Comparative Analysis of Monthly Reports on the Oil Market

Wednesday 14 August 2024

Summary and Oil Market Context

Demand

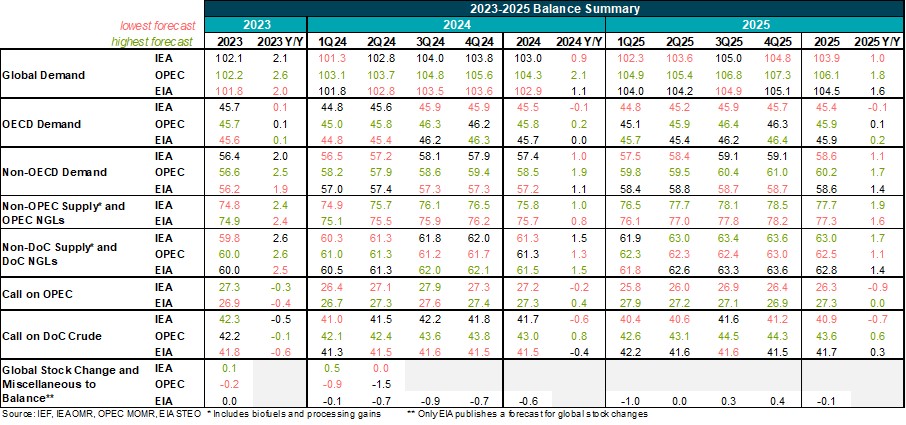

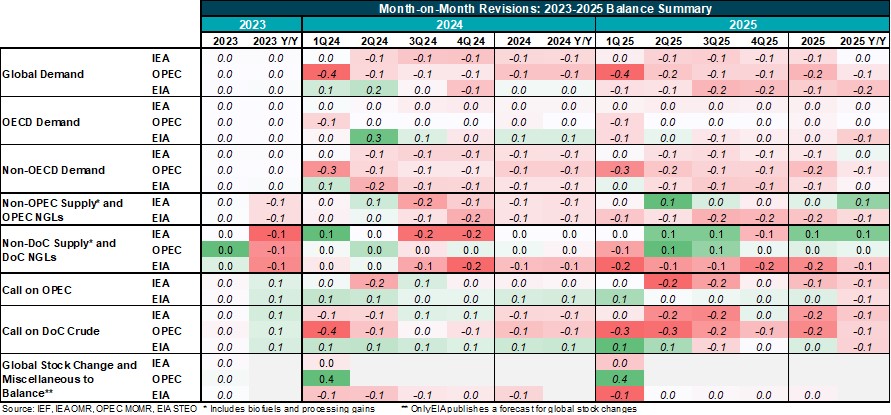

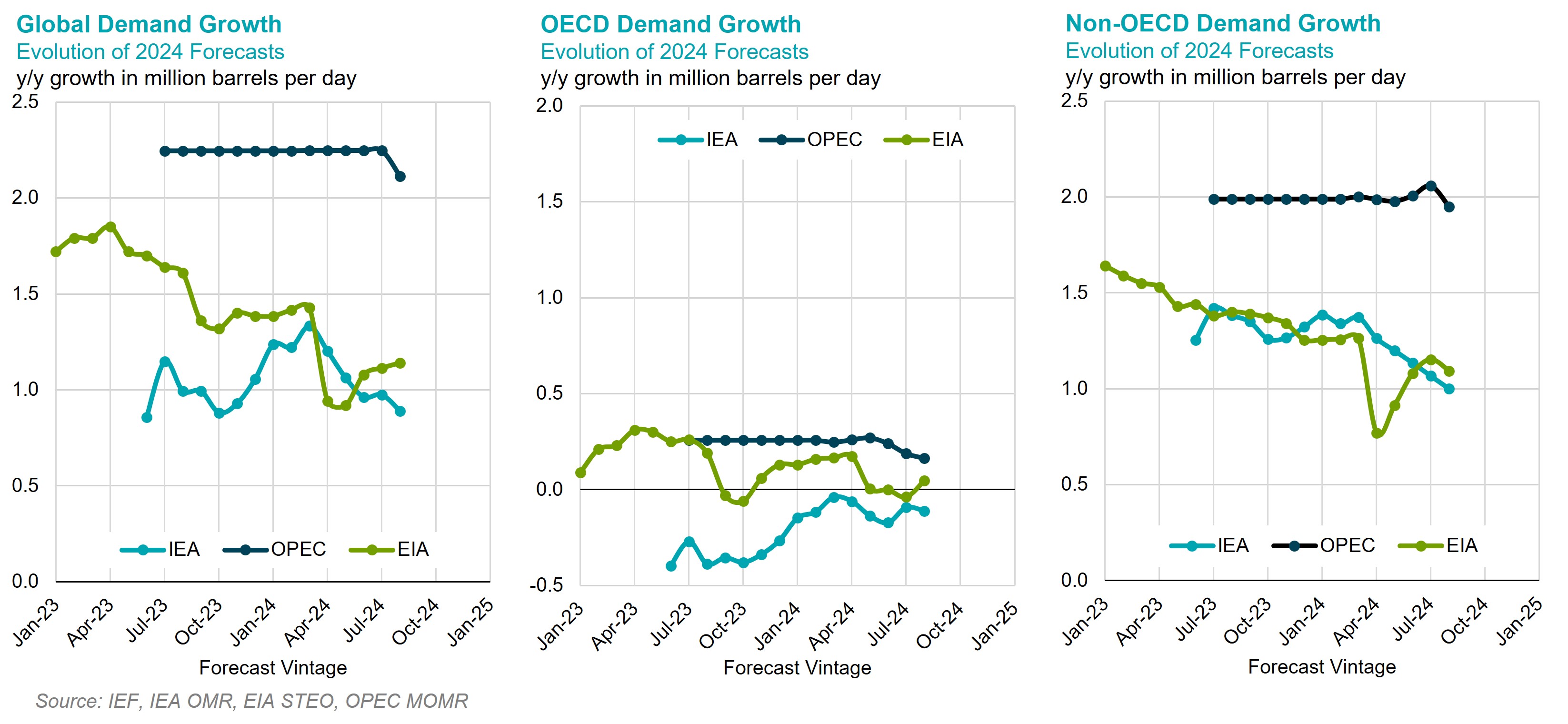

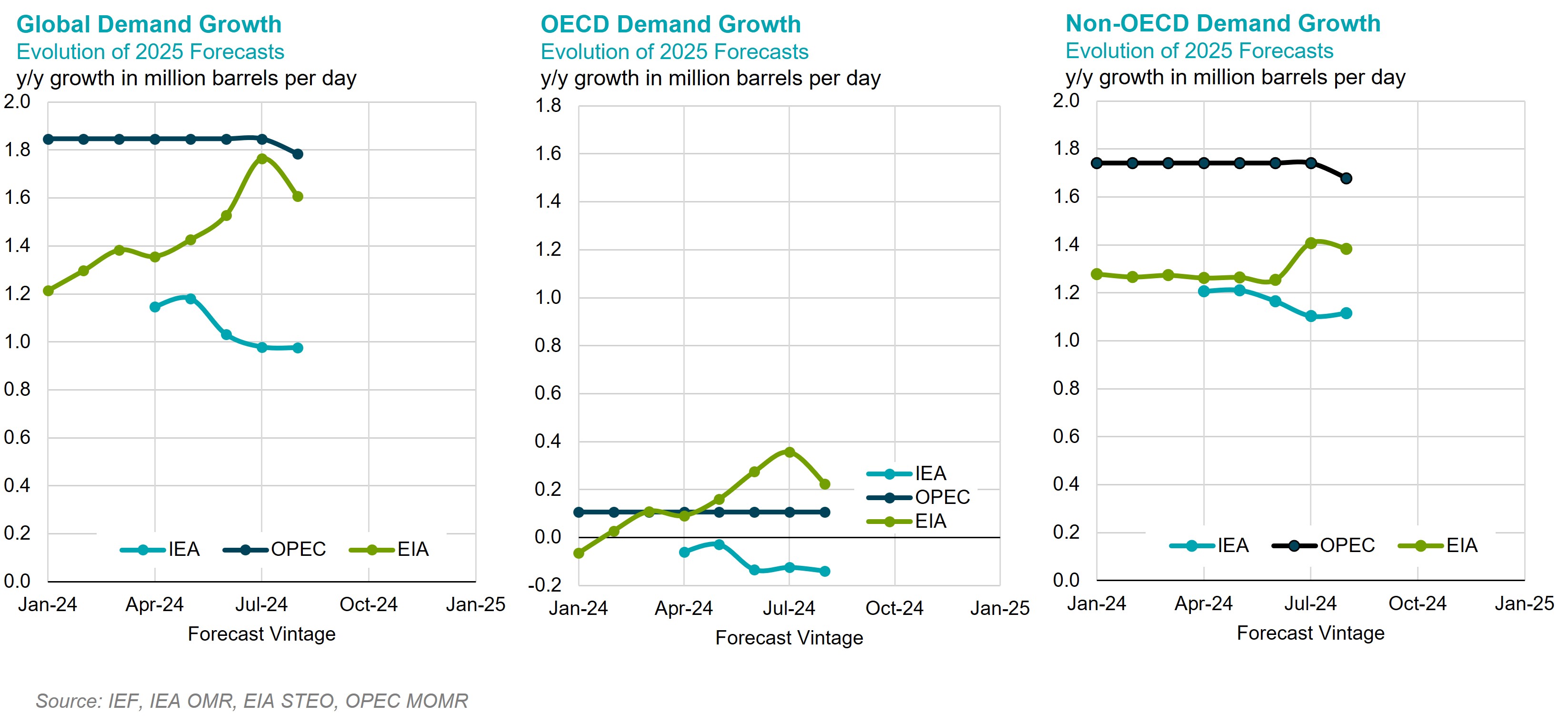

Forecasts for short-term global oil consumption have slightly reduced divergence compared to last month. OPEC has revised its global demand growth down by 0.1 mb/d to 2.1 mb/d for 2024 y/y for the first time this year, but its forecasts are still higher by more than a million barrels a day compared to the IEA and EIA. This slight revision by OPEC features real data collected for the first quarter of 2024 and, in certain instances, the second quarter of 2024. Additionally, it reflects a modest decrease in growth expectations for Chinese oil demand in 2024. In contrast, the IEA and EIA expect global demand growth of 0.9 mb/d and 1.1 mb/d, respectively, for the same year. OPEC has almost maintained its forecast growth for 2025 at 1.8 mb/d, while the EIA has revised its estimates down by 0.2 mb/d to 1.6 mb/d, compared to the 1.8 mb/d growth in last month’s estimates. The IEA has also revised down its global demand growth forecasts by about 0.1 mb/d for 2024 y/y, while keeping the 2025 forecast unchanged.

Supply

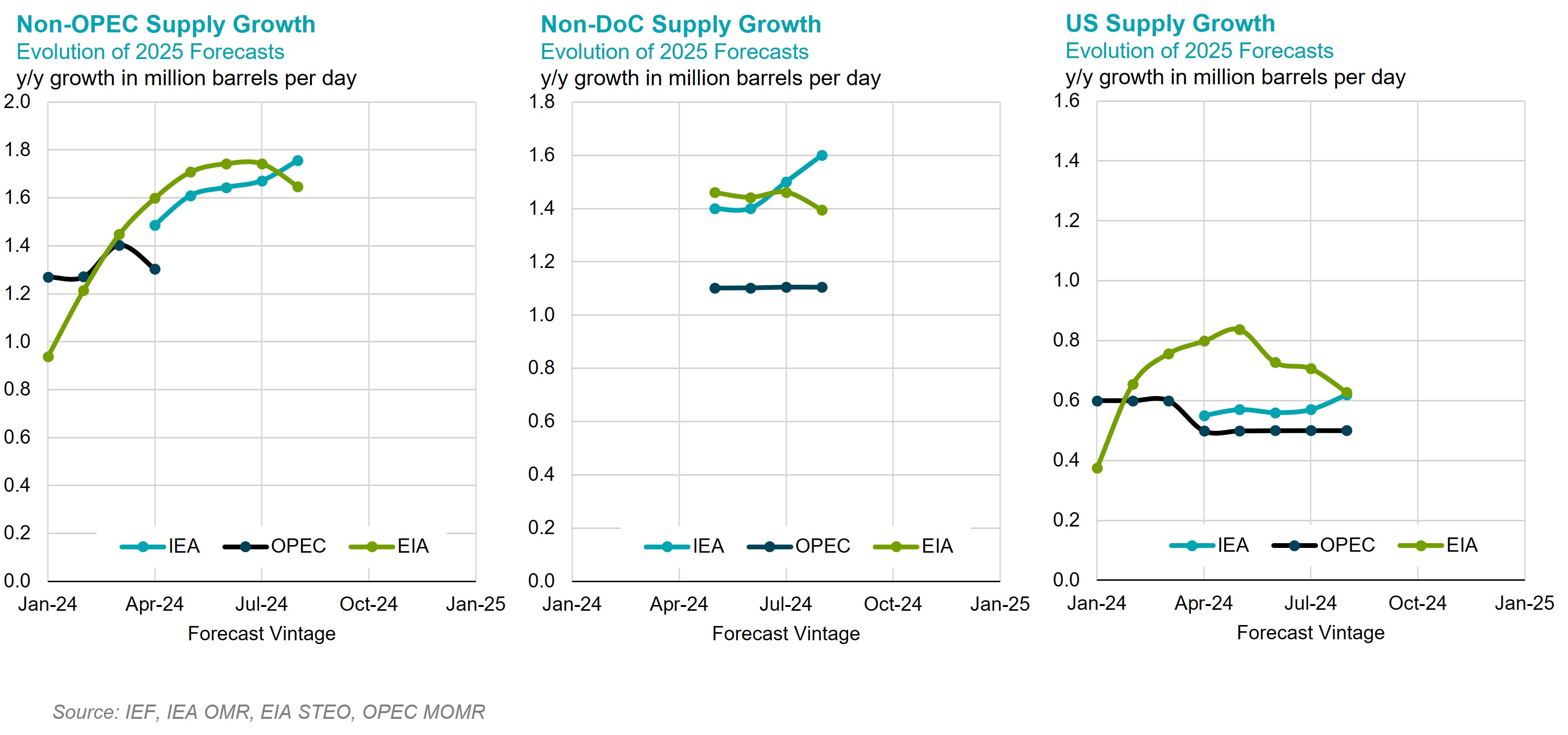

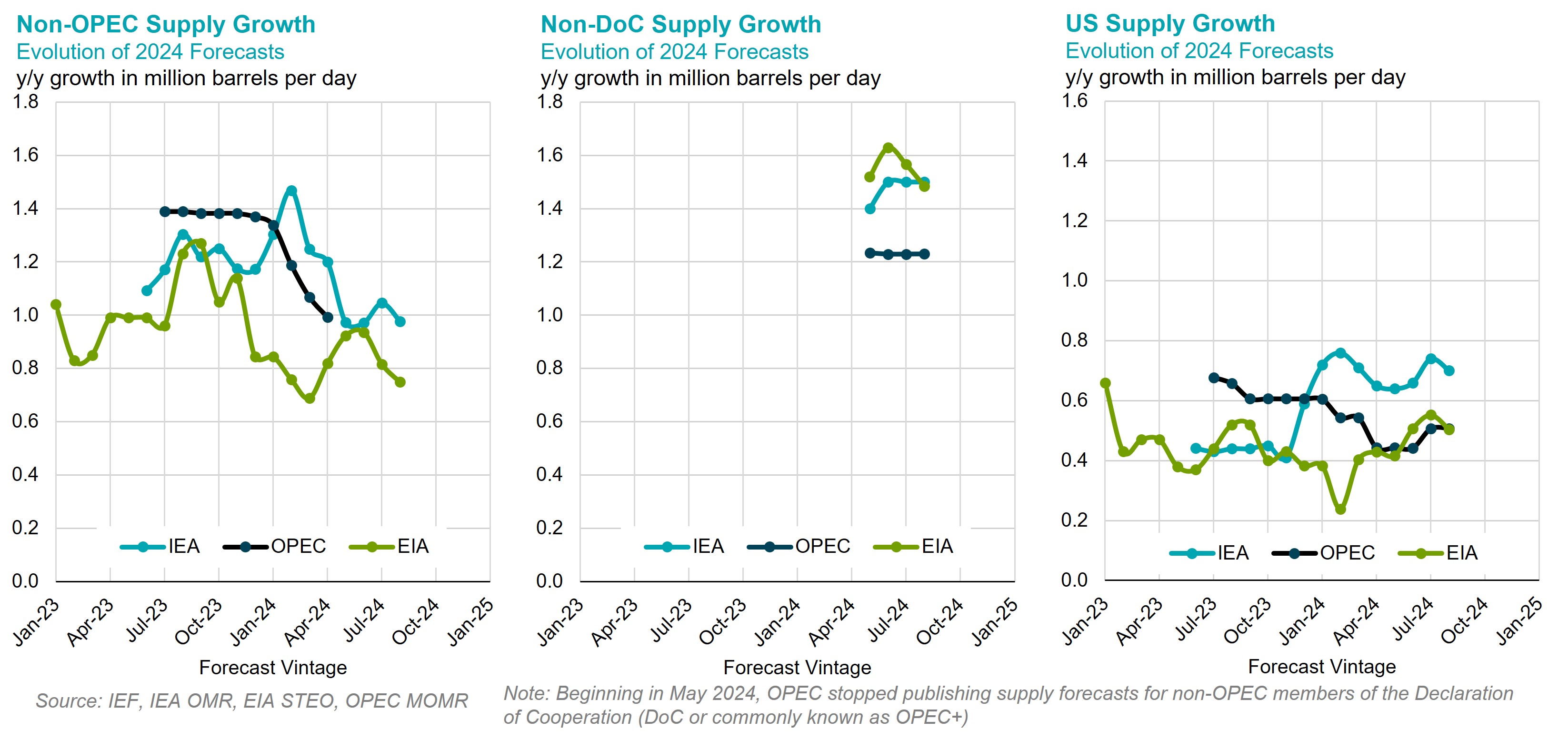

OPEC has maintained its forecast of oil supply growth from non-Declaration of Cooperation (non-DoC) countries at around 1.3 mb/d in 2024, and kept its forecast growth for 2025 at 1.1 mb/d y/y. The growth is primarily fueled by production increases in Brazil, the US, and Canada during both years. The EIA has kept its forecasts for non-OPEC supply growth at 0.8 mb/d for 2024 y/y, while slightly downgrading the 2025 growth estimate by 0.1 mb/d to 1.6 mb/d y/y. Meanwhile, the IEA has maintained its non-DoC supply growth projections at 1.5 mb/d for 2024 y/y, while revising its supply growth forecast upward by 0.1 mb/d to 1.7 mb/d in 2025 y/y. The disparity among the short-term non-DoC supply growth forecasts from these three organizations is expected to reach 0.2 mb/d for 2024 and 0.6 mb/d for 2025.

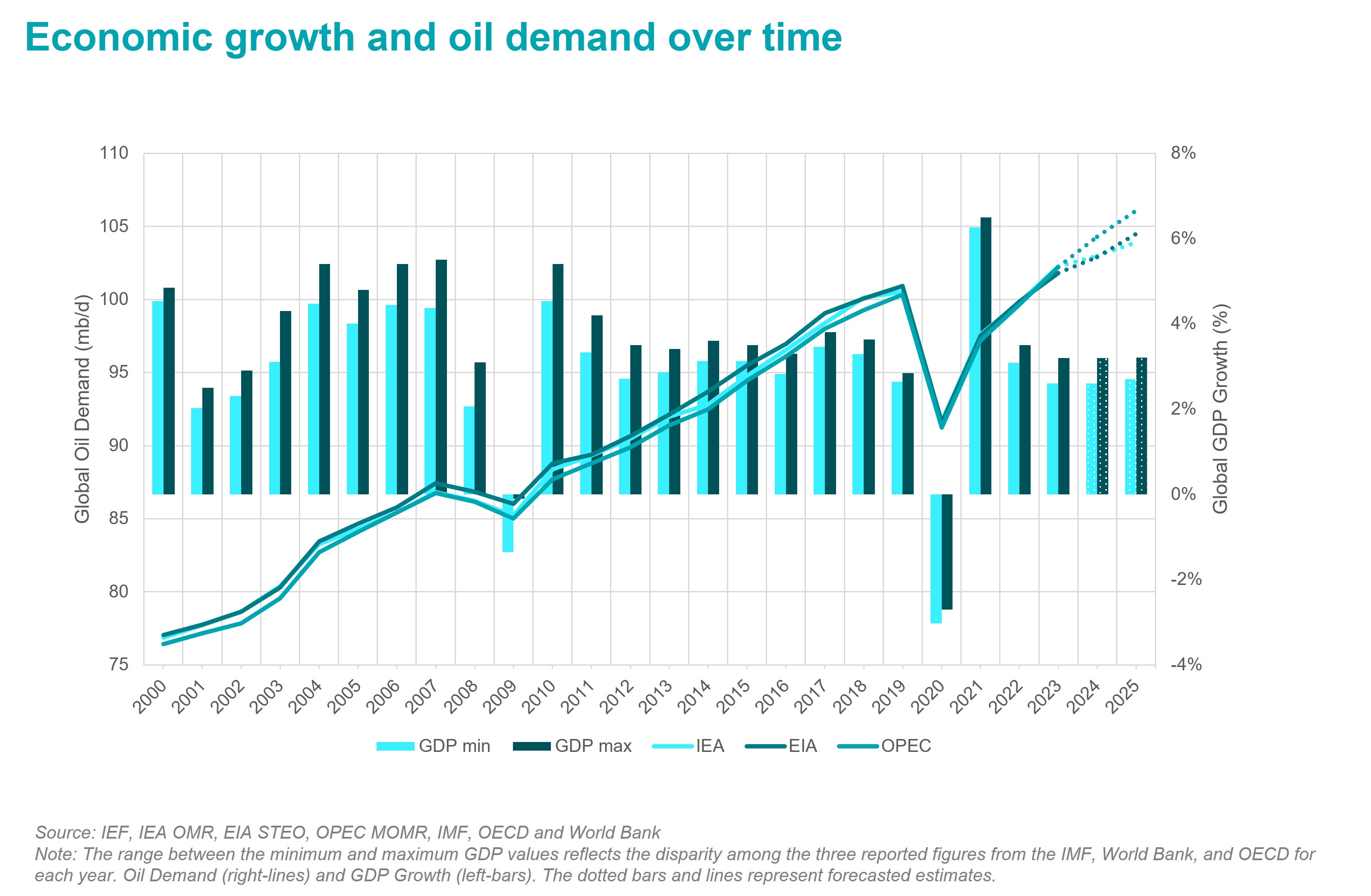

Economic Growth (GDP) and Oil Demand

The recently released economic forecasts of the OECD, IMF, and World Bank indicate notable growth disparities for 2025 that underscore uncertainty in relation to economic growth and oil demand. The OECD and IMF project a steady growth trajectory at 3.21 percent and 3.2 percent respectively, while the World Bank gives a more cautious outlook for 2025 at 2.7 percent. Energy demand growth remains closely aligned with GDP growth mainly in developing and emerging economies. Although economic recessions typically result in temporary declines in oil demand, historical trends suggest that these impacts are limited and rapidly offset by sustained increases in oil demand. This rebound is often driven by factors such as low prices, opportunities to replenish commercial and strategic stocks or demand support from monetary and fiscal policies, including quantitative easing. Over the past two decades, global oil demand estimates from the IEA and EIA have consistently exceeded those from OPEC. However, since the aftermath of the COVID-19 pandemic, increasingly ambitious assumptions regarding oil demand substitution - fueled by rapid advancements in clean technologies and efficiency improvements - have gained traction, potentially reversing this trend (see below).

Compound Oil Market Volatility

Oil markets are exposed to multiple layers of uncertainty manifest in diverging economic and oil demand outlooks, broadening military conflicts in both the Middle East and Europe, recent stock market corrections affecting short and long oil futures positions, and the uncertain outcome of US Elections on energy and climate policy. Digital disruptions, and data dependency of monetary policy further cloud oil markets stability. Though a soft landing is still considered more probable than a global downturn, risk and uncertainty prevail and can easily shift consensus.

Summary of 2023-2025 Balances

- OPEC has revised its global demand growth down to 2.1 mb/d for 2024 y/y for the first time this year, from 2.2 mb/d in the last revision, while maintaining its forecast for 2025.

- Despite the slight revision down from OPEC this month, the divergence in global demand growth forecasts is still high across the three agencies, with more than a million barrels per day difference in 2024.

- The EIA has kept its forecast for global demand growth this year at 1.1 mb/d while downgrading its forecast by approximately 0.2 mb/d to 1.6 mb/d for 2025 y/y.

- The EIA has revised up its forecasts for OECD demand by 0.1 mb/d for 2024 y/y, and this increase was offset by a downward revision in growth from non-OECD countries, which kept global demand unchanged. The EIA’s 2025 global demand growth forecast shows a downward revision of 0.2 mb/d y/y.

- The IEA has revised down its global demand growth forecasts by 0.1 mb/d for both the full year 2024 and the full year 2025.

- OPEC released its forecasts with no change in non-DoC supply growth for 2024 and 2025 y/y.

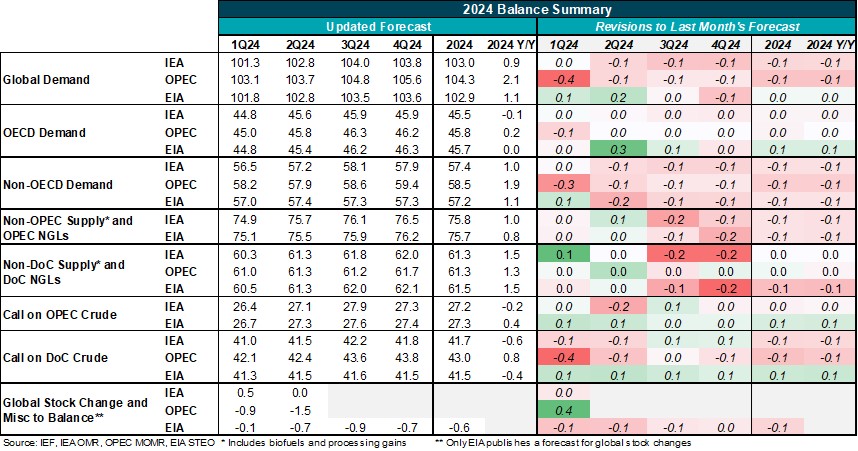

Summary of 2024 Balances and Revisions

- OPEC has revised down its forecast for global oil demand growth in 2024 by 0.1 mb/d, bringing the new projection to 2.1 mb/d y/y. This marks the first time OPEC has cut its 2024 global demand growth estimate this year, although its forecasts remain higher by more than a million barrels a day compared to the projections from the IEA and EIA.

- EIA has revised up its OECD demand growth by 0.1 mb/d for the full year in 2024, while the IEA kept its growth forecast unchanged.

Evolution of 2024 Annual Demand Growth Forecasts

- OPEC has revised down its global oil demand growth in 2024 for the first time this year, driven by new data collection and slightly slower expectations for Chinese oil demand growth.

- The EIA's 2024 global demand growth forecast shows an upward revision for the fourth consecutive month, driven by an increase in OECD demand this month.

- IEA revised its global demand growth forecast for 2024 by 0.1 mb/d y/y.

Evolution of 2024 Annual Non-OPEC Supply Growth Forecasts

- The EIA’s y/y growth in non-OPEC supply has been revised down for the third consecutive month.

- The IEA's forecast for US supply growth is still approximately 0.2 mb/d higher than those forecasted by OPEC and the EIA.

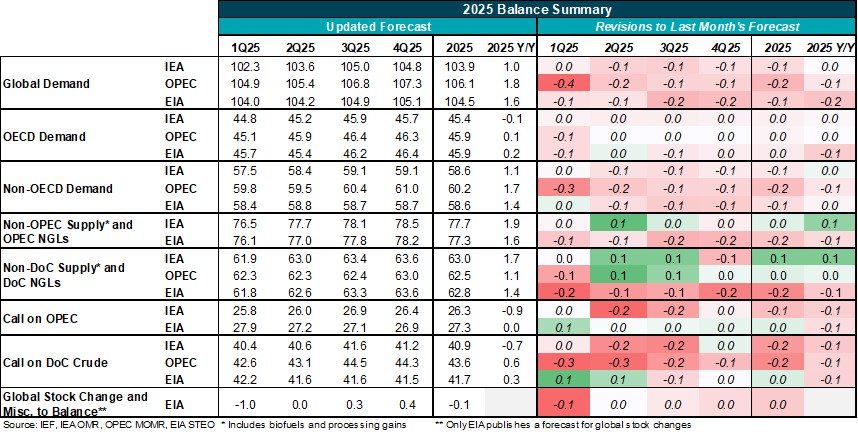

Summary of 2025 Balances and Revisions

- The divergence in global oil demand growth forecasts among major agencies remains significant, despite this month’s downward revision by the EIA.

- Although OPEC has slightly revised its estimate downward for global demand, its levels remain approximately 0.8 mb/d above the IEA projections and 0.2 mb/d higher than those of the EIA.

- The EIA has revised its global demand growth forecast downward by approximately 0.2 mb/d y/y

Evolution of 2025 Annual Demand Growth Forecasts

- OPEC has revised its global demand growth forecast downward for the first time this year.

- Despite the downward revision by OPEC, its global demand growth forecasts is still 0.8 mb/d higher than the IEA’s projections.

- IEA has revised its global demand growth forecasts downward for the third consecutive month.

Evolution of 2025 Annual Non-OPEC Supply Growth Forecasts

- The EIA has kept its non-OPEC supply growth forecasts almost unchanged y/y and is now aligning more closely with the IEA's projections.

- The EIA's forecast for the US oil supply growth is still 0.21 mb/d stronger than that developed by OPEC, despite its downward revision.