Comparative Analysis of Monthly Reports on the Oil Market

Friday 12 July 2024

Oil Market Context

Key points

Demand

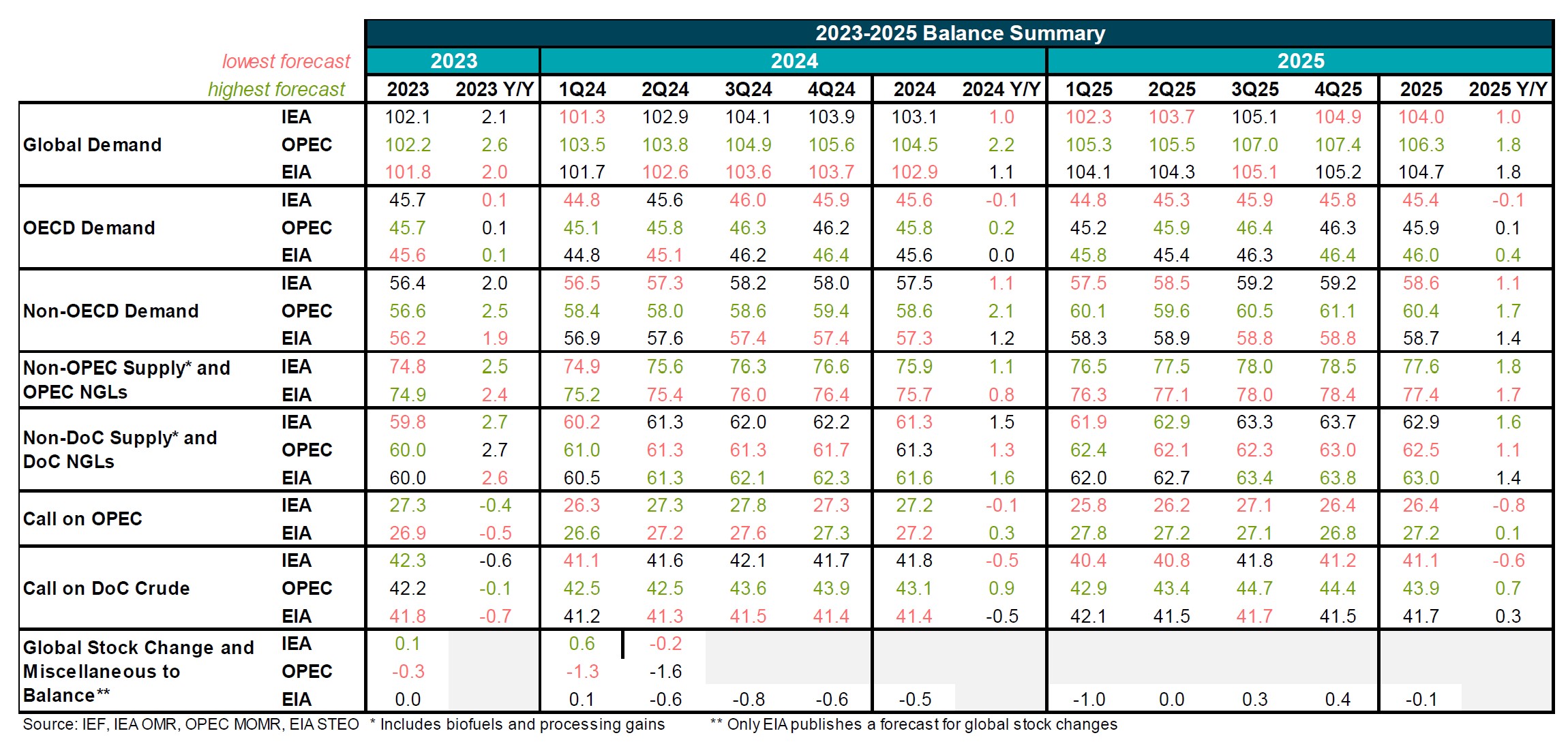

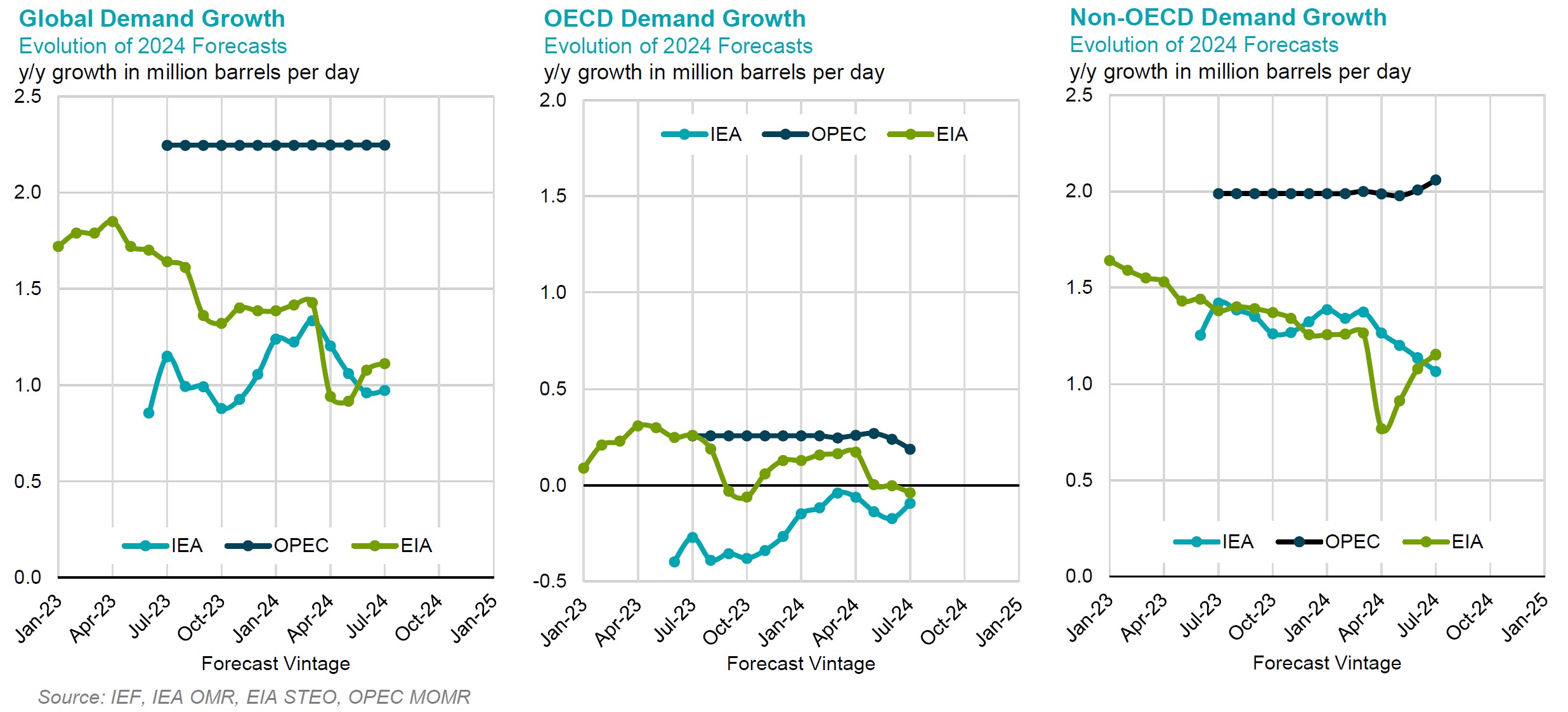

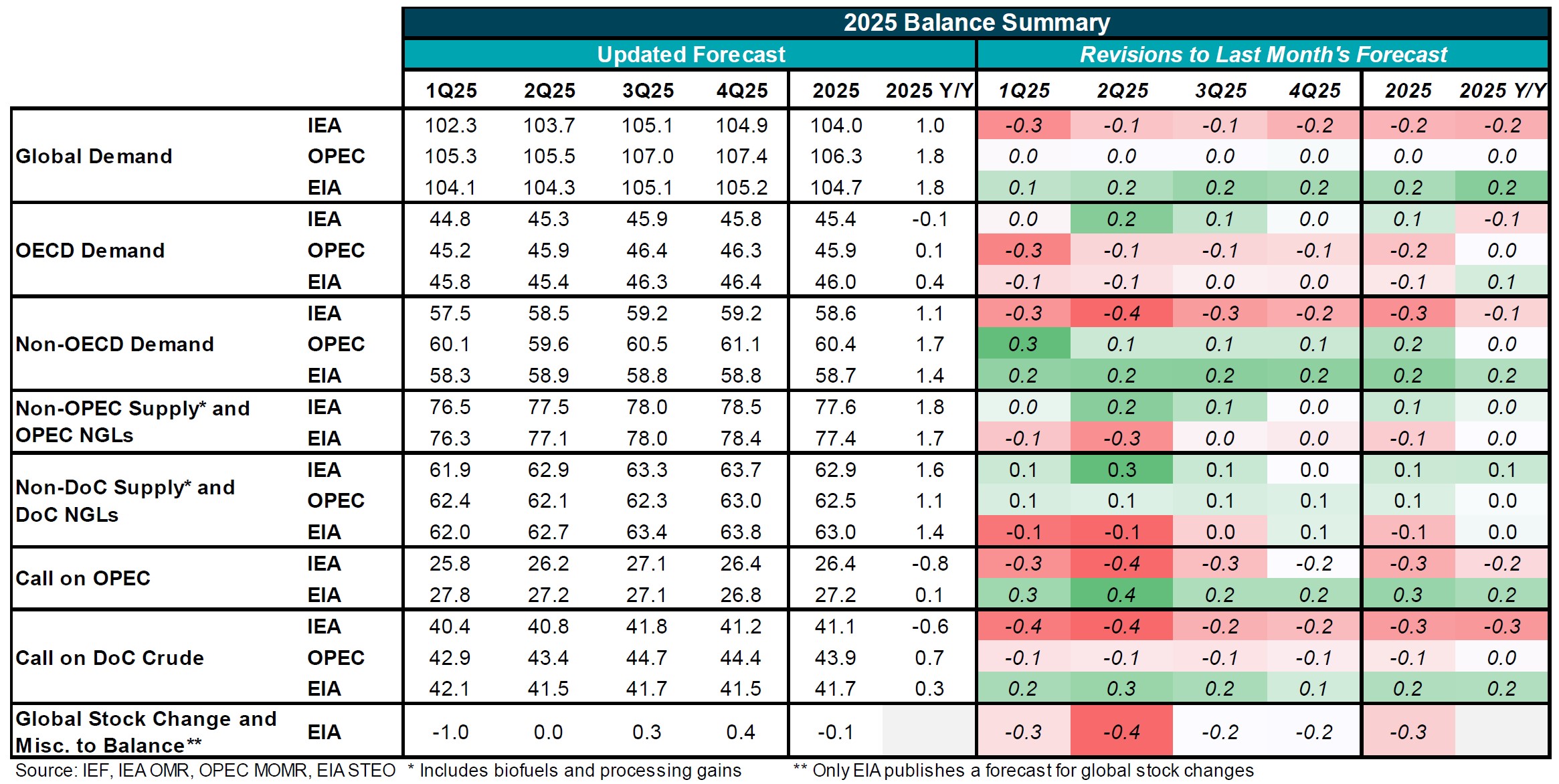

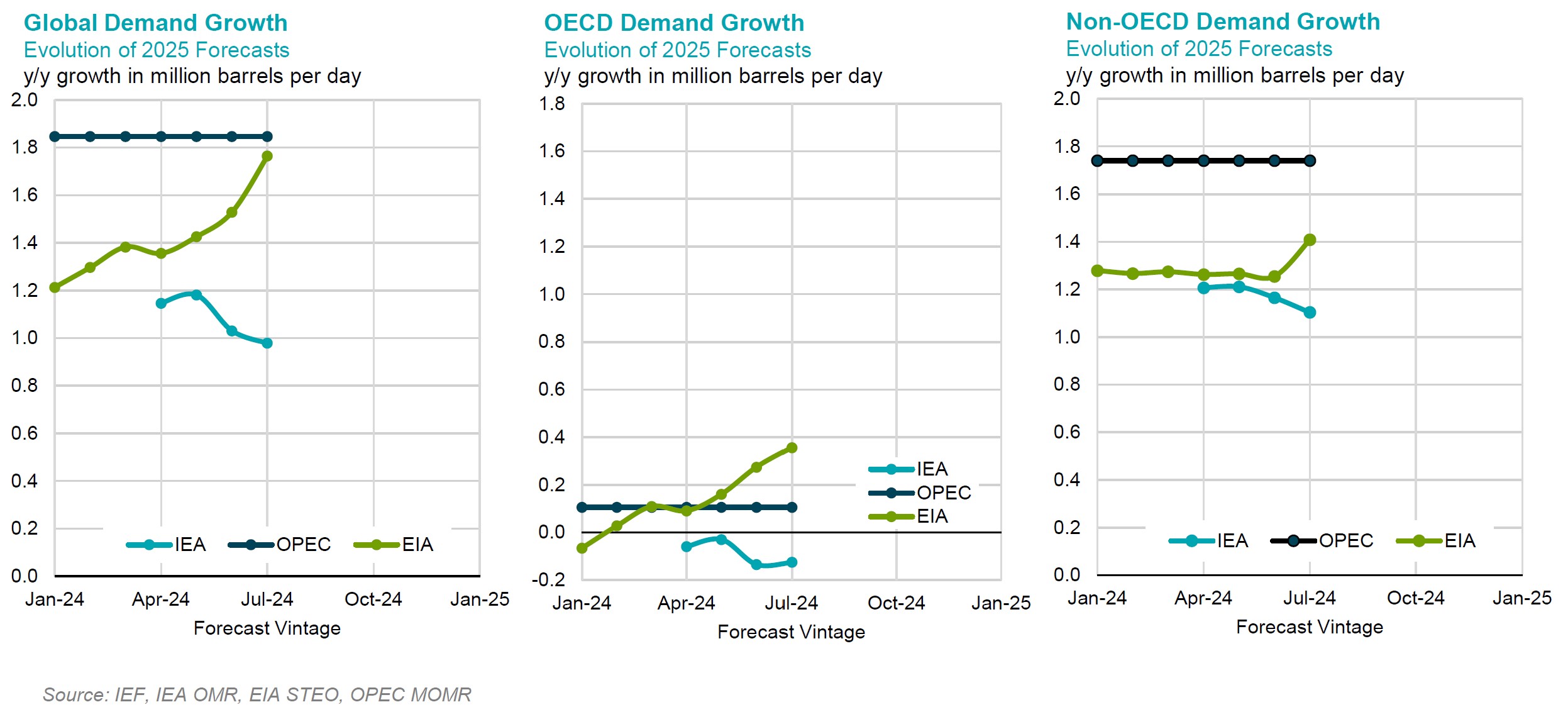

Projections for near-term worldwide oil consumption still vary widely, underscoring oil demand uncertainties. OPEC continues to project 2.2 mb/d oil demand growth in 2024 y/y. The IEA and EIA, in contrast, predict 1 mb/d and 1.1 mb/d demand growth for 2024, respectively. Both OPEC and EIA estimate global oil demand to grow by approximately 1.8 mb/d in 2025 y/y. The demand growth forecasts of the three organizations for 2025 range from 1 mb/d to 1.8 mb/d.

Supply

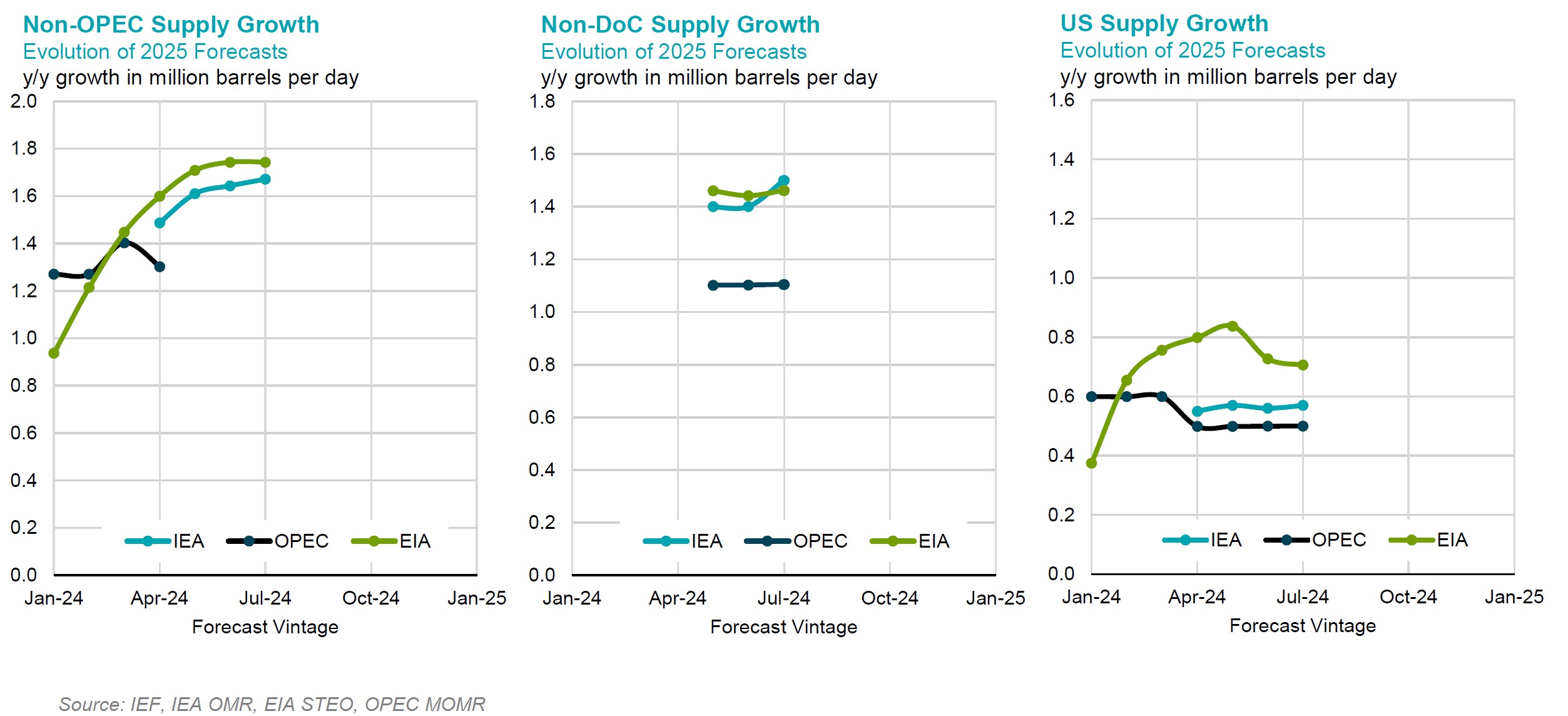

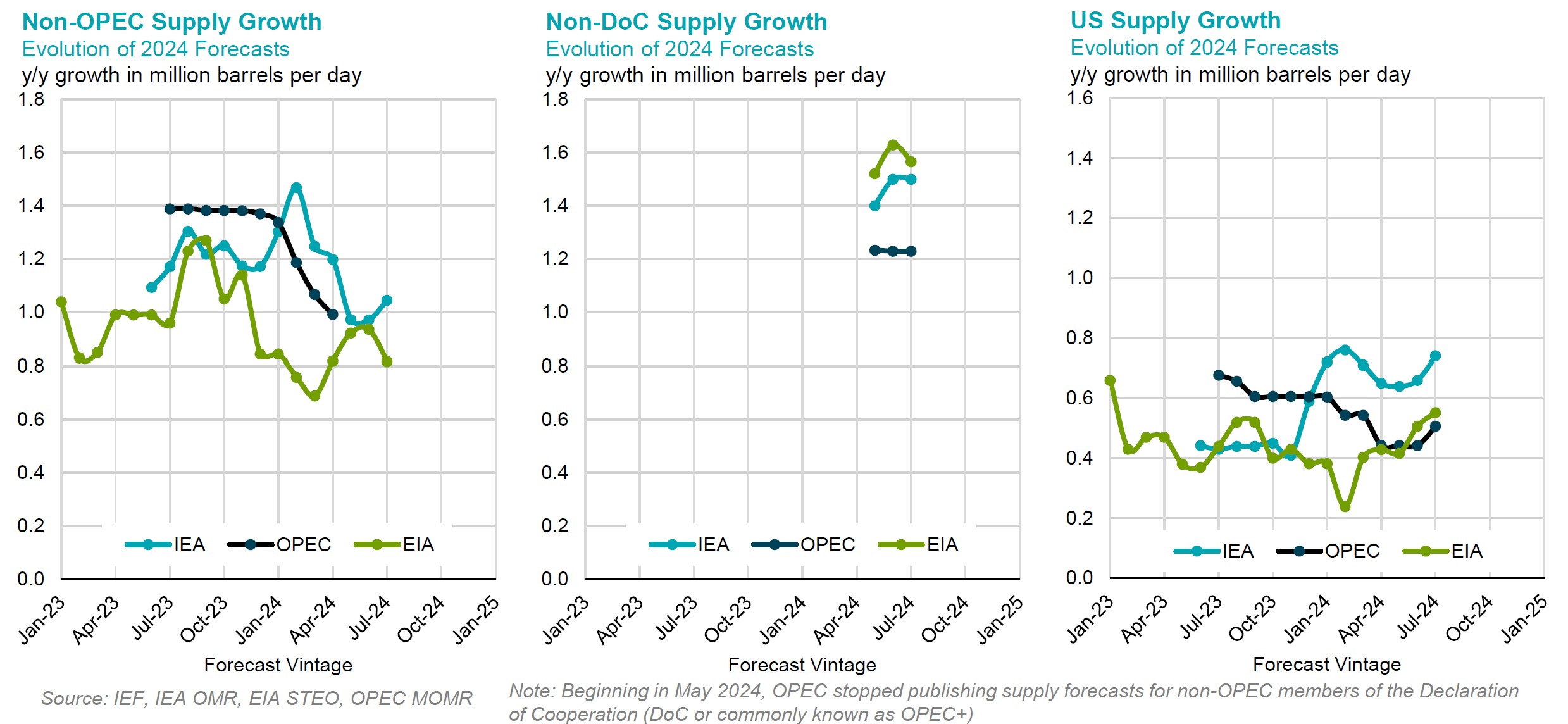

OPEC predicts non-DoC oil supply to grow by 1.3 mb/d in 2024 y/y and 1.1 mb/d in 2025 y/y driven by the US, Brazil, and Canada in both years. US crude oil production is expected to grow from 13.2 mb/d in 2024 to 13.8 mb/d in 2025, according to EIA. The EIA has reduced its forecast for non-OPEC supply growth by 0.2 mb/d to 0.8 mb/d in 2024 y/y, in comparison to last month, while keeping its supply growth forecasts for 2025 at 1.7 mb/d y/y. The IEA revised its non-DoC supply growth forecasts upwards by 0.1 mb/d for full year 2025, while keeping its estimates for 2024 unchanged. The range between the three organizations' short-term non-Doc supply growth forecasts is expected to reach 0.3 mb/d in 2024 y/y and 0.5 in 2025 y/y.

Policy

Gasoline consumption in the transport sectors is a key determinant of oil demand trajectories. On July 5, tariffs imposed by the European Commission on electric vehicle imports from China to level the playing field among car manufacturers entered in effect, provisionally. Without a resolution found over the next four months, the measure adds to other producer-consumer initiatives to shield and stimulate national industries. These may well delay transitioning away from fossil fuels in a just, orderly, and equitable manner, rather than accelerate action as governments agreed at the Dubai COP28 UN Climate Conference.

Risks

Though macroeconomic indicators have steadied, risks to global energy security remain elevated. Conflict and geopolitical tensions persist, involving attacks on critical energy infrastructure and supply chains, including maritime shipping lanes. The Red Sea shipping crisis continues, while the easing of restrictions in the Panama Canal is expected to increase traffic in the coming months. While oil market concerns over hurricane Beryl in the Gulf of Mexico have eased, it is still early in the hurricane season.

Summary of 2023-2025 Balances

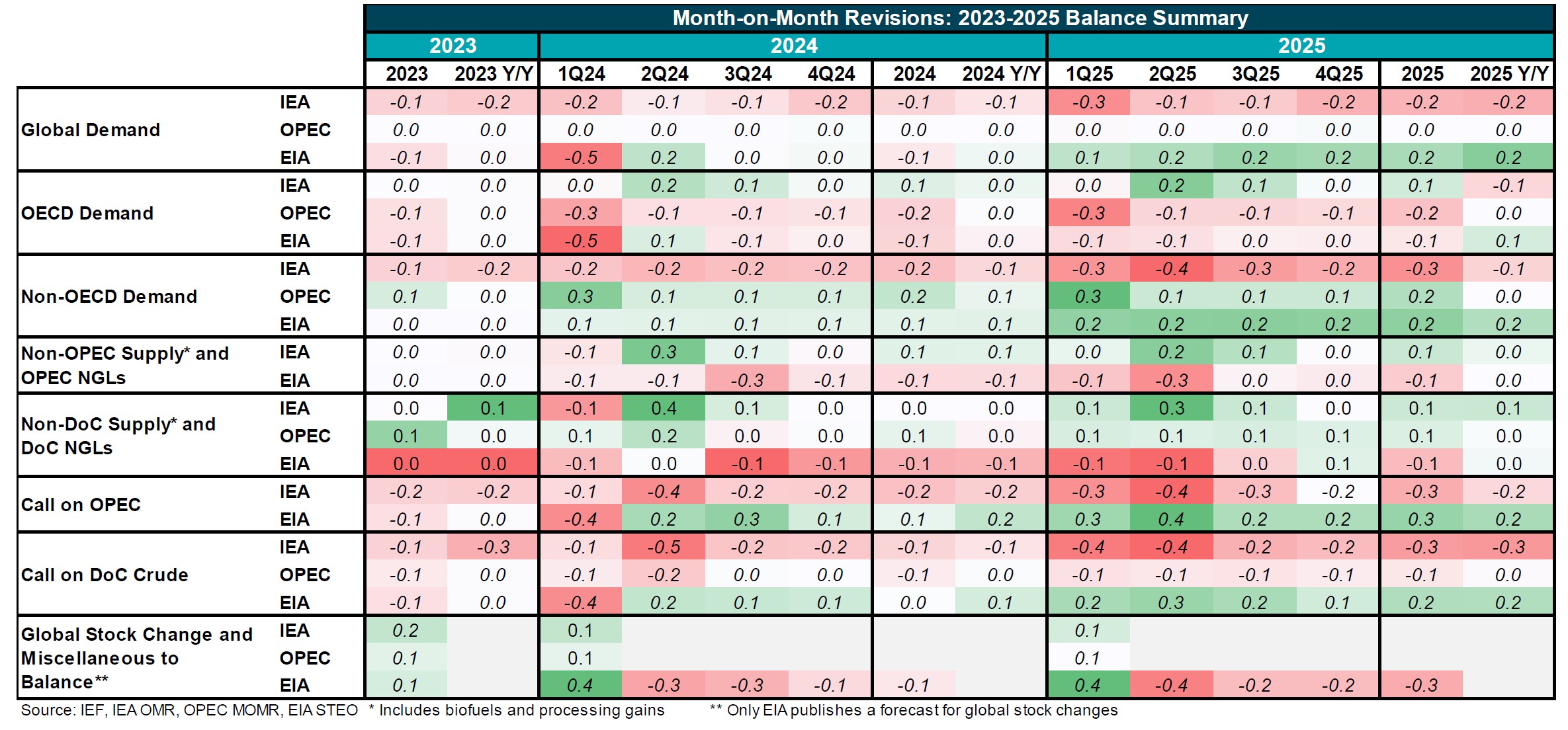

- The divergence in global demand forecasts is still high across IEA, EIA and OPEC assessments, with a range of approximately 1.2 mb/d projected for 2024 y/y, and 0.8 mb/d expected for 2025 y/y.

- OPEC has kept its global oil demand growth forecast unchanged compared to last month's assessment for both 2024 and 2025.

- The EIA has kept its forecast for global demand growth this year at 1.1 mb/d, while increasing its forecast by ~0.2 mb/d to ~1.8 mb/d in 2025 y/y.

- The EIA kept its Q3 and Q4 2024 demand forecasts with no change, while revising down the full year 2024 forecast by 0.1 mb/d. The 2025 demand growth forecast shows an upward revision of 0.1 mb/d in 1Q25 and 0.2 mb/d from 2Q25 through 4Q25.

- IEA has revised down its non-OECD demand growth forecasts by 0.2 mb/d for the full year 2024 and 0.3 mb/d for the full year in 2025.

- OPEC released its forecasts with almost no change in global demand assessments for the second month.

2024 Outlook Comparison

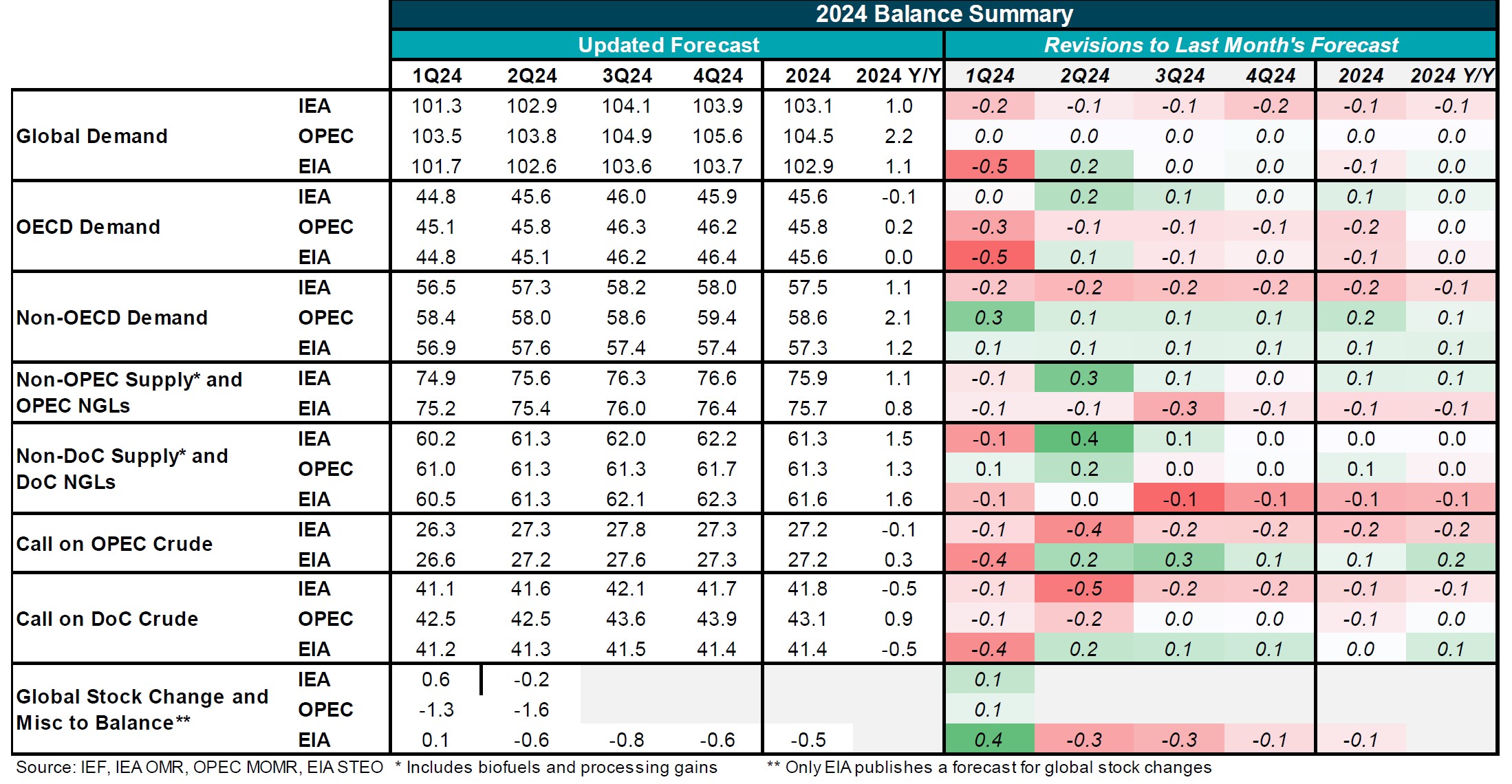

Summary of 2024 Balances and Revisions

- OPEC has maintained its forecast for global oil demand growth in 2024 y/y. OPEC demand growth projections remain more than double the growth rates predicted by the IEA and EIA in 2024.

- EIA and OPEC have revised up their non-OECD demand growth by 0.1 mb/d from 2Q24 through 4Q24, while the IEA revised down their forecast for the same period by 0.2 mb/d

- OPEC revised downward its OECD demand growth forecast by 0.2 mb/d for the full year in 2024 while IEA revised

Evolution of 2024 Annual Demand Growth Forecasts

- The EIA's 2024 global demand growth forecast shows a modest upward revision, based on an upward revision to non-OECD demand.

- OPEC has maintained its position of stable global demand growth, with the downward revision by the OECD being offset by the upward from non-OECD countries.

- IEA revised its global demand evolution for 2024 y/y slightly upwards in this month's assessment.

Evolution of 2024 Annual Non-OPEC Supply Growth Forecasts

- The EIA's year-on-year growth in non-OPEC supply is revised down by ~ 0.1 mb/d.

- EIA still shows the strongest 2024 non-DoC supply growth, in comparison to the other agencies, at more than 1.57 mb/d.

- The IEA's forecast for US supply growth is still approximately 1.5 times those projected by OPEC and up to 190 kb/d higher than those projected by EIA.

Summary of 2025 Balances and Revisions

- The disparity in global oil demand forecasts among major agencies is still remarkable, despite the upward revision of the EIA this month.

- OPEC's estimate for global demand levels is 2.3 million mb/d higher compared to the IEA projections.

- The EIA has made an upward revision to global demand with an increase of ~0.2 mb/d y/y.

Evolution of 2025 Annual Demand Growth Forecasts

- EIA has significantly revised its global demand growth forecast up by more than 0.2 mb/d, nearly reaching OPEC's estimates.

- OPEC's and EIA's 2025 global demand growth forecast is ~0.8 mb/d higher than the IEA's, due to higher projections for demand growth in non-OECD regions and others.

- IEA's global demand growth forecasts have been revised downward for the second month in a row.

Evolution of 2025 Annual Non-OPEC Supply Growth Forecasts

- The EIA has kept its non-OPEC supply growth forecasts almost unchanged y/y and is now aligning more closely with the IEA's projections.

- The EIA's forecast for the US oil supply growth is still 0.21 mb/d stronger than that developed by OPEC, despite its downward revision.