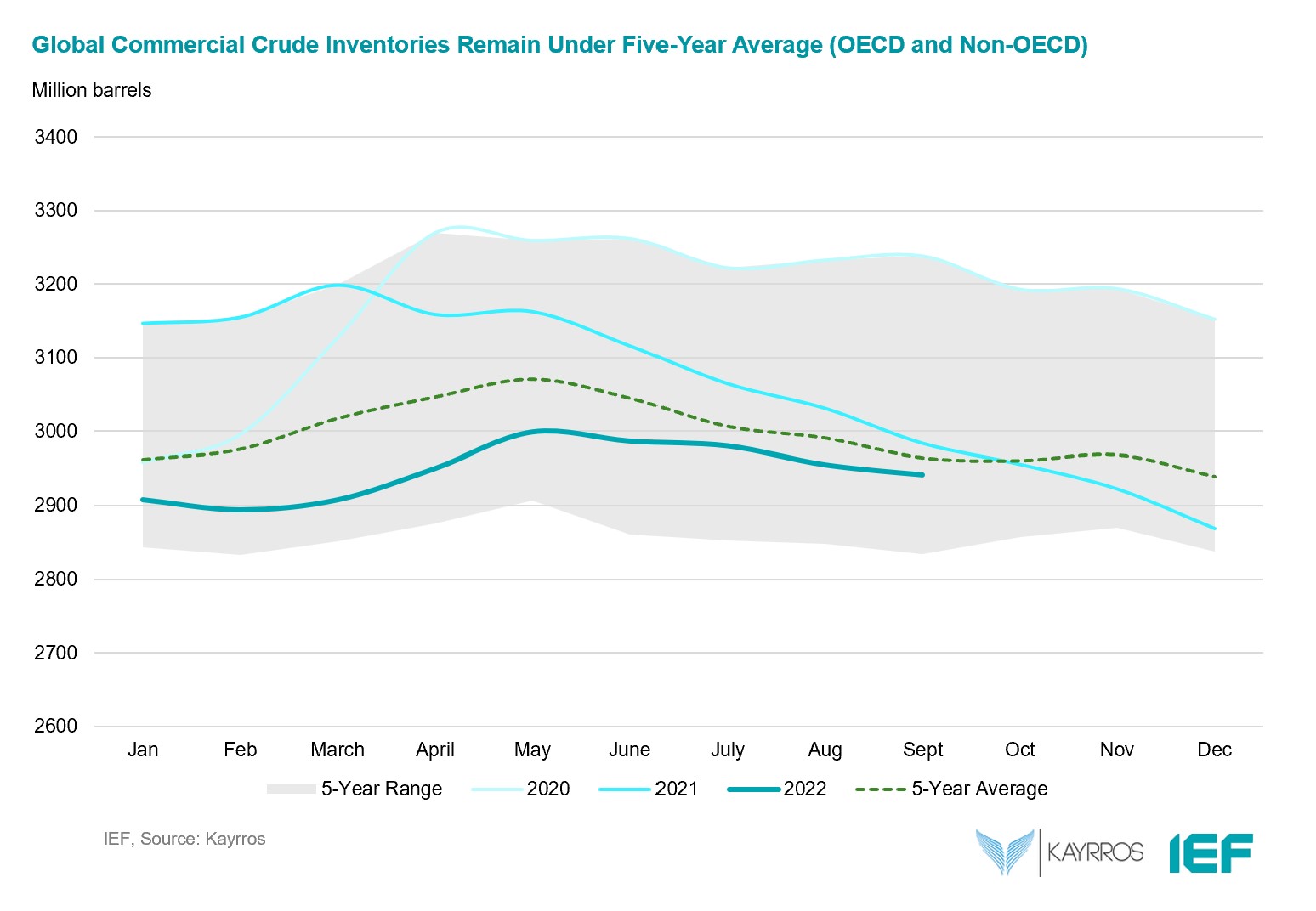

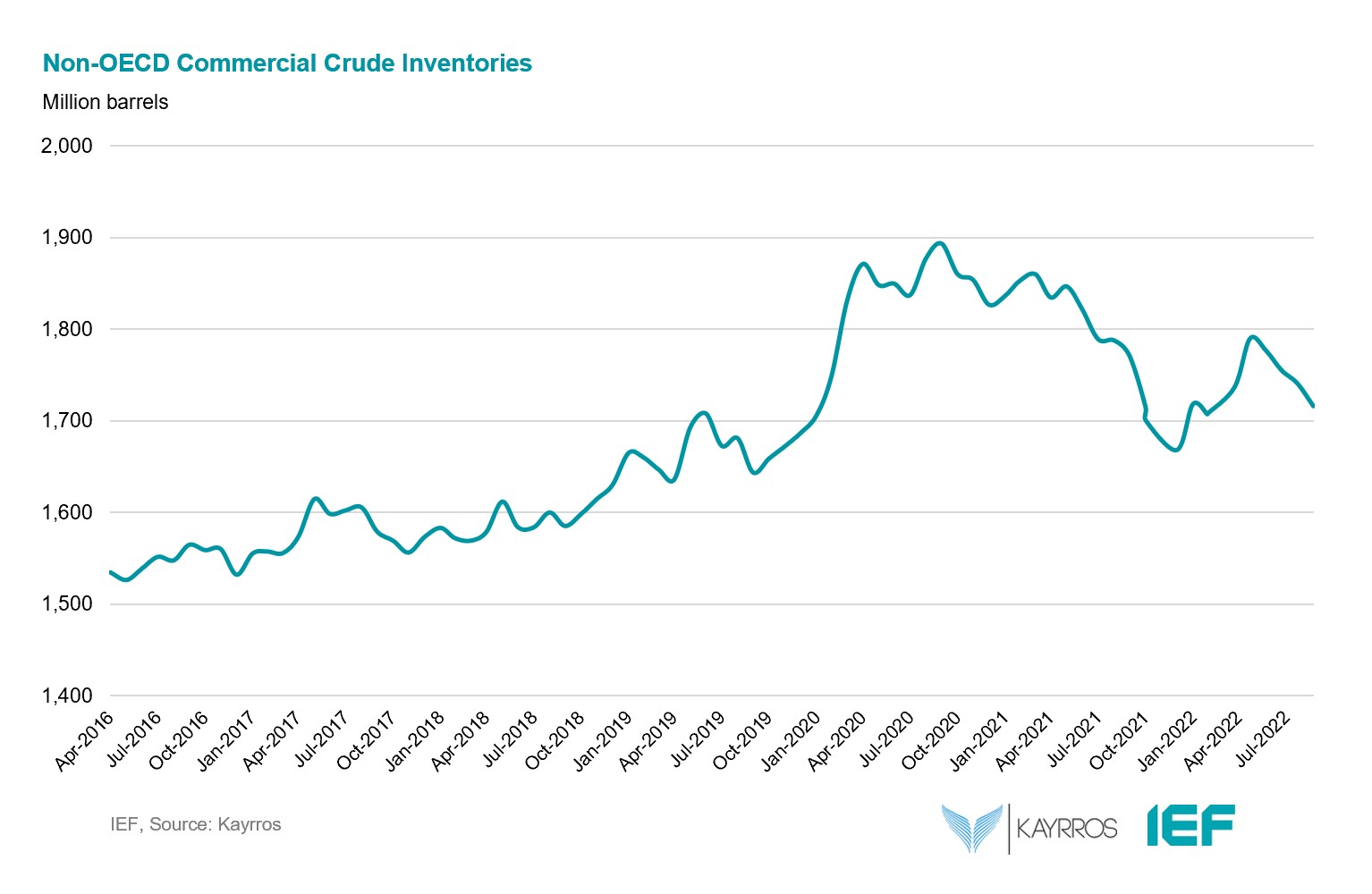

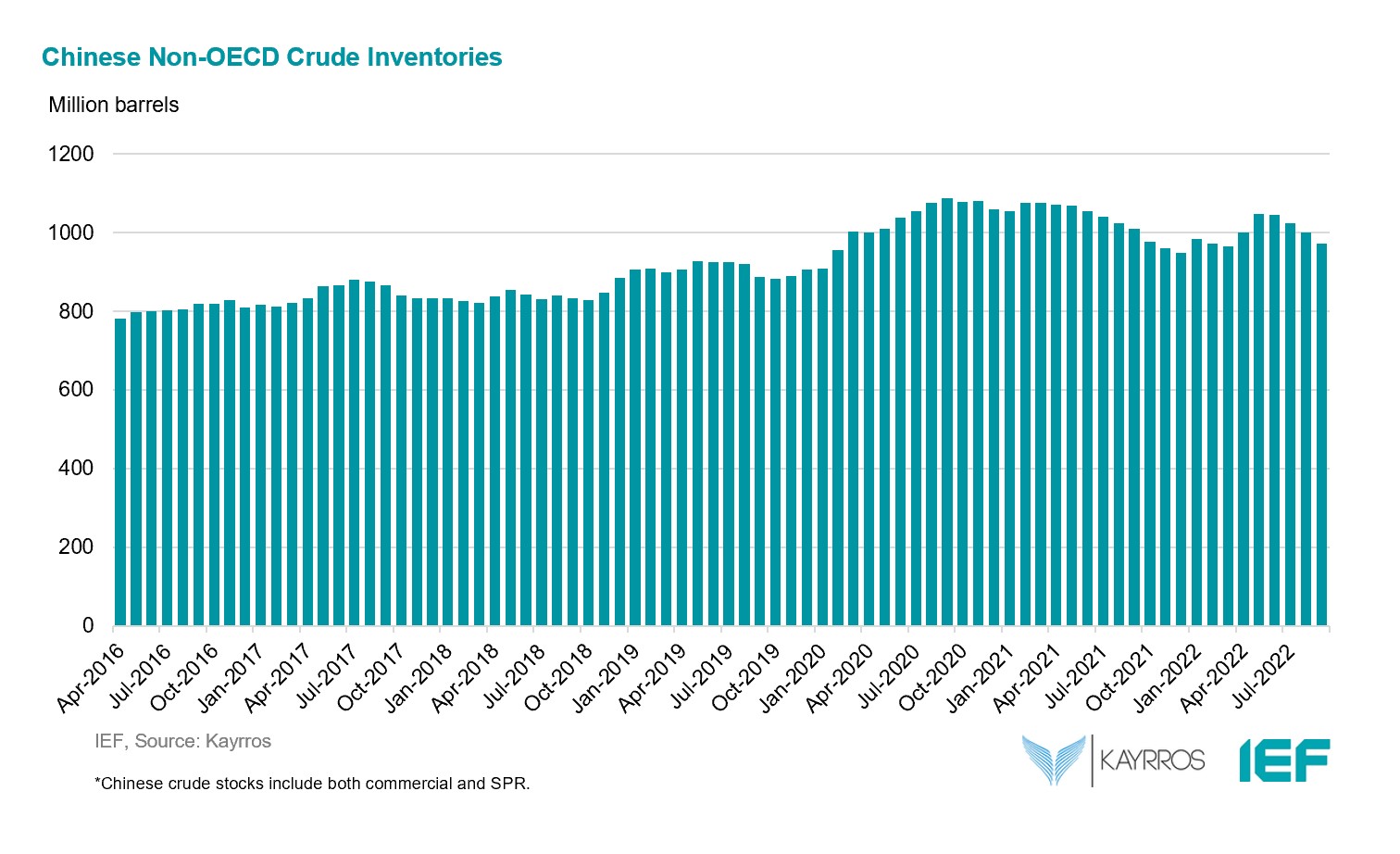

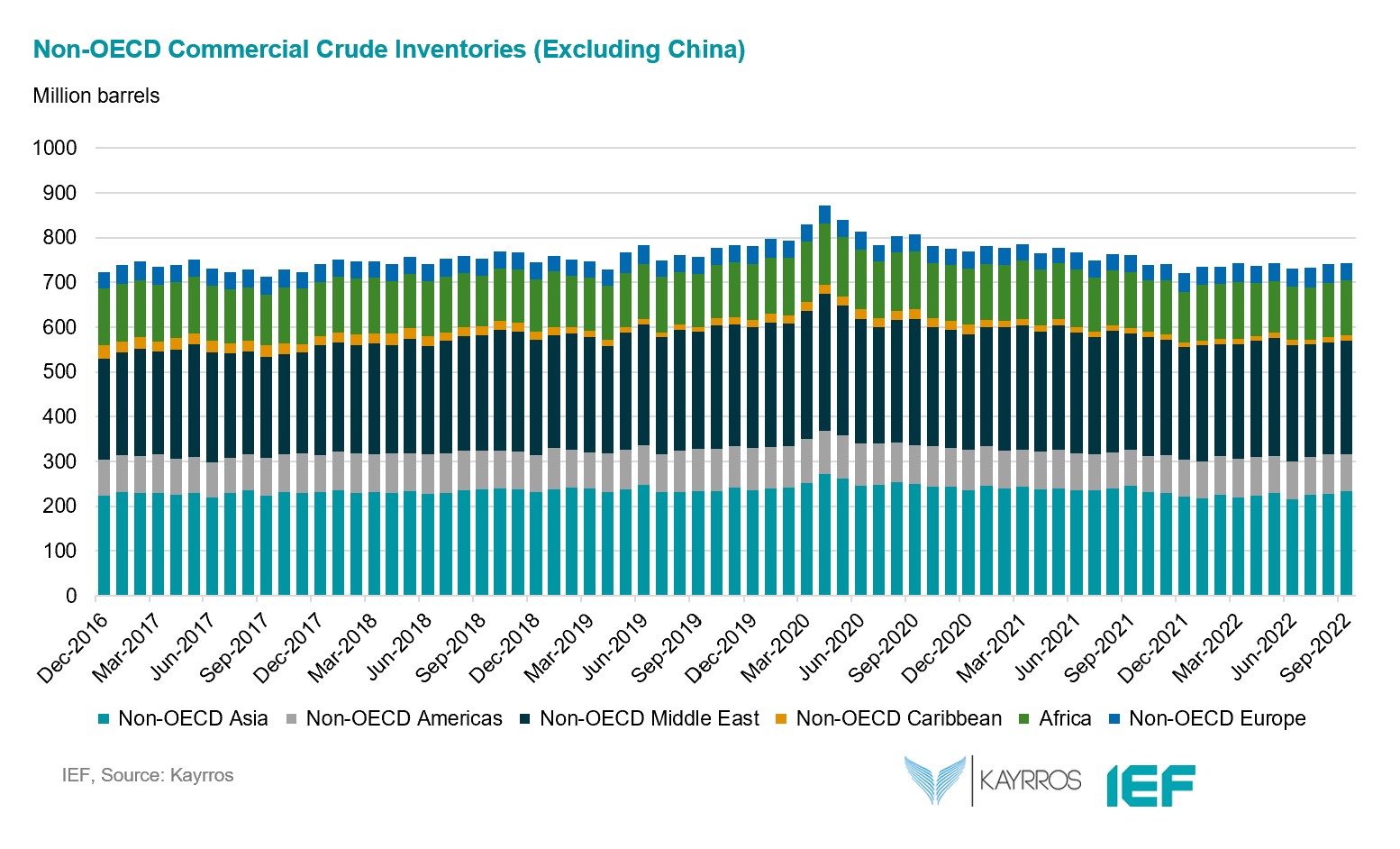

IEF-Kayrros Stock Analysis:

Explanatory Note

The IEF conducts a comprehensive comparative analysis of the short-, medium-, and long-term energy outlooks of the IEA, OPEC, and the EIA to inform the IEA-IEF-OPEC Symposium on Energy Outlooks that the IEF hosts in Riyadh as part of the trilateral work programme on a yearly basis.

To inform IEF stakeholders on how perspectives on the oil market of both organisations evolve over time regularly, this monthly summary provides:

- An overview of key events and initiatives in the international policy and market context.

- Key findings and a snapshot overview of data points gained from comparing basic historical data and short-term forecasts of the IEA Oil Market Report, the OPEC Monthly Oil Market Report, and the EIA Short-term Energy Outlook.

- A comparative analysis of oil inventory data reported by the IEA, OPEC, and EIA, and secondary sources in collaboration with Kayrros (added in an updated report on the IEF website).

The International Energy Forum

The International Energy Forum is the leading global facilitator of dialogue between sovereign energy market participants. It incorporates members of International Energy Agency and the Organization of the Petroleum Exporting Countries, and also key players including China, India, Russia and South Africa. The forum's biennial ministerial meetings are the world's largest gathering of energy ministers, where discussions focus on global energy security and the transition towards a sustainable and inclusive energy future. The forum has a permanent secretariat of international staff based in the Diplomatic Quarter of Riyadh, Saudi Arabia. For more information visit www.ief.org.