IEF Global Oil Inventories

JODI Data Transparency Report

A report by the International Energy Forum

December 2024

Introduction

Oil inventories play a pivotal role in providing insights into market conditions and order flows, serving as a fundamental component of supply and demand dynamics. Changes in stock levels, whether an increase or decrease in inventories, reflect supply stages, and demand directions. These changes inform crude price mechanisms and consequently influence energy prices in both physical and financial markets.

Inventory data reflects the stock levels of oil stored throughout the entire crude value chain, including production sites, transportation hubs, refineries, and commercial and strategic storage facilities. This information helps shape the evolution of short-, medium-, and long-term trading positions.

There are three main types of storage that gather oil inventories: Emergency or Strategic Reserves, which are held to ensure energy security in case of significant supply disruptions; Commercial Stocks, which are maintained to respond to regular market fluctuations; and In-Transit inventories, which consist of crude oil being transported via pipelines, tankers, railcars, or trucks but have not yet reached their storage offtake or processing destination.

Tracking and monitoring oil inventories is vital to assess oil market stability and the oil supply-demand balance and is a key determinant of global energy security. Inventories function as a safety measure to shield against supply disruptions caused by force majeure events, such as natural catastrophes including extreme weather and seismic events (hurricanes, earthquakes and tsunamis), geopolitical risks, or any other unforeseen situation that could impact negatively the balance of oil and energy markets.

In terms of supply, inventories serve as a regulator for producers’ performance, allowing them to systematically adjust their production levels to meet the volumes required by the oil market and avoid any over-or under-supply situations. A sudden or structural imbalance in oil supply and demand could lead to excessive price volatility and interfere with investment cycles. This does not only affect firms’ and producers’ financial results but also impacts financial market stability in producer and consumer countries, as well as wider macro-economic balance. Oil inventories help to manage fluctuations in demand and supply by ensuring that there is sufficient oil inventory available to meet market needs during periods of high demand or faltering supply. By maintaining sufficient oil inventory levels, companies and governments can help stabilize prices and reduce extreme market volatility.

In terms of demand, oil inventory data serve as a pivotal barometer for understanding and forecasting consumption trajectories. Inventory levels function as a critical indicator of market balance and usage patterns. A drawdown in crude inventories typically signals that consumption is outpacing production, hinting at robust uptake and potentially higher price action. Market participants, including traders, researchers, and investors, closely scrutinize weekly stockpile bulletins to assess short-term demand and make data-driven decisions. These inventory fluctuations not only mirror current offtake but also shape future pricing and extraction strategies.

Insights gained from oil inventory data contribute to managing real-time and short-term risks related to oil supply chains through the implementation of financial instruments to overcome disruptions and price volatility, as well as to ensure policy and regulatory compliance amidst market changes. In the longer run, governments and companies also rely on oil inventory data, including volumes, capacities, and changes, to elaborate appropriate energy security mechanisms and oil market strategies. These strategies encompass production adjustments, investment decisions for the development of existing and new production and infrastructure capacities, as well as wider macroeconomic policy formulation.

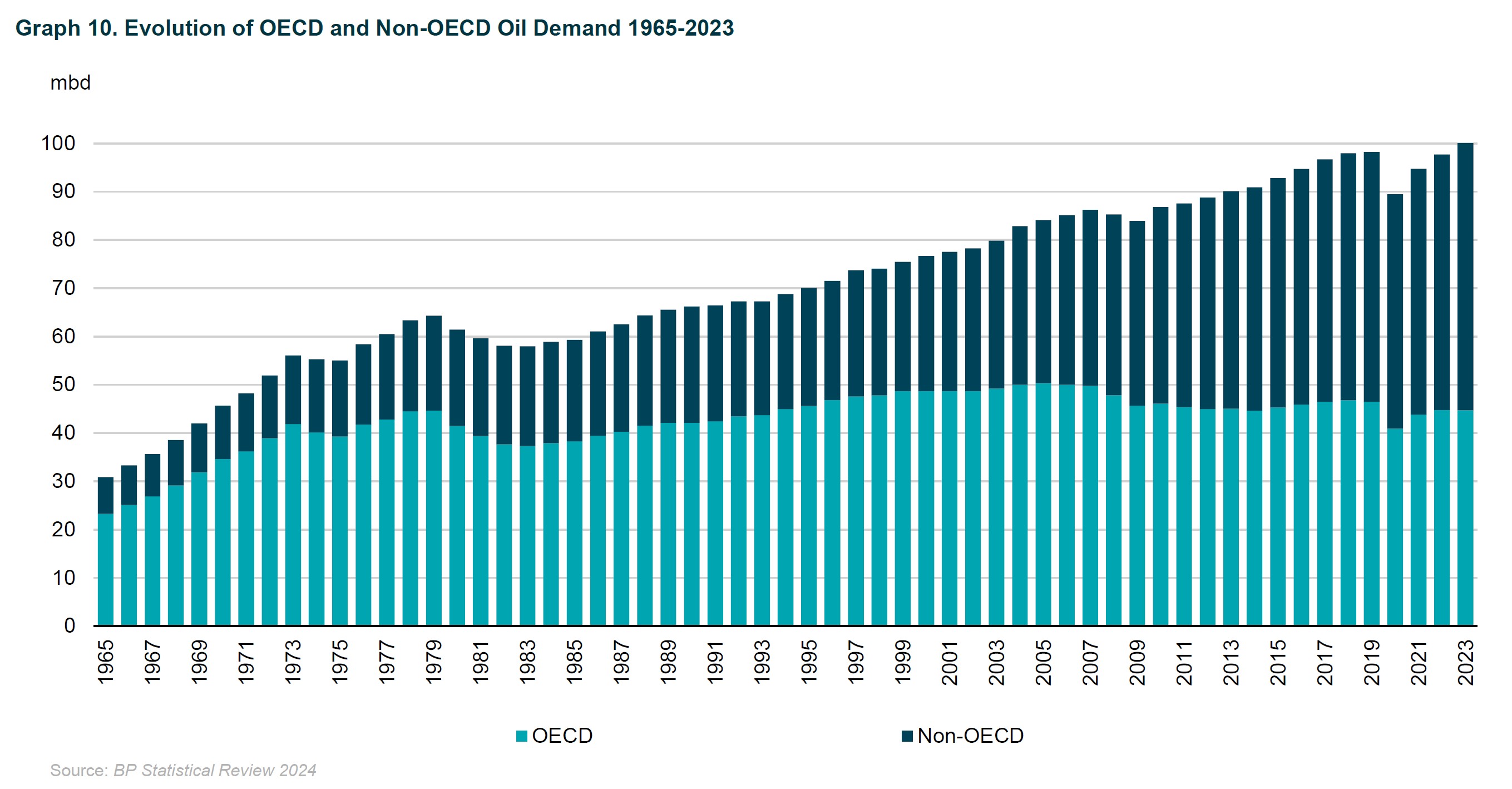

Monitoring global energy market data, particularly oil inventory data, is an essential part of the IEF producer-consumer dialogue, which led to the establishment of the Joint Organizations Data Initiative (JODI) in 2005. The objective of JODI is to ensure that energy market data from official government sources is complete, comprehensive, readily accessible, timely, and regularly updated. This goal has gained increasing significance over time due to shifts in energy transitions and oil demand growth, particularly as demand moves from advanced OECD countries to non-OECD growth economies. In these areas, oil inventory data from official sources is often underreported, making it challenging to accurately assess market conditions. Governments and oil market stakeholders have increasingly recognized the need for transparency in the oil market due to developments that heighten uncertainty for all parties involved. This concern is particularly pressing if oil inventory data reporting does not meet well-established international standards. The IEF plays a crucial role in promoting this transparency through its producer-consumer dialogue and the coordination of JODI (See also Extraordinary IEF Ministerial Meeting).

The growing importance of enhanced producer-consumer dialogue and improving energy market data transparency was reiterated in the G20 Communiqué of G20 Energy Ministers meeting held in Riyadh, Saudi Arabia on September 27-28, 2020. The Communiqué extended an "invitation for the IEF in cooperation with the IEA and the OPEC, under the umbrella of JODI and trilateral agreement, to take steps with the aim to fill the gap in data transparency for more comprehensive energy data coverage and analysis in cooperation with other international and regional organizations." (G20, 2020).

Heightened geopolitical tensions and geoeconomic shifts, as well as rising uncertainties in energy markets due to energy transition policies, underscore the critical importance of more regular and efficient reporting on oil inventories and in particular on the JODI platform set up for this purpose. Enhanced collaboration among international organizations and government officials to improve oil inventory data will reinforce trust and investor confidence, helping to meet energy security, sustainable development, and climate targets in an orderly and just manner.

Key Figures

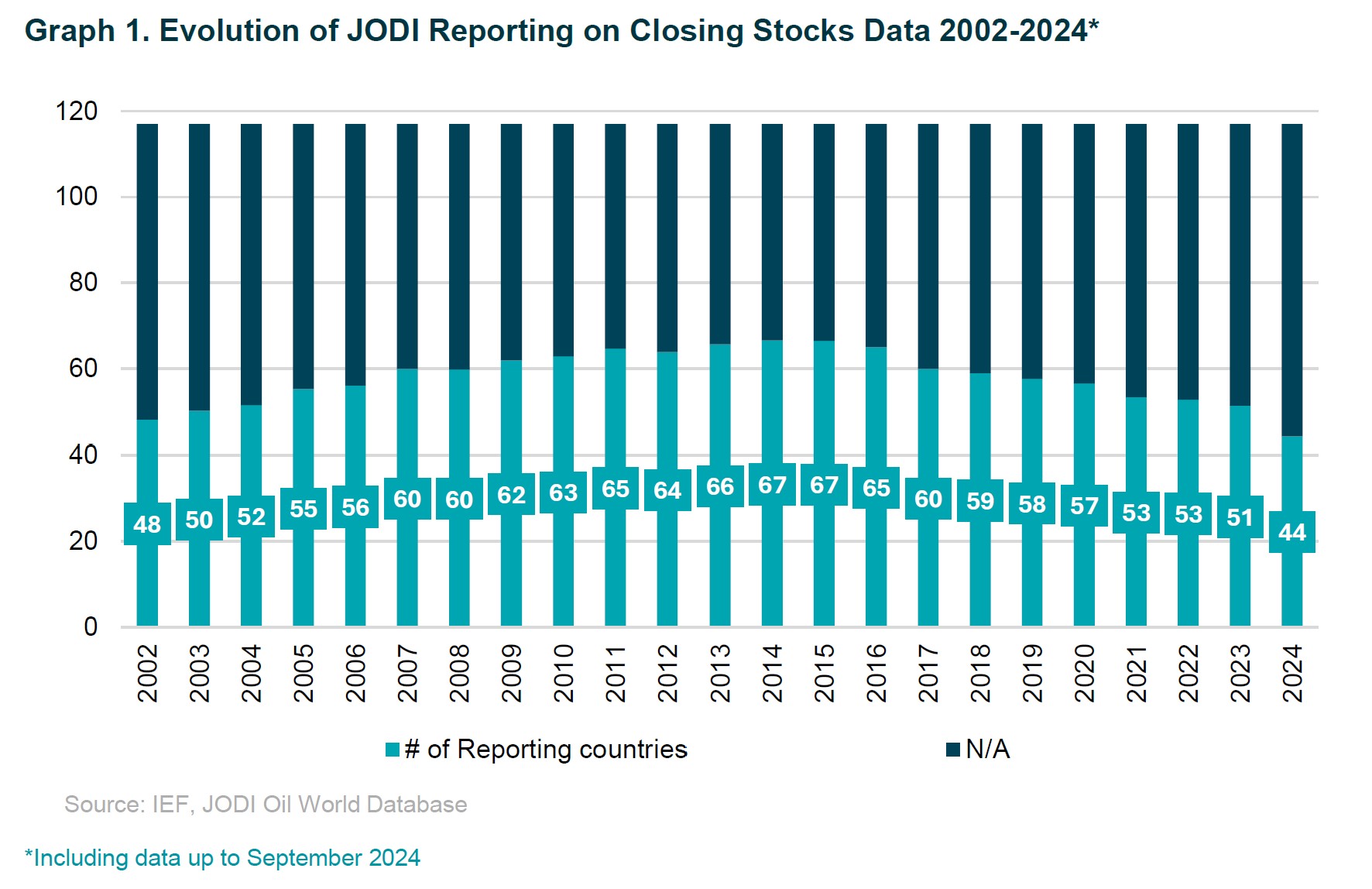

Figure 1 - Evolution of JODI Reporting on Closing Stocks Data 2002-2024

Download Figure 1

Download Figure 1 Figure 4 - Regional Economic Growth Compared to Global Trends

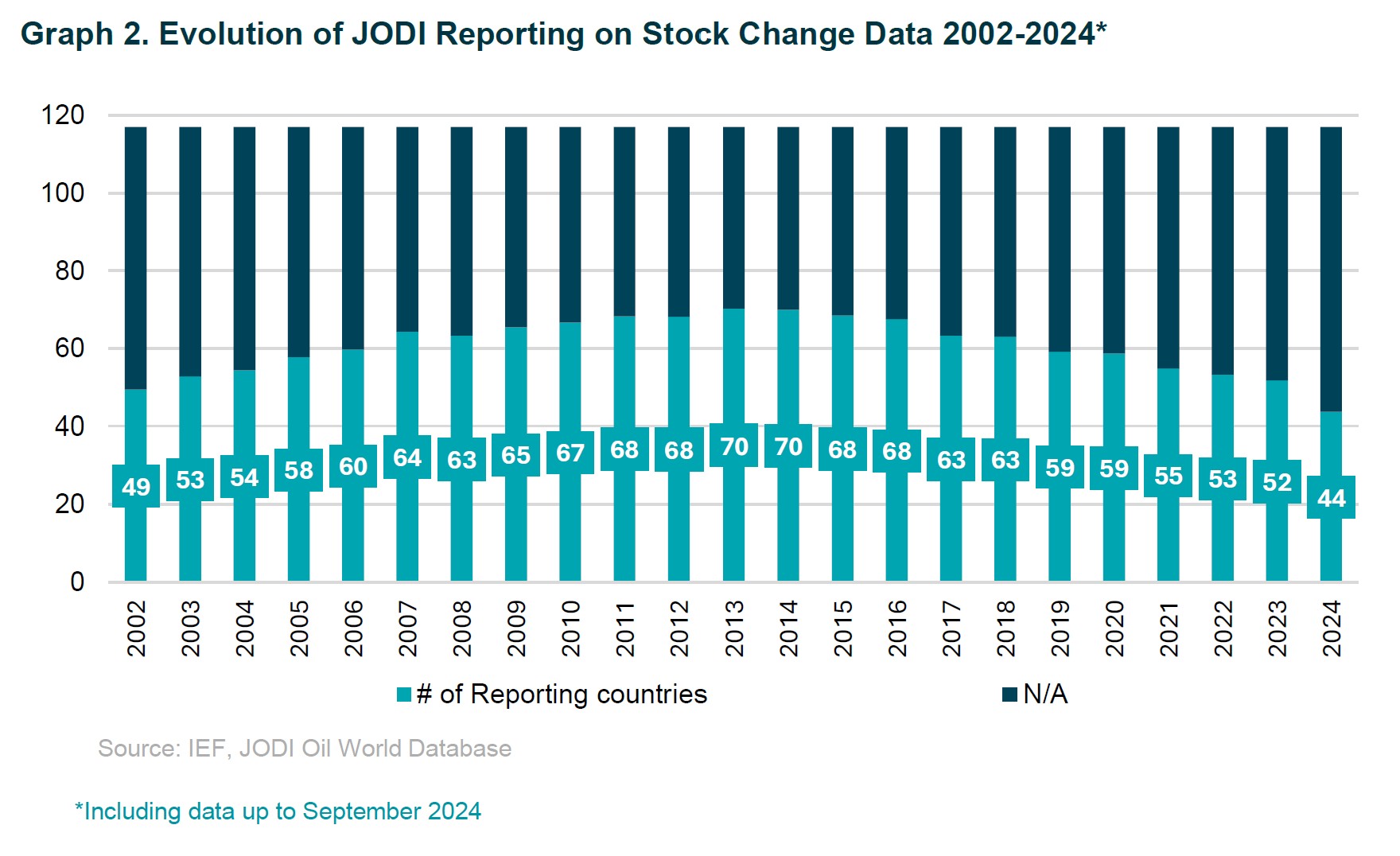

Download Figure 2

Download Figure 2 Figure 5 - IEA OPEC and US EIA projections of Oil Demand in the Transport Sector

Download Figure 3

Download Figure 3 Figure 9 - Total World Greenhouse Emissions from Transportation Sector, by Mode (Mt)

Download Figure 4

Download Figure 4 Figure 12 - Jet fuel demand from the major consumers presented in JODI

Download Figure 5

Download Figure 5 About the International Energy Forum

The International Energy Forum (IEF) is the world's largest international organization of energy ministers, representing both producing and consuming nations. The IEF has a broad mandate to examine all energy issues, including oil and gas, clean and renewable energy, sustainability, energy transitions and new technologies, data transparency, and energy access. Through the Forum and its associated events, officials, industry executives, and other experts engage in a dialogue of increasing importance to global energy security and sustainability.