Comparative Analysis of Monthly Reports on the Oil Market

Friday 13 December 2024

Summary and Oil Market Context

Demand

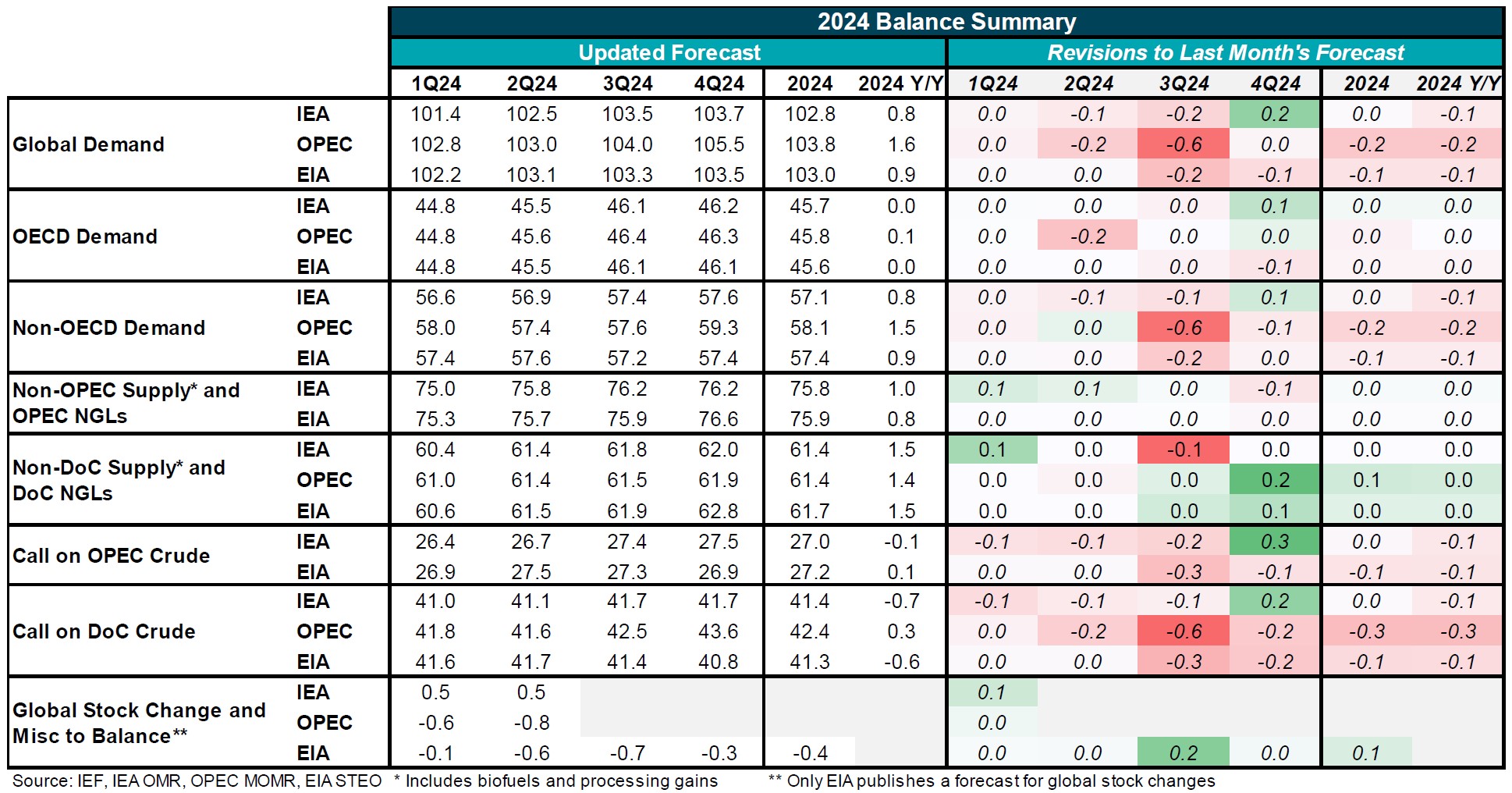

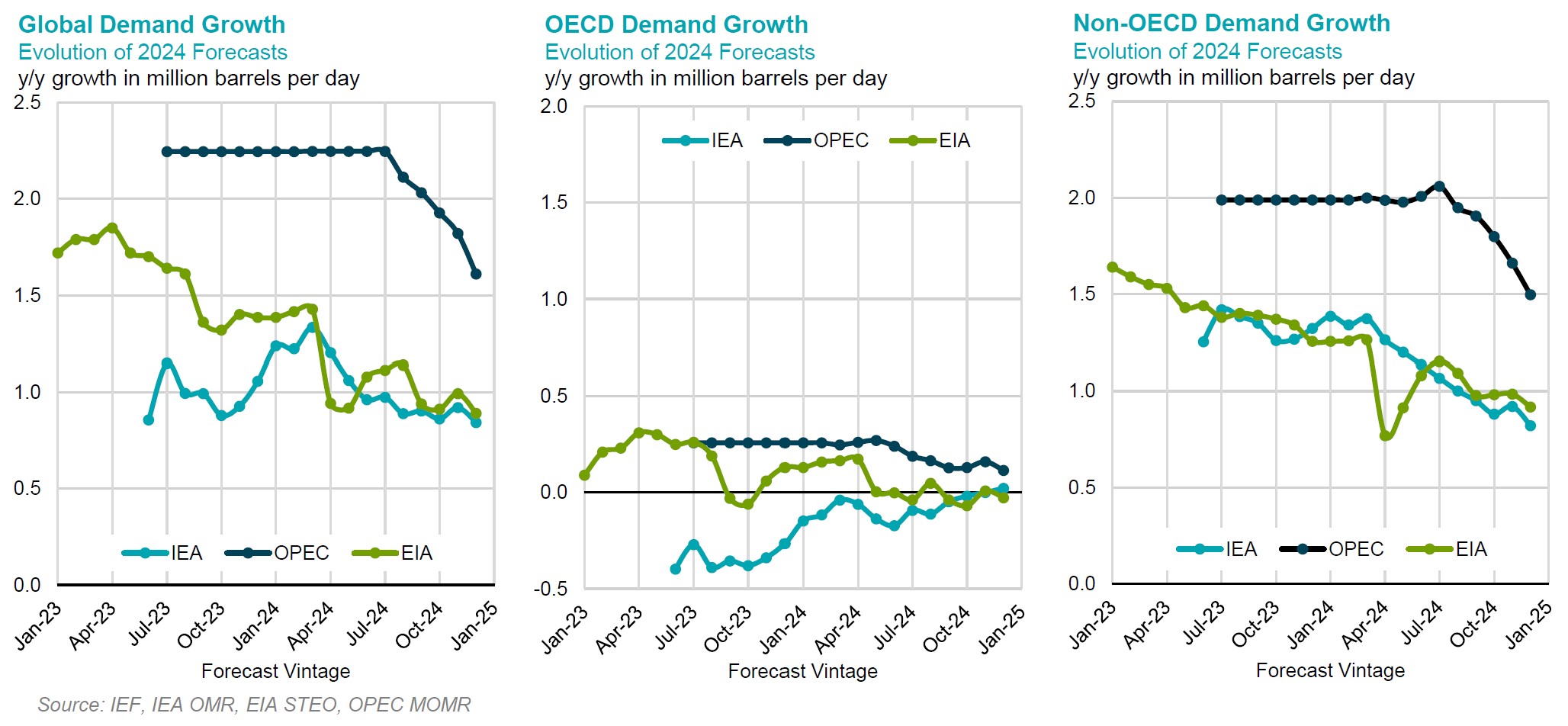

OPEC has revised its global oil demand growth estimate downward by more than 0.2 mb/d to 1.6 mb/d for 2024 year-on-year (y/y), for the fifth consecutive month. Similarly, OPEC has also revised down its 2025 global oil demand growth forecast by approximately 0.1 mb/d to 1.4 mb/d y/y. These adjustments are due to the updated quarterly statistics of this year. These revisions have reduced the gap in global oil demand between the IEA and EIA to 0.8 mb/d y/y for 2024 and 0.3 mb/d y/y for 2025.

The EIA has also revised its global demand growth forecasts down by 0.1 mb/d y/y for 2024 to 0.9 mb/d, while it has revised its 2025 demand growth estimates up by 0.1 mb/d to 1.3 mb/d y/y. India is projected to increase its demand for liquid fuels by 0.2 mb/d in 2024 and by more than 0.3 mb/d in 2025, primarily due to the expected rise in demand from the transportation sector

The IEA has slightly revised down its global oil demand growth for this year to approximately 0.8 mb/d in 2024 y/y, while keeping its global demand growth forecasts unchanged for the full year of 2024. This adjustment is due to weaker-than-expected demand from major consumers in non-OECD countries. However, the forecasted global demand for 2025 shows an increase of 0.1 mb/d year-over-year, reaching 1.1 mb/d in 2025.

Supply

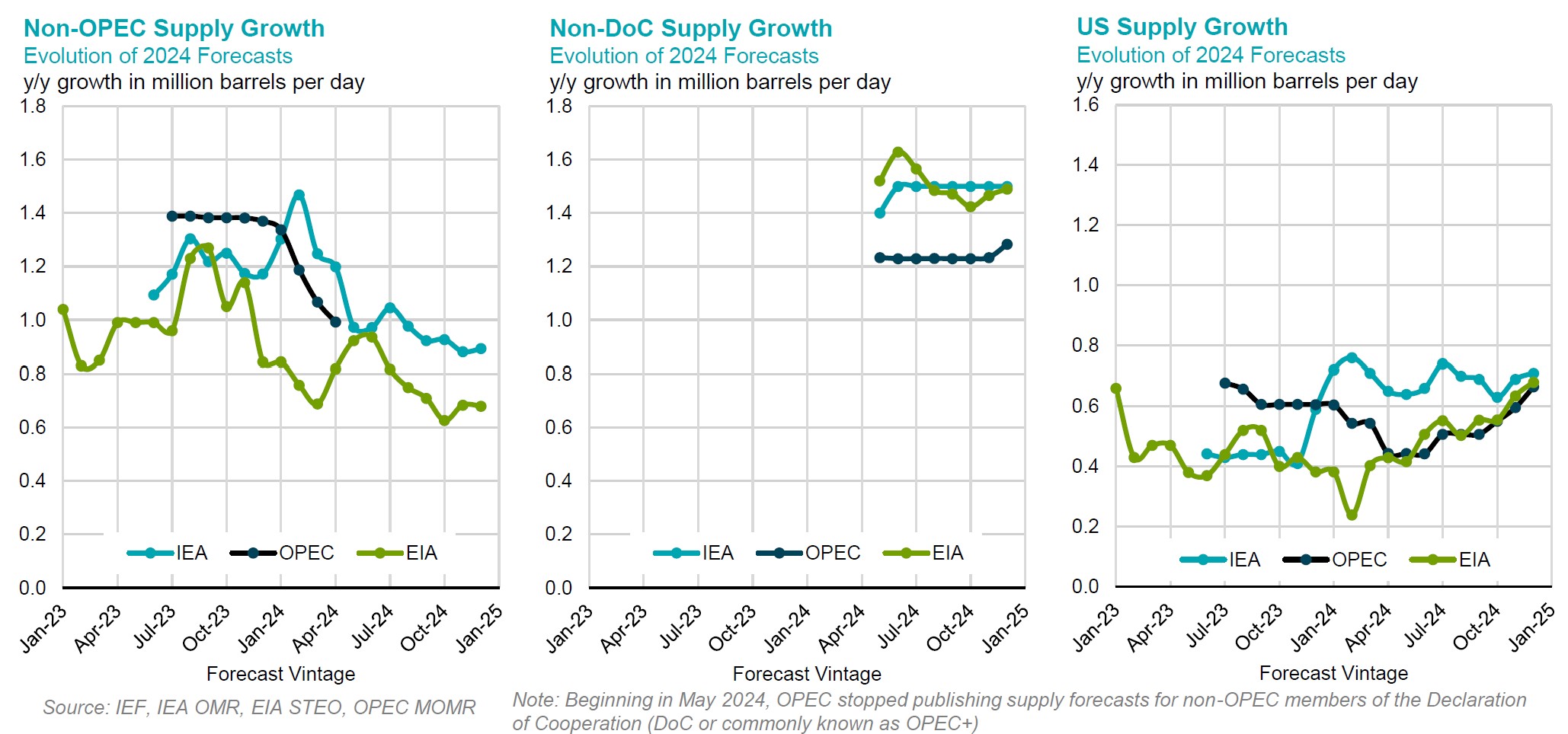

OPEC has revised its projections for non-Declaration of Cooperation (non-DoC) oil supply growth upward by 0.1 mb/d for the full year of 2024, with approximately a similar increase expected for the full year of 2025. This growth trend is primarily driven by the robust production capabilities of the United States and Canada in both forecast periods.

The EIA has kept its projections for non-DoC supply growth unchanged for the full year of 2024, while increasing it by 0.1 mb/d for the full year of 2025. Similarly, the EIA has muted its forecasts for Non-OPEC supply growth for this year but revised down its 2025 growth forecasts by 0.1 mb/d year-on-year. The EIA has also maintained its crude oil production forecast for the US at 13.2 mb/d for 2024 and 13.5 mb/d for 2025.

The IEA has kept its supply growth forecasts for non-DoC unchanged for both 2024 and 2025 y/y. For non-OPEC, it has maintained its supply growth forecasts for 2024 y/y and revised the 2025 growth forecasts downward by 0.1 mb/d y/y

The gap in non-DoC supply growth forecasts among these three agencies is projected to reach 0.1 mb/d y/y for 2024 and 0.4 mb/d y/y for 2025

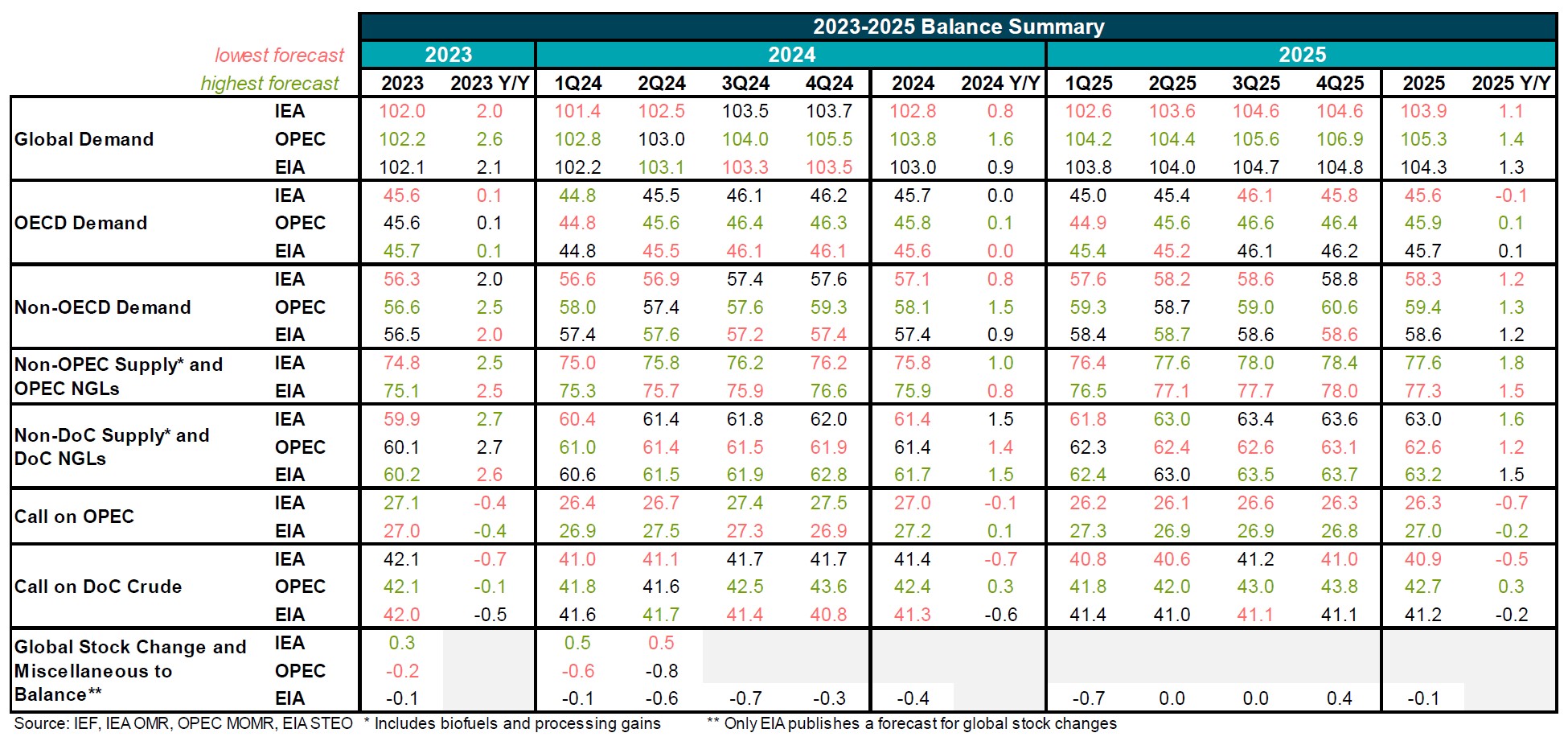

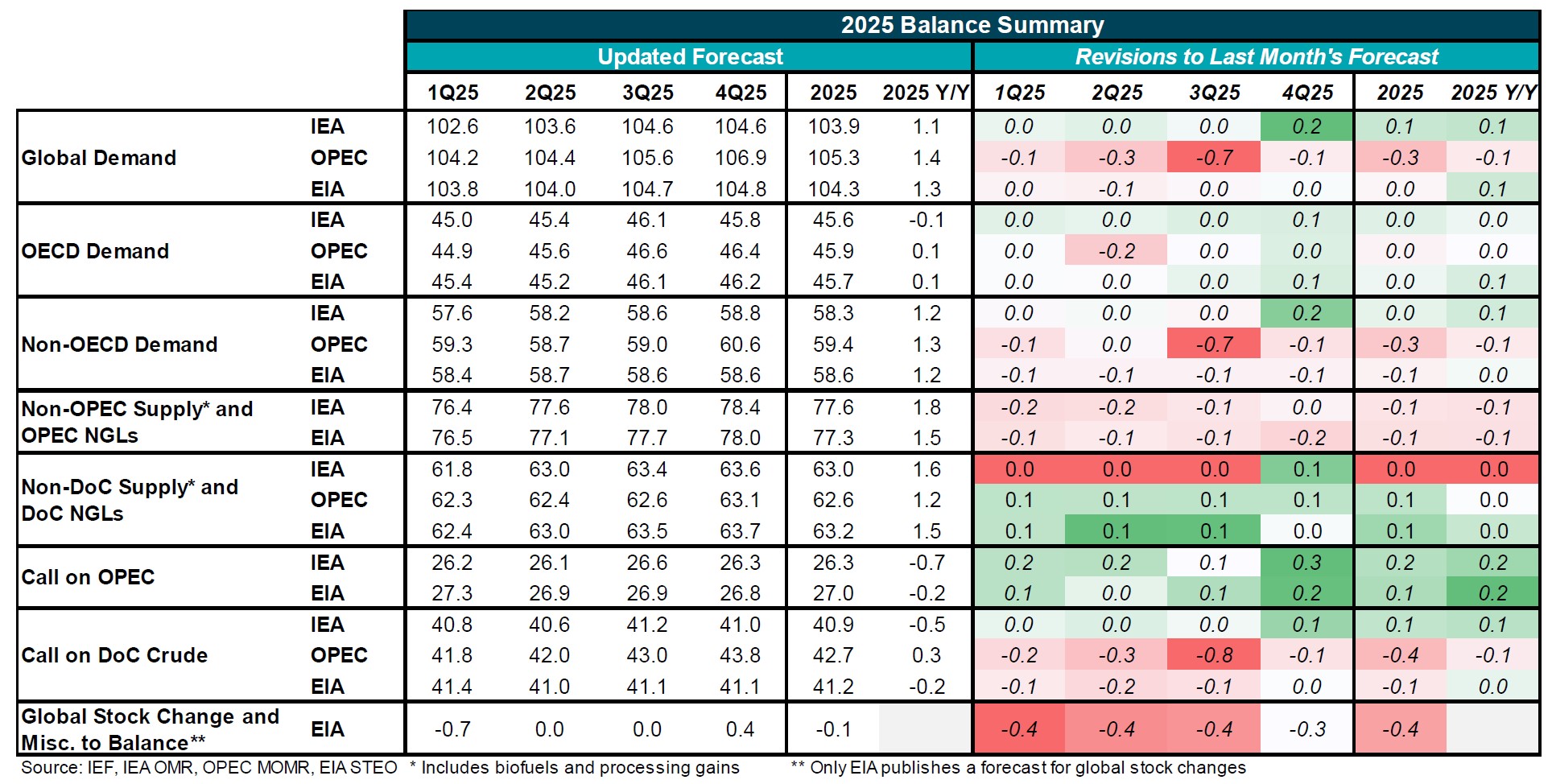

Summary of 2023-2025 Balances

- OPEC has adjusted its global oil demand growth projections downward for the fifth successive month, impacting both 2024 and 2025 outlooks. The organization has reduced its 2024 growth forecast by approximately 0.2 mb/d to 1.6 mb/d y/y. For the full year of 2025, OPEC has revised down its global demand growth estimate by 0.3 mb/d.

- The IEA has kept its forecast for global demand growth for the full years of 2024 while increasing the 2025 forecasts by 0.1 mb/d.

- The divergence in global oil demand growth estimates among the three agencies has narrowed, with a variation of approximately 0.8 mb/d expected for y/y growth in 2024 and 0.3 mb/d in 2025.

- OPEC has revised its projections for non-OECD oil demand growth downward for both the full year 2024 and 2025 by 0.2 mb/d and 0.3 mb/d, respectively.

- The EIA has adjusted its global demand growth forecasts downward by 0.1 mb/d for the full year 2024, while it has revised its forecasts for 2025 upward by 0.1 mb/d y/y.

- The IEA has revised its forecasts for global demand growth downward by 0.1 mb/d y/y, while it has revised the forecast upward by 0.1 mb/d for 2025 y/y.

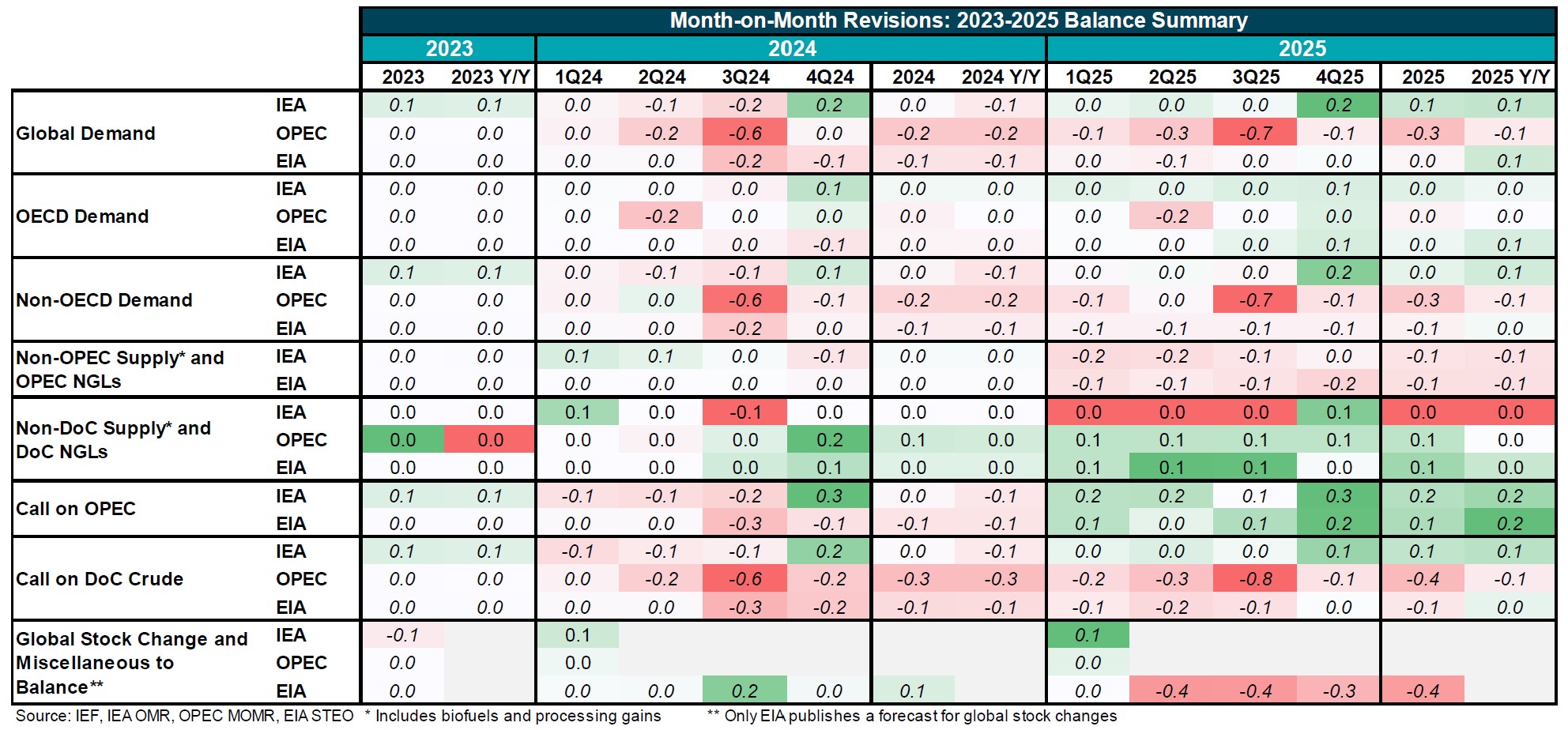

Summary of 2024 Balances and Revisions

- OPEC has revised its global demand growth forecasts for the second and third quarters of 2024 by 0.2 mb/d and 0.6 mb/d, respectively, due to updated statistics. This has influenced the full-year growth projection to be reduced by 0.2 mb/d.

- The EIA and IEA have revised their global demand growth forecasts downward by approximately 0.1 mb/d y/y.

Evolution of 2024 Annual Demand Growth Forecasts

- OPEC has revised its projections for global oil demand growth in 2024 downward for the fifth consecutive month, reducing it by approximately 0.2 mb/d due to newly received data.

- The projections from the three agencies regarding the OECD are more aligned compared to those for the non-OECD, where the gap remains over 0.5 mb/d, despite the recent reduction from OPEC.

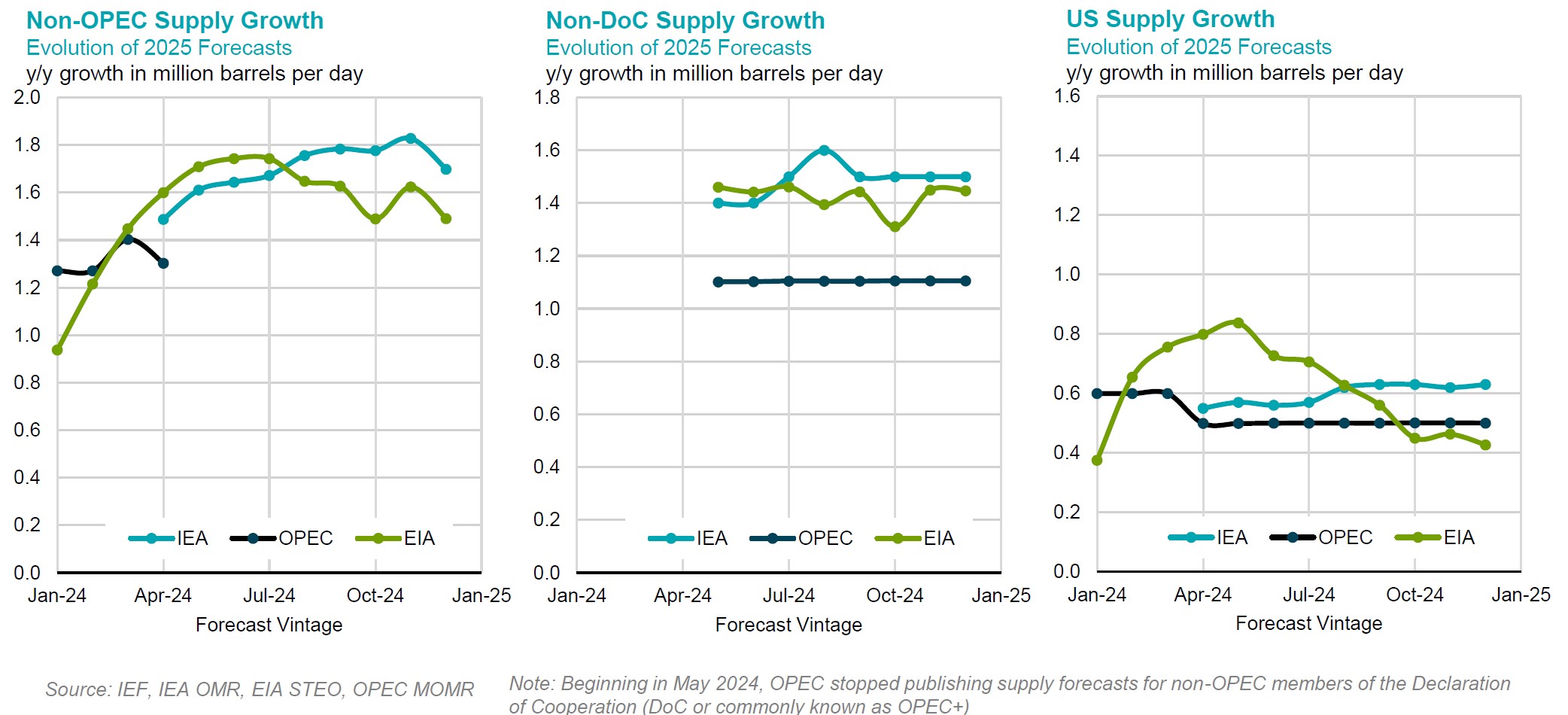

Evolution of 2024 Annual Non-OPEC Supply Growth Forecasts

- The divergence in non-OPEC supply growth between the EIA and IEA is currently about 0.2 mb/d, compared to the marginal differences observed last June.

- The IEA, OPEC, and EIA continue to display strong alignment regarding US supply growth in recent months.

Summary of 2025 Balances and Revisions

- OPEC revised its forecasts for global demand growth down by 0.3 mb/d for the full year in 2025, driven by a reduction in non-OECD demand growth.

- The IEA has revised its global non-OPEC supply growth forecast upward by approximately 0.1 mb/d for the full year of 2025.

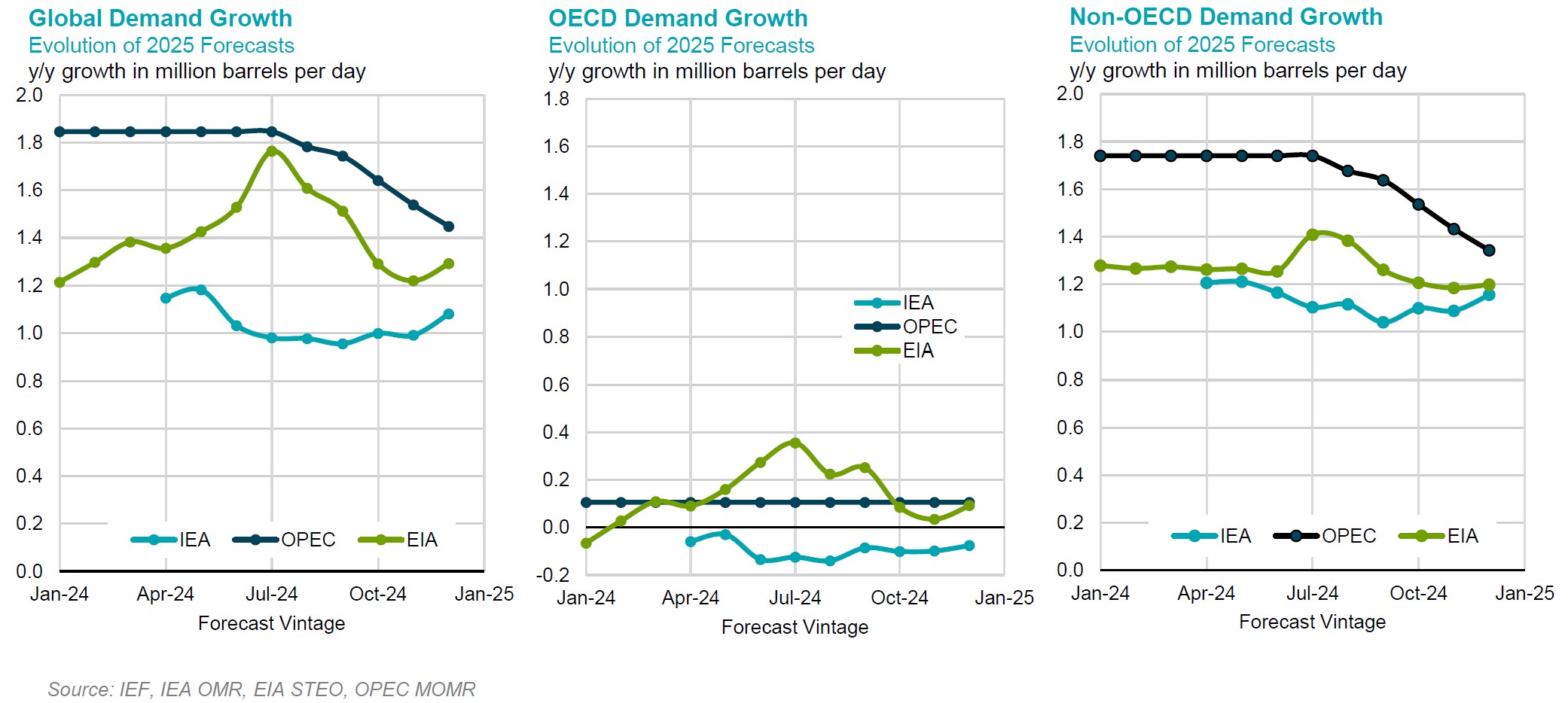

Evolution of 2025 Annual Demand Growth Forecasts

- OPEC has revised its global demand growth forecast downward for the fifth consecutive month by approximately 0.1 mb/d y/y, bringing it to 1.4 mb/d y/y.

- The three agencies have narrowed their non-OECD demand growth forecasts from approximately 0.6 mb/d y/y in April of this year to less than 0.2 mb/d this month.

Evolution of 2025 Annual Non-OPEC Supply Growth Forecasts

- The EIA and IEA both adjusted their forecasts of non-OPEC supply growth downward.

- The US supply growth forecasts between the IEA and EIA are widening, with the gap reaching 0.2 mb/d this month.