Comparative Analysis of Monthly Reports on the Oil Market

Thursday 15 February 2024

Oil Market Context

Onshore oil inventories plummet on robust demand and supply disruptions

Global onshore inventories fell for a sixth consecutive month in January to their lowest level since at least 2016, according to IEA. Observed onshore inventories fell by 36 mb in December and a further 60 mb in January. OECD commercial inventories ended 2023 at 2,761 mb, which is 85.9 mb below the five-year average.

Additionally, floating crude storage has fallen to an eight-year low led by steady drawdowns from Iran and Venezuela over the past two years.

While overall, onshore inventories have steadily fallen, recent headlines highlighted a large 12 mb crude build in the US last week that was exacerbated by unplanned refinery outages and partially offset by a 6 mb draw in product inventories. Oil in transit on the water has also increased in recent months as voyage times have increased with tankers avoiding the Red Sea.

Currently, forecasts from IEA, OPEC, and EIA agree that both global demand growth and non-OPEC supply growth will slow in 2024 compared to last year. However, the outlooks contrast on the likelihood that global inventories will increase or decrease this year. The primary area of contention lies in global demand. This month’s reports show a 1 mb/d divergence in 2024 global demand growth forecasts (OPEC’s 2.2 mb/d vs. IEA’s 1.2 mb/d) and a 2 mb/d divergence in 2024 global demand level forecasts (OPEC’s 104.4 mb/d vs EIA’s 102.4 mb/d).

IMF revised up its global growth forecast

The IMF’s January World Economic Outlook revised up its global GDP forecast for 2024 to 3.1%, up 0.2 percentage points from its October forecast. The revisions were driven by greater-than-expected resilience in the US and several large emerging economies, as well as fiscal support in China. The IMF noted that the likelihood of a hard landing has receded but warned that further escalation in the Red Sea or a commodity price spike could cause growth to disappoint.

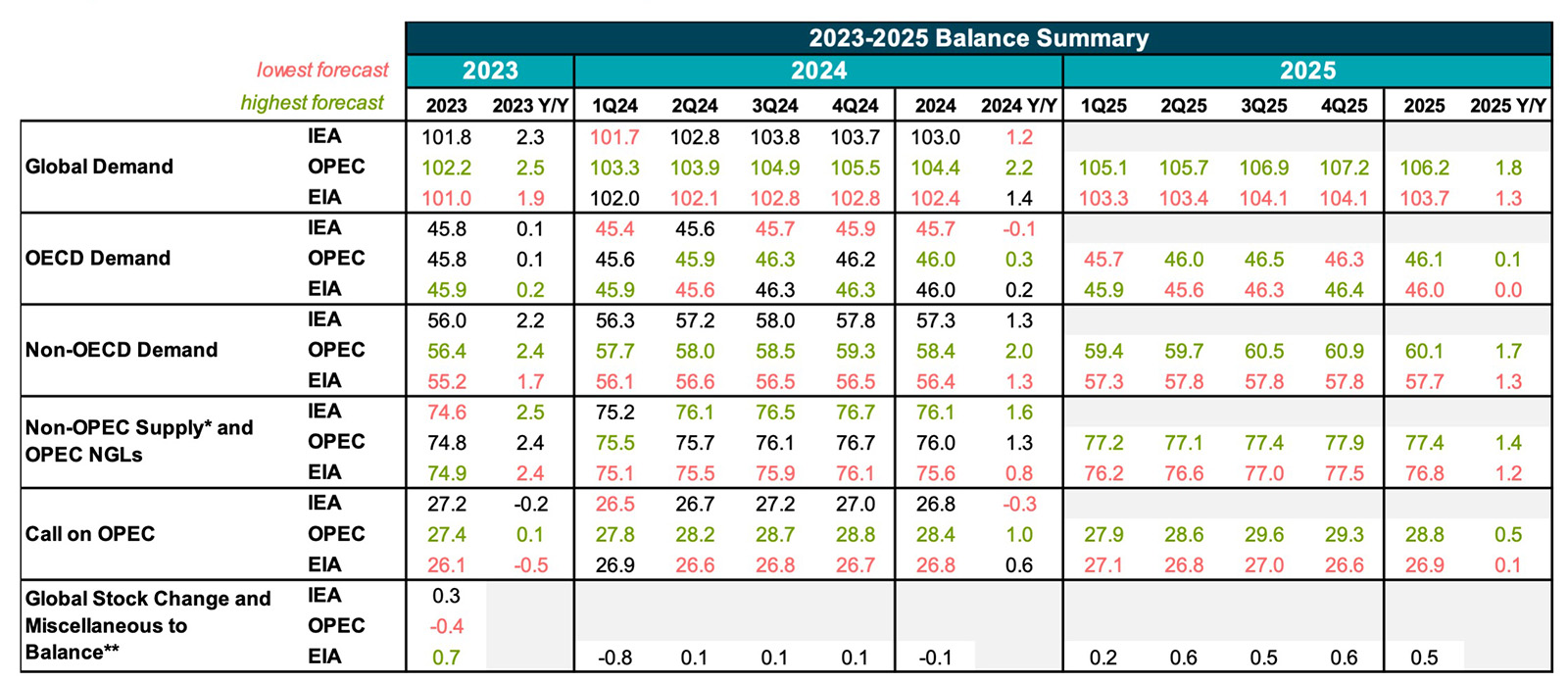

Summary of 2023-2025 Balances

- Demand growth forecasts diverge by 1.0 mb/d in 2024 and 0.5 mb/d in 2025. OPEC sees the most robust growth both years. OPEC and EIA’s 2025 global demand levels diverge by 2.5 mb/d – roughly equivalent to the current consumption levels of South Korea or Canada.

- Non-OPEC supply growth is expected to slow from ~2.4 mb/d in 2023 to 0.8-1.6 mb/d this year. IEA sees twice as much growth vs. EIA largely due to a higher US forecast.

- OPEC and EIA both see the call on OPEC rising in 2024 and 2025 as demand growth outpaces non-OPEC supply growth in both years.

- Baseline 2023 balances still diverge by 1.1 mb/d with EIA estimating a 0.7 mb/d global inventory build for the year, IEA estimating a 0.3 mb/d build and OPEC estimating a 0.4 mb/d draw.

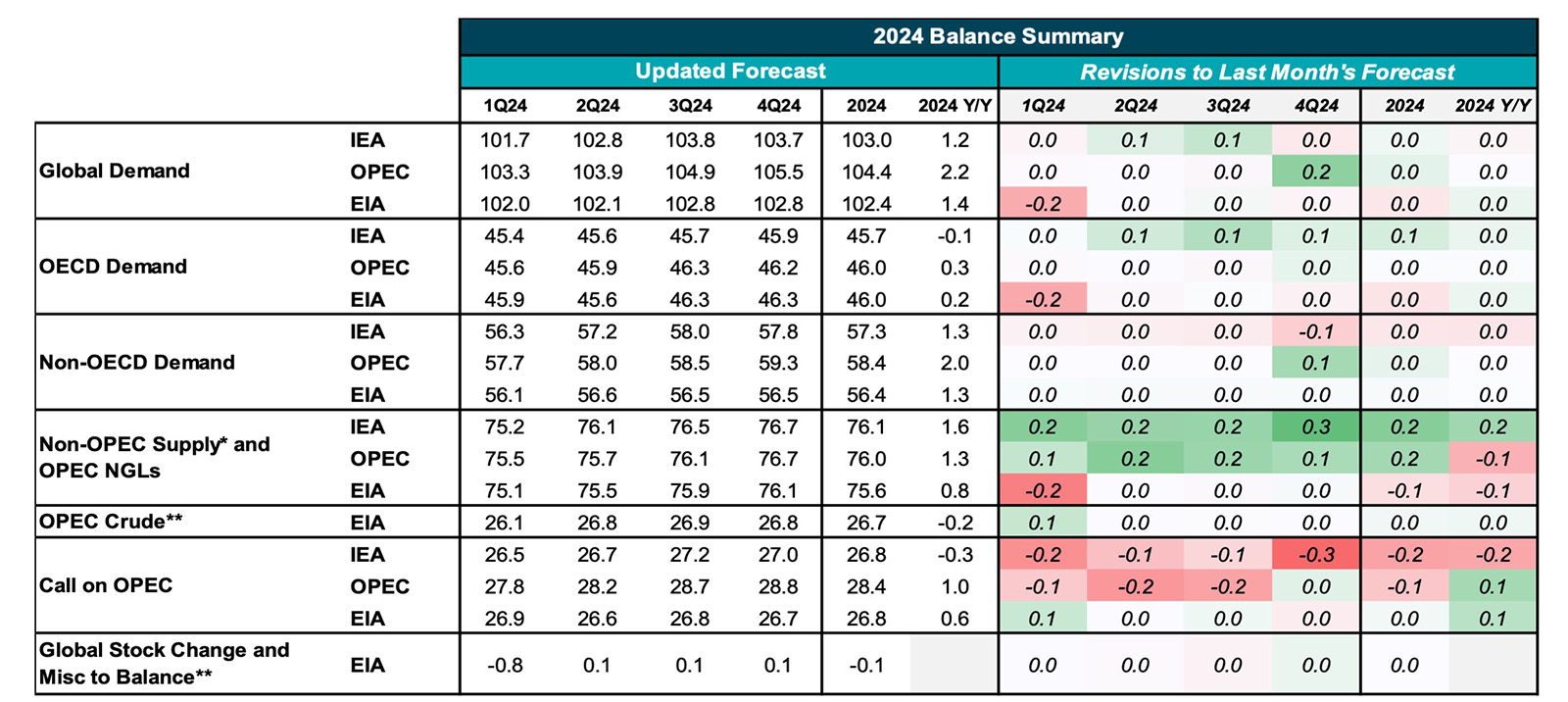

Summary of 2024 Balances and Revisions

- Annual demand forecasts for 2024 were relatively unchanged this month. IEA’s forecast remains 1 mb/d lower than OPEC’s, driven by a 0.7 mb/d lower non-OECD outlook. IEA also sees a contraction in OECD demand, whereas OPEC and EIA see growth.

- IEA and OPEC revised up non-OPEC supply levels by 0.2 mb/d. IEA’s non-OPEC supply growth was also revised up 0.2 mb/d, whereas OPEC’s was revised down 0.1 mb/d (due to baseline adjustments).

- IEA now sees two times greater non-OPEC supply growth compared to EIA, driven by diverging US forecasts.

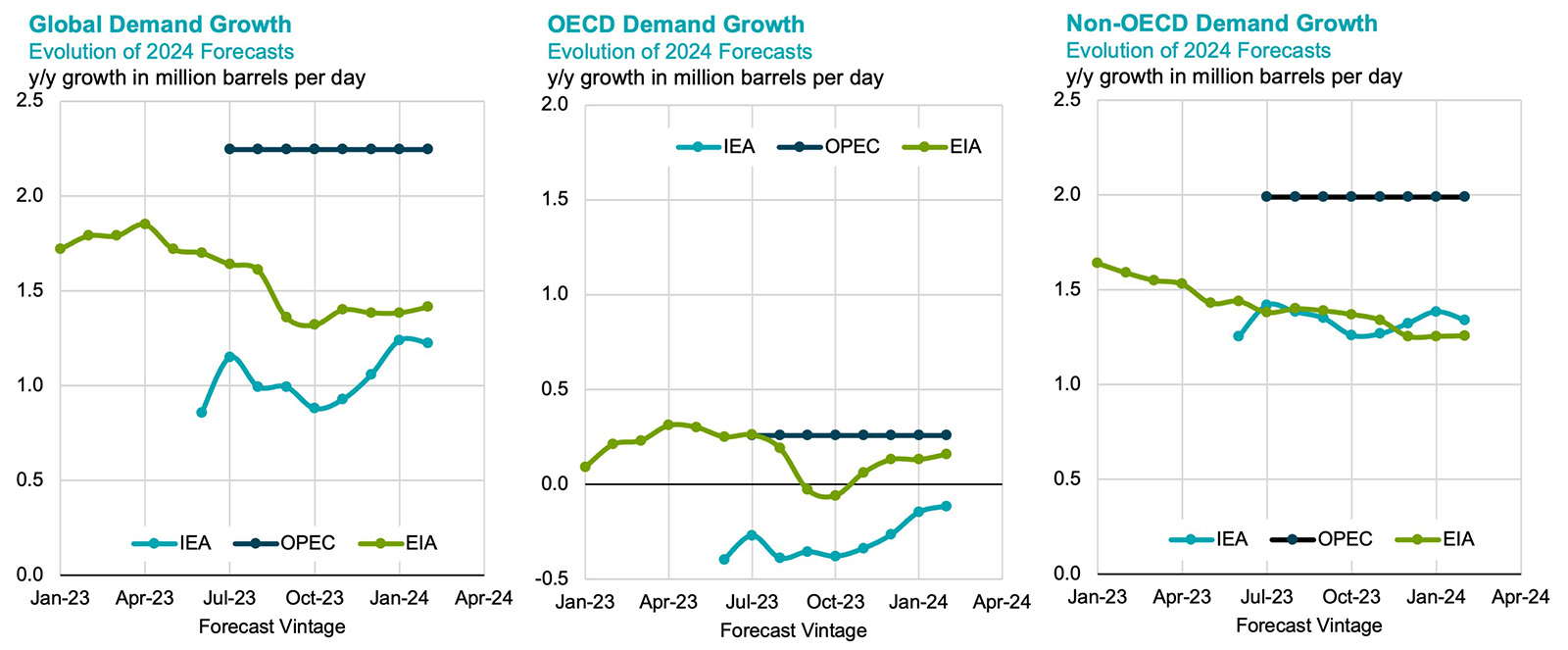

Evolution of 2024 Annual Demand Growth Forecasts

- OPEC’s 2024 global demand growth forecast is 1.0 mb/d higher than IEA’s due to a higher Middle East, Russian, other non-OECD and OECD Americas demand forecasts.

- IEA revised up OECD demand growth for a 4th consecutive month, but it still sees a contraction this year while OPEC and EIA see growth.

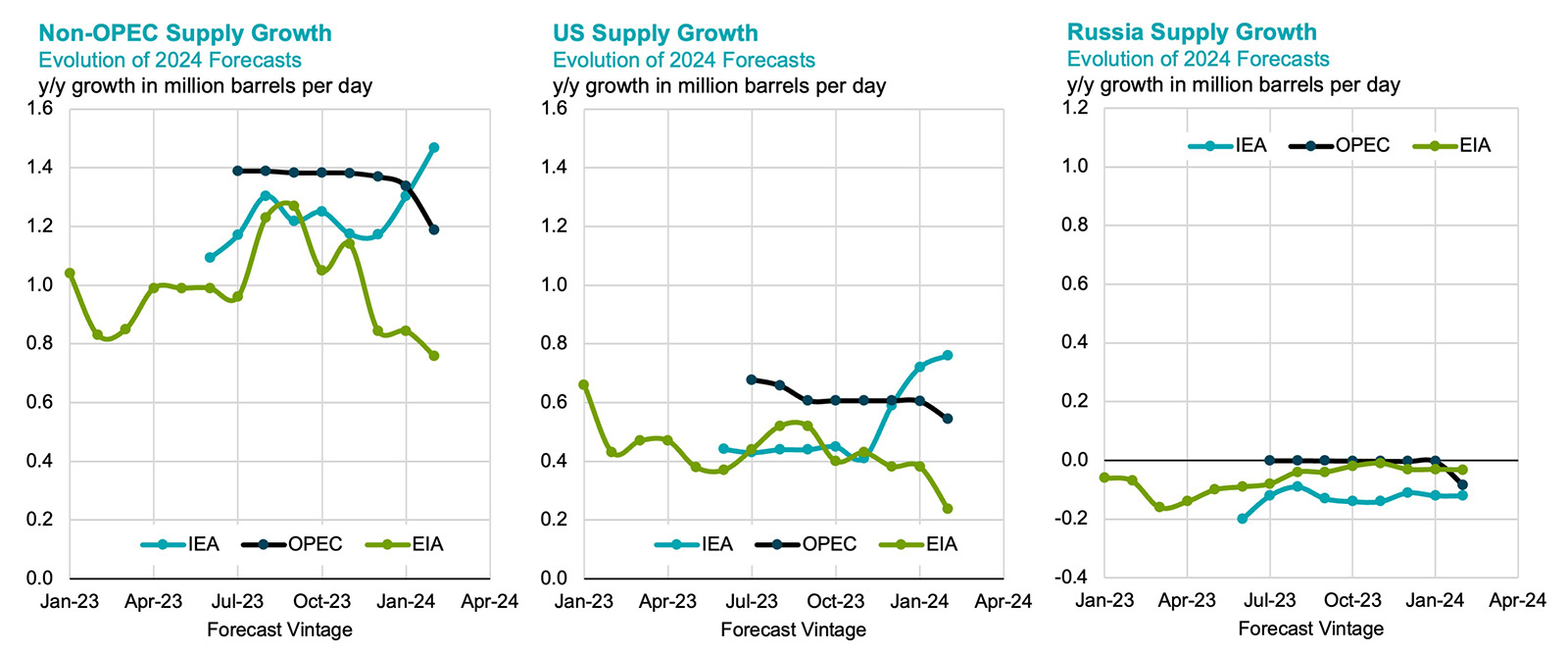

Evolution of 2024 Annual Non-OPEC Supply Growth Forecasts

- EIA continues to see lower non-OPEC supply growth than IEA and OPEC due primarily to a weaker US forecast.

- IEA has revised up its US supply growth outlook by 0.4 mb/d over the past three months while EIA has revised its US forecast lower by ~0.3 mb/d since September. IEA now sees more than 3x stronger US growth compared to EIA.