Comparative Analysis of Monthly Reports on the Oil Market

Friday 13 September 2024

Summary and Oil Market Context

Demand

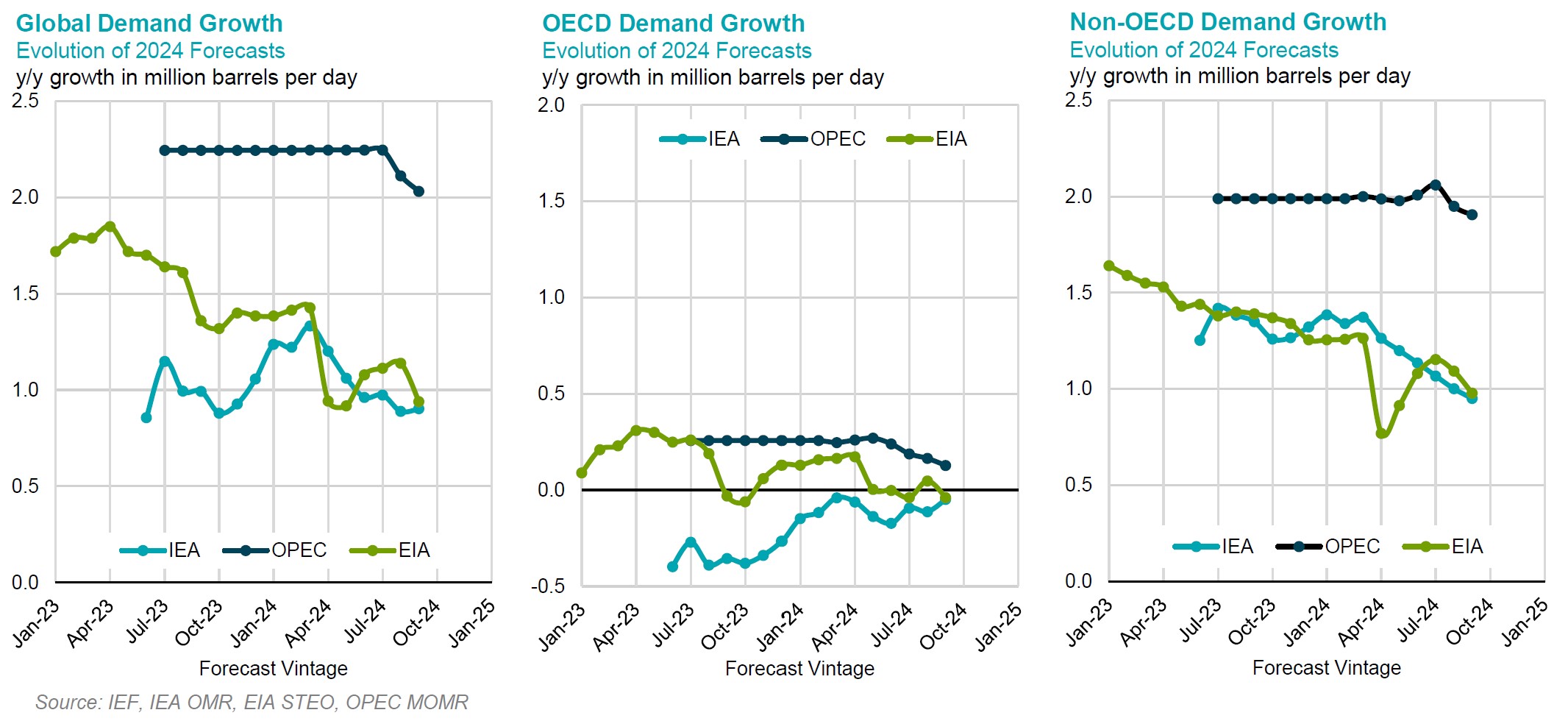

OPEC has slightly adjusted its global demand growth projection downward by approximately 0.1 mb/d to 2 mb/d for 2024 year-over-year. However, this forecast remains substantially higher, by over a million barrels per day, than the estimates provided by the IEA and EIA. The EIA is also revising its global demand growth forecast downward by 0.2 mb/d for 2024 year-over-year. In contrast, the IEA has maintained its global demand growth forecasts unchanged for 2024 y/y. OPEC has also revised downward its growth forecast for 2025 by a modest 40 tb/d. The divergence in global demand growth forecasts across the three agencies for 2025 is approximately 0.7 mb/d year-over-year.

Supply

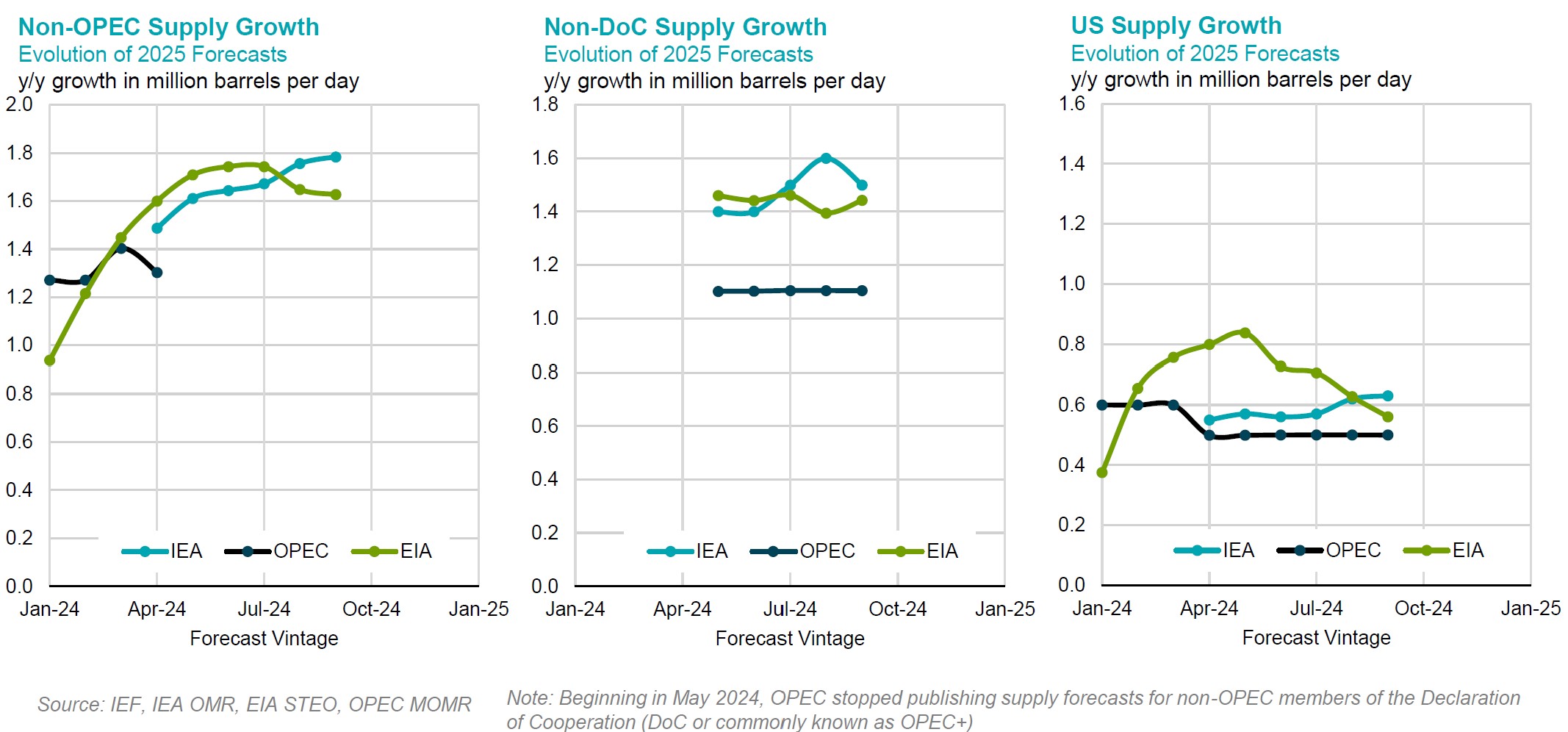

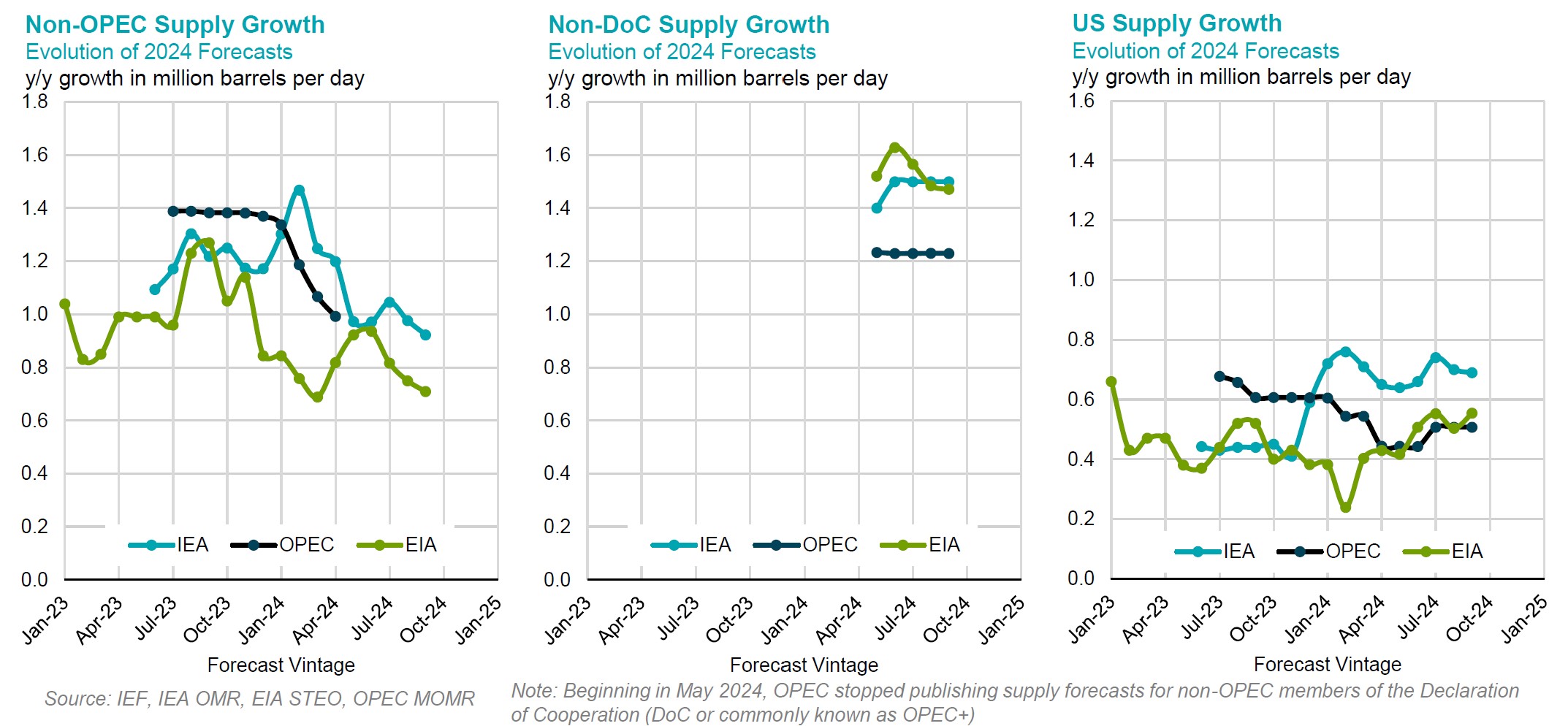

OPEC has kept its projections for non-Declaration of Cooperation (non-DoC) oil supply growth unchanged at around 1.3 mb/d in 2024 y/y and 1.2 mb/d in 2025 y/y. The EIA has also maintained its forecasts for non-OPEC supply growth for both 2024 and 2025 unchanged at 0.8 mb/d y/y and 1.6 mb/d for 2024 y/y and 2025 y/y, respectively. The IEA has kept its non-DoC supply growth projections unchanged for 2024 y/y while projecting a downward revision of 0.1 mb/d to 1.6 mb/d for 2025 y/y. The divergence among the short-term non-DoC supply growth forecasts from these three organizations is expected to reach 0.2 mb/d for 2024 y/y and 0.4 mb/d for 2025 y/y.

Energy supply and demand: Challenges in a volatile market

Members of the OPEC+ alliance decided to extend voluntary cuts on September 5th reportedly postponing their planned increase in oil production by 180 tb/d in October to maintain oil market stability. This decision is part of a broader strategy to gradually reintegrate a total of 2.2 mb/d of voluntary production cuts into the market over the coming months. The next meeting of the JMMC will be held on October 2nd, and then OPEC+ ministers will hold a full meeting of the group on December 1st.

Beyond weakening economic trends and oil inventory build, disruptions remain a significant risk to the global energy balance. Recent oil production outages in Libya have led to temporary loss of approximately half a million barrels per day.

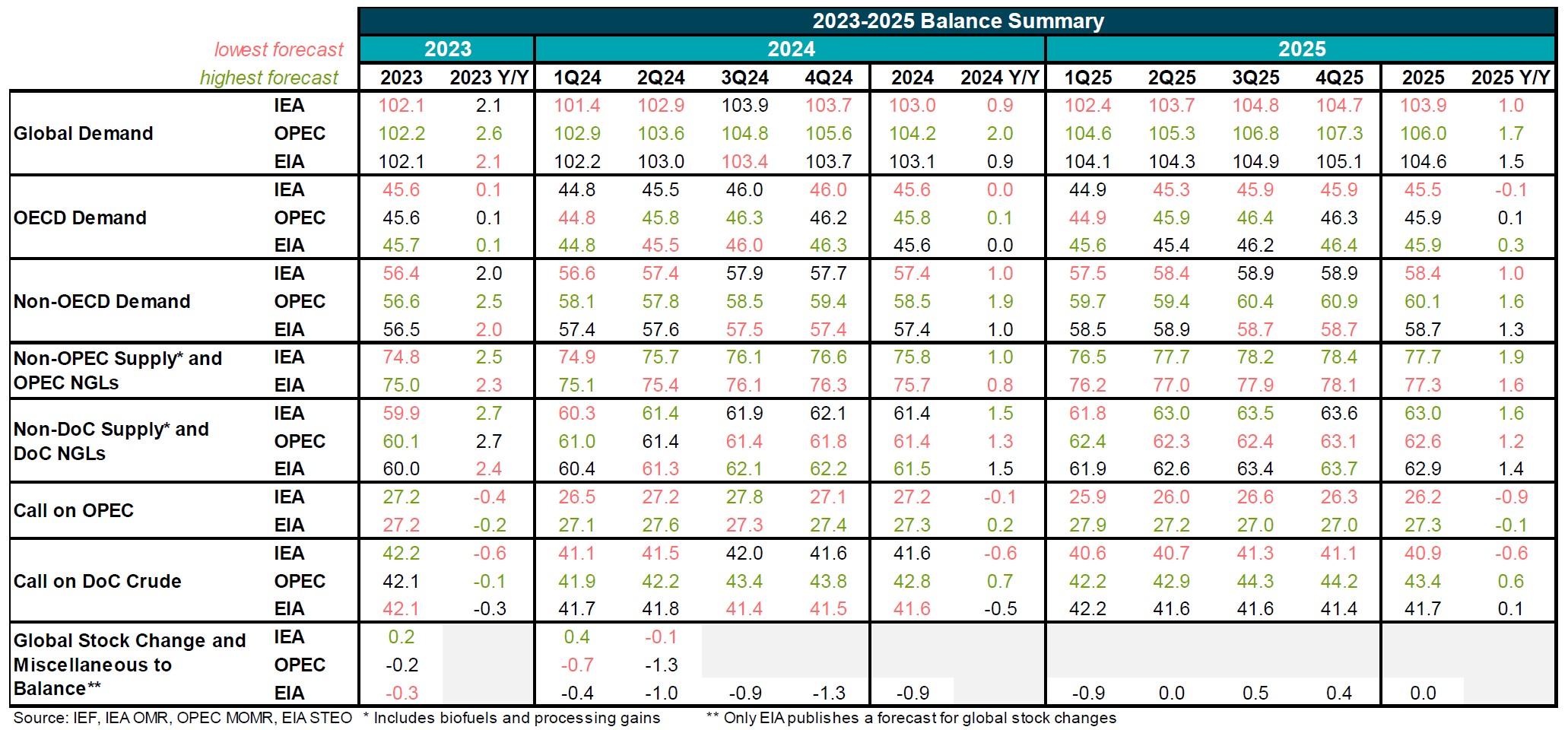

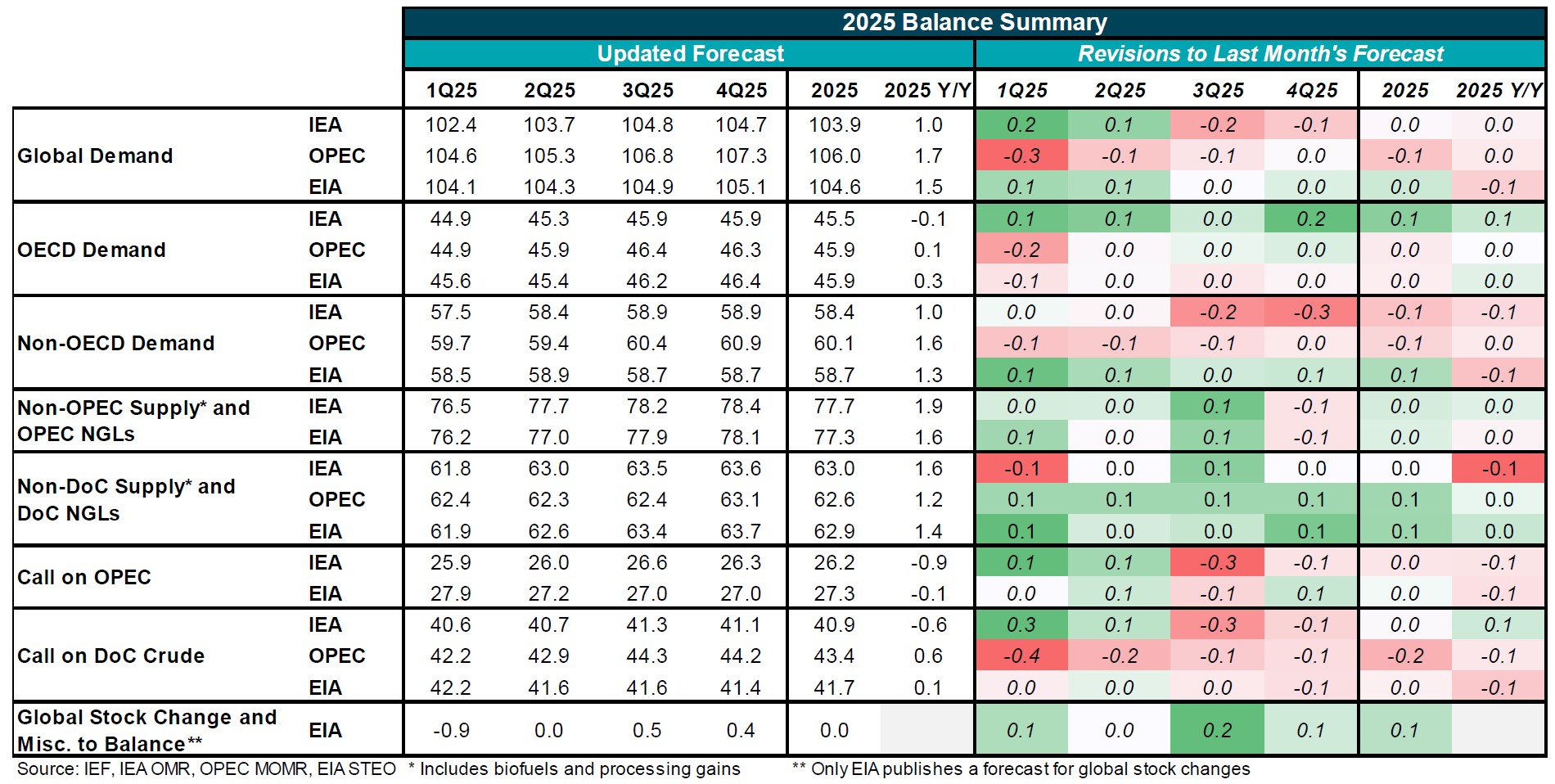

Summary of 2023-2025 Balances

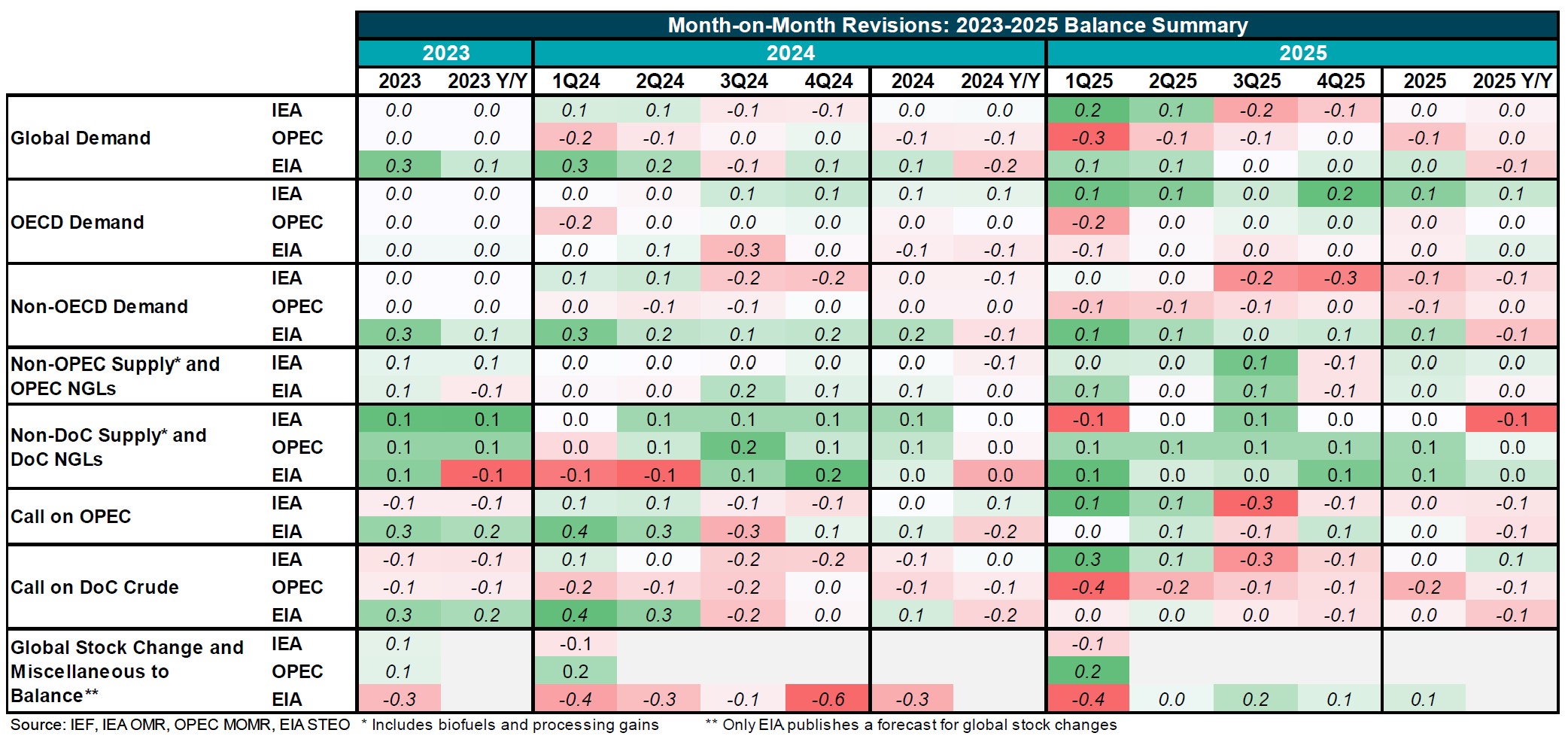

- OPEC has revised slightly its global demand growth forecast down to 2.0 mb/d for 2024 year-over-year, marking the second consecutive downward revision this year. For 2025, the forecast has also been adjusted for the first time to 1.7 mb/d, down from 1.8 mb/d in the previous month's revision.

- Despite this modest decrease from OPEC this month, the divergence in global demand growth forecasts remains significant among the three agencies, with a difference of over one million barrels per day for 2024.

- The IEA has maintained its forecast for global demand growth for 2024 and 2025 at 0.9 mb/d year-over-year and 1 mb/d year-over-year, respectively.

- The EIA has revised its forecasts for global demand upward by 0.1 mb/d for the full year 2024, driven by non-OECD demand growth, while keeping its forecasts for 2025 unchanged.

- The IEA has revised its OECD demand growth forecasts upward by 0.1 mb/d for both 2024 and 2025 year-over-year, while revising down its non-OECD growth forecast by 0.1 mb/d year-over-year for both years.

- OPEC revised its non-DoC supply growth upward for the full years 2024 and 2025 by 0.1 mb/d each year.

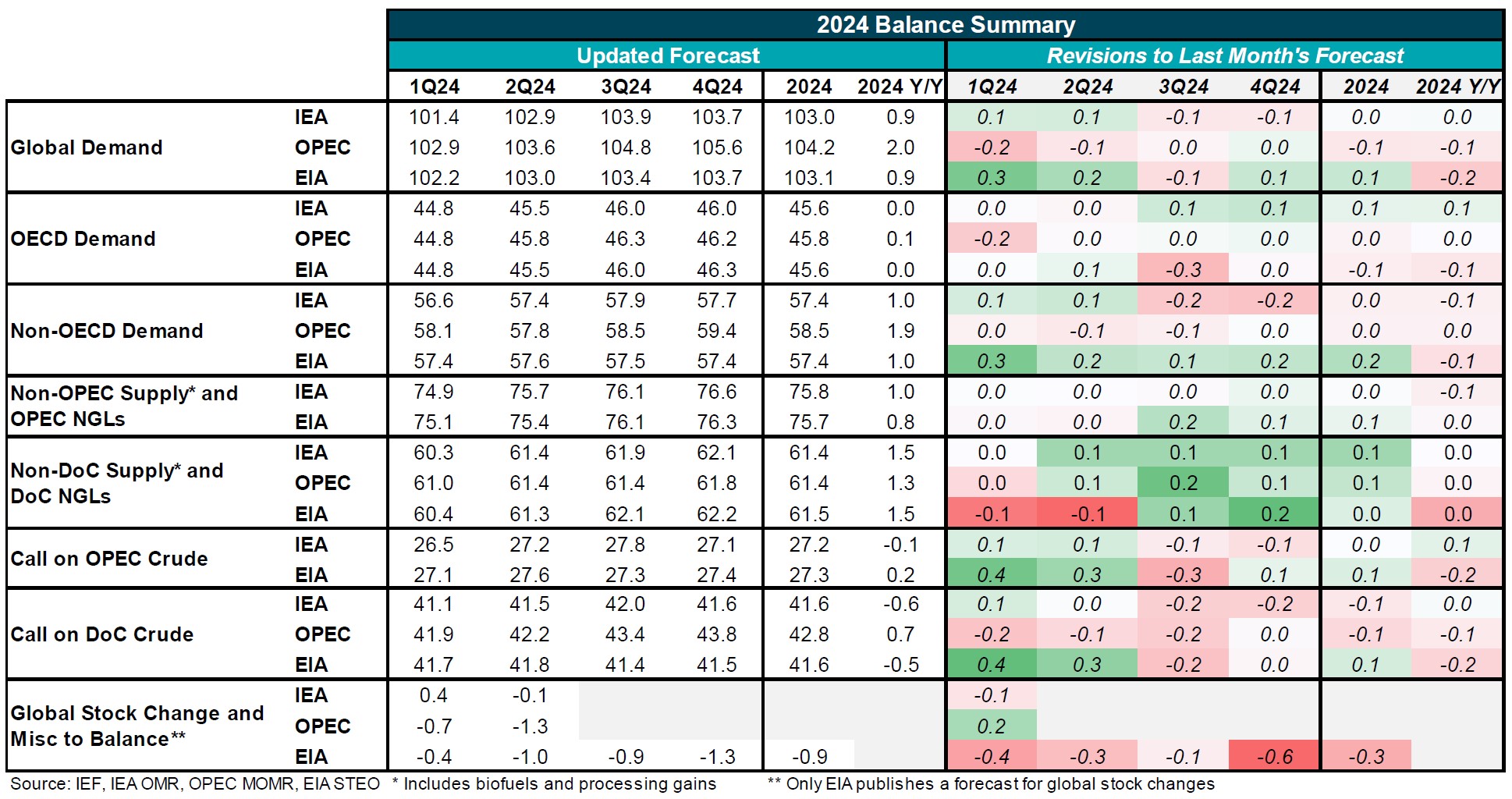

Summary of 2024 Balances and Revisions

- OPEC has revised down its forecast for global oil demand growth in 2024 by 0.1 mb/d to 2.0 mb/d year-on-year.

- The EIA has revised up its global demand growth by 0.1 mb/d for the full year in 2024, while the IEA has kept its global demand growth forecast unchanged.

Evolution of 2024 Annual Demand Growth Forecasts

- OPEC has revised down its global oil demand growth by approximately 80 tb/d in 2024, informed by new data received.

- The EIA's global demand growth forecast shows a downward revision of nearly 0.2 mb/d year-on-year.

- The IEA has kept its global demand forecasts unchanged, with the decline in Non-OECD demand offset by an increase in OECD demand.

Evolution of 2024 Annual Non-OPEC Supply Growth Forecasts

- The EIA's year-on-year growth in non-OPEC supply has been revised down for the fourth consecutive month.

- The divergence between the IEA's and EIA's forecast for US supply growth declined to less than 0.15 mb/d, down from 0.2 mb/d in last month's revision.

Summary of 2025 Balances and Revisions

- The divergence in global oil demand growth forecasts among major agencies remains significant, despite this month's downward revisions.

- Although OPEC has slightly revised its estimate downward for global demand, its levels remain approximately 0.7 mb/d above the IEA projections y/y and 0.2 mb/d higher than those of the EIA y/y.

- The EIA has revised its global demand growth forecast downward by approximately 0.1 mb/d y/y.

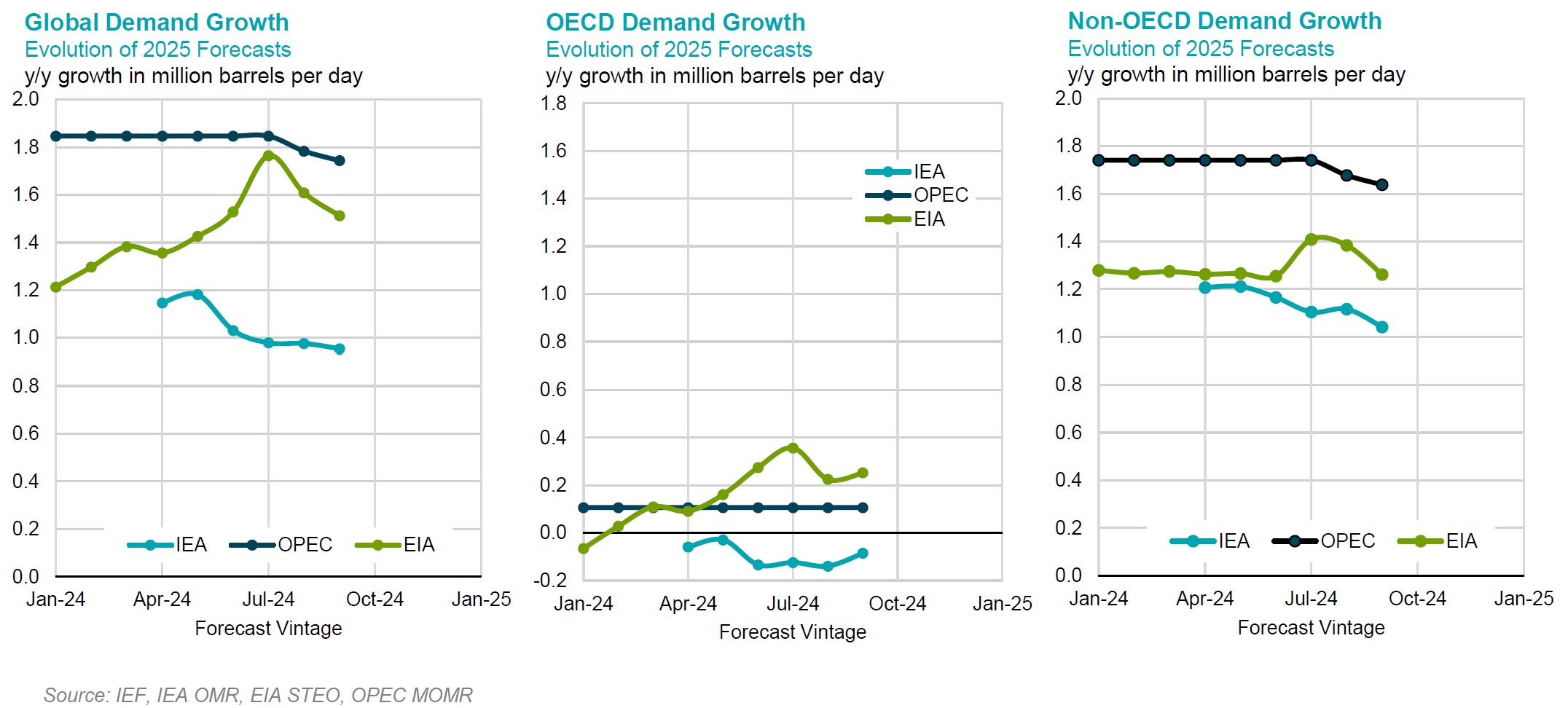

Evolution of 2025 Annual Demand Growth Forecasts

- OPEC has slightly revised its global demand growth forecast downward (~40 tb/d) for the second time this year.

- Despite the relative downward revision by OPEC, its global demand growth forecast is still 0.7 mb/d greater than the IEA's projections.

- The IEA has almost maintained its global demand growth for 2025 unchanged.

Evolution of 2025 Annual Non-OPEC Supply Growth Forecasts

- The divergence between IEA's and EIA's non-OPEC supply growth forecasts reached almost 0.2 mb/d, with the IEA maintaining its upward revision.

- The IEA's forecast for US oil supply growth exceeded the EIA's and OPEC's forecasts for the first time this year.