Upstream Oil and Gas Investment Outlook

A report by the International Energy Forum and S&P Global Commodity Insights

June 2024

Executive Summary

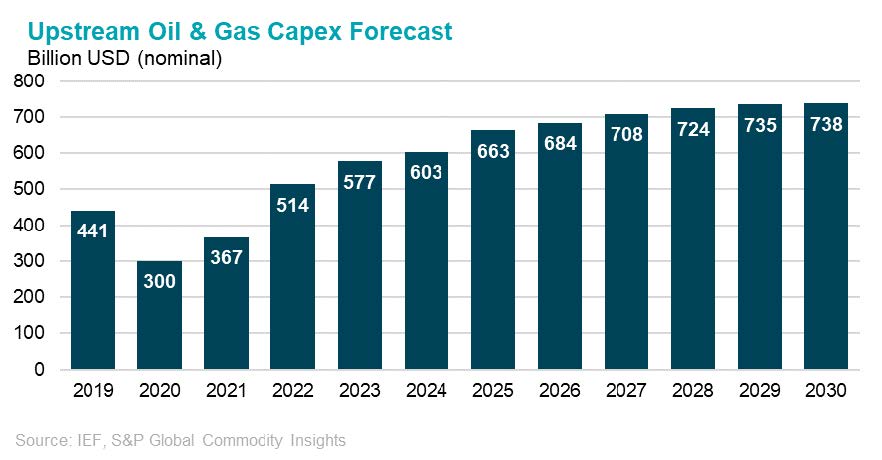

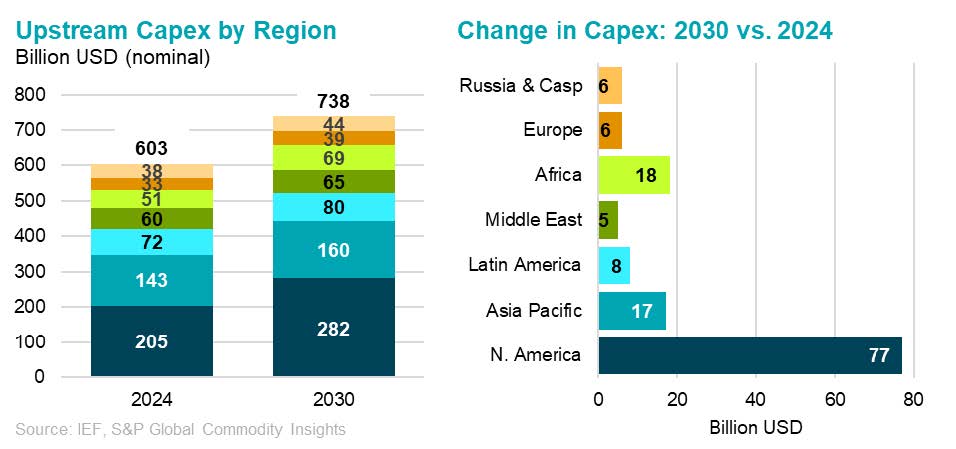

- Annual upstream investment will need to increase by $135 billion to a total of $738 billion by 2030 to ensure adequate supplies. This estimate for 2030 is 15% higher than we assessed a year ago and 41% higher than assessed two years ago due primarily to rising costs and a stronger demand outlook. A cumulative $4.3 trillion will be needed between 2025 and 2030, even as demand growth slows toward a plateau.

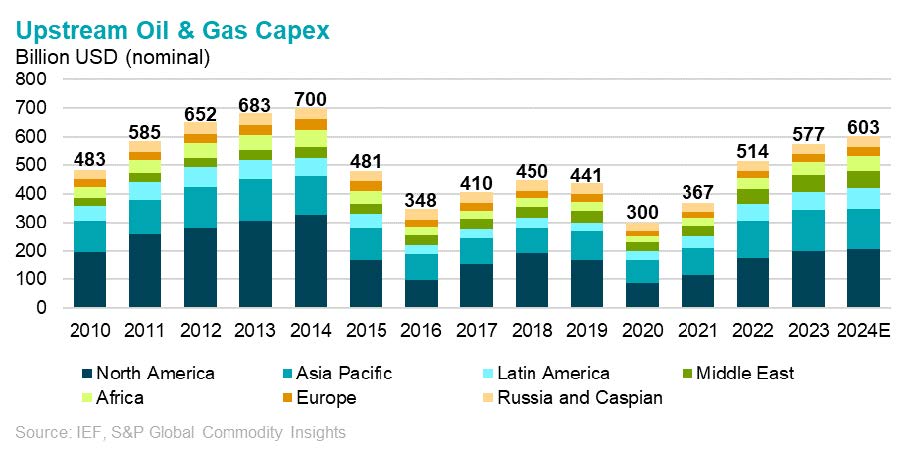

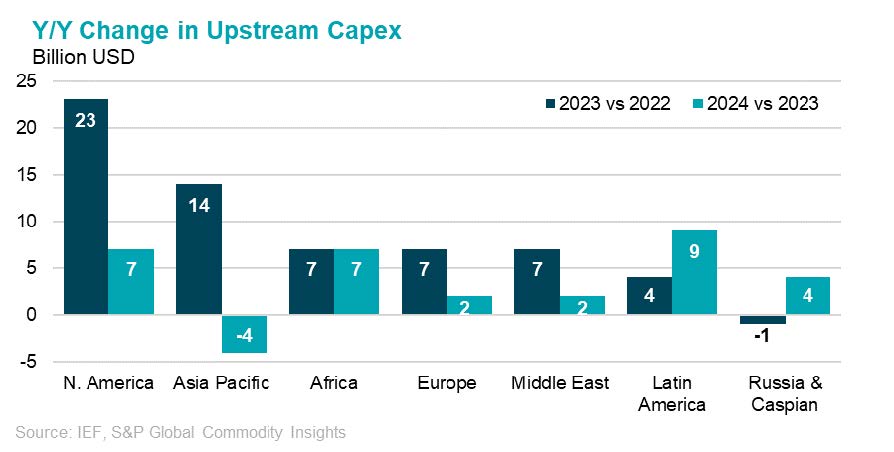

- Oil and gas annual upstream capital expenditures rose by $63 billion year-on-year in 2023 and are expected to rise a further $26 billion in 2024, surpassing $600 billion for the first time in a decade. Upstream investment in 2024 is expected to be more than double 2020’s low of $300 billion and be well above 2015-2019 levels of ~$425 billion. More than a third of the spending will come from North America this year. However, LatinAmerica is expected to be the largest source of incremental capex growth in 2024, surpassing North America for the first time since at least 2004.

- More than 60% of the increase in upstream capex spent between now and 2030 will come from the Americas. While North America is expected to be the largest driver of capex growth to 2030, Latin America will continue to play an increasingly significant role in non-OPEC supply growth, particularly for conventional crude, with expansions planned for Brazil and Guyana. Around 2.2 million barrels per day (mb/d) in new or expanded conventional projects have been approved and are expected to be producing in Latin America by 2030 – this is more than a third of the total 6 mb/d that have been sanctioned globally.

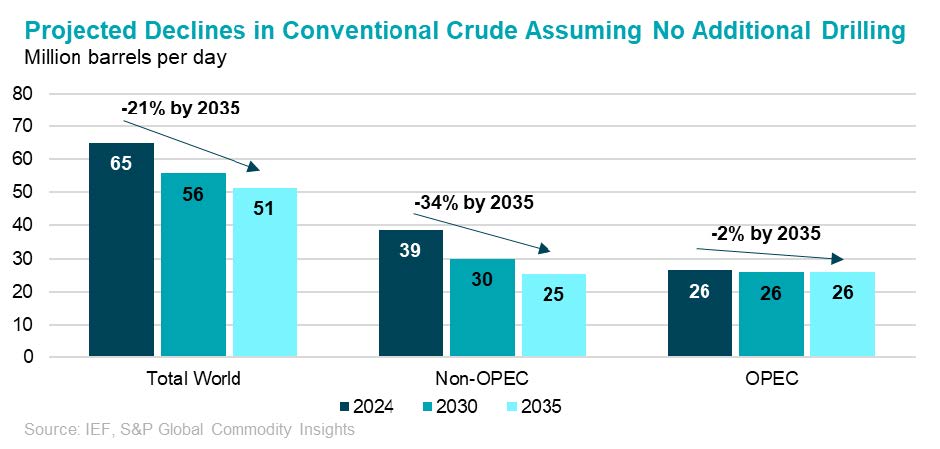

- The risks of underinvestment and a supply shortage have receded over the past year, despite the upward revisions to the forecasted investment requirements, as: (1) elevated prices have supported more investment, (2) capital constrains have eased, (3) production has remained resilient in Russia, Iran, and Venezuela despite sanctions, (4) non-OPEC supply has surprised to the upside, and (5) spare production capacity has been restored. However, the risk of underinvestment and undersupply could rise again if there are changes to the commodity price environment, geopolitical landscape, or to a lesser degree, changes to environmental, foreign, and monetary policies, and ESG regulations. Continued upstream investment is still needed to both offset expected production declines and to meet future demand growth.

- The investment and fundamentals outlook has improved primarily due to supplyside factors, but looking ahead demand uncertainty will play a more prominent role. This investment outlook assumes demand for total liquids rises to nearly 110 mb/d by 2030 and then plateaus and slowly declines to ~100 mb/d in 2050, requiring a significant capex tail. However, there is a lot of uncertainty around the demand trajectory and the pace of the energy transition. This creates a difficult environment for making investment decisions. Base case forecasts from consensus-leading organizations diverge by as much as 7 mb/d for 2030 and this gap widens to 27 mb/d when more ambitious climate scenarios are included.

- Increased investment supports energy security and the energy transition. A just, orderly, and equitable energy transition requires a foundation of energy security. The past two years have demonstrated the consequences of "disorderly" transitions: price shocks, shortages, disruptions, political backlash, bitter divisions, and conflict. Ensuring adequate investment levels can help provide stability and enable a just transition. But it will require the market to remain nimble and flexible to overcome potential hurdles and adapt to new realities.

Introduction: An Era of (Relative) Stability or Calm Between Storms?

Global oil liquids demand reached a new record in 2023 and is expected to continue setting fresh highs in each successive year this decade, albeit at a decelerating pace of growth. Yet, the primary story in the oil market in the past two years has been on the supply side.

Over the past year, geopolitical risk has risen with the escalation of the Israel-Hamas war, continued military conflict in Ukraine, and a growing number of attacks on shipping in the Red Sea. Yet, amid the tumult, physical oil production has remained relatively unscathed. Oil trade has adjusted and rerouted, mitigating the impact of increasingly dangerous transit routes and sanctions.

At the same time, output in the US, Canada, Brazil, and Guyana is surging to all-time highs, there is record total non-OPEC supply, historically high OPEC spare production capacity, and decade high upstream investment.

In the past two editions of our annual upstream investment report, we warned of a rising risk of underinvestment in the upstream sector this decade if upstream investment did not rebound sustainably from COVID-induced lows. As things stand today, that risk has receded for this decade, though it has not completely disappeared. A higher commodity price environment has eased capital constraints for upstream oil and gas companies and producers have responded by repairing their pandemic-hit balance sheets and increasing investment. Upstream capex in 2024 is expected to be nearly 40% higher than 2019 levels. At the same time, and despite sanctions, production has remained resilient in Russia, Iran, and Venezuela. Additionally, consolidation in the US shale sector, higher commodity prices, private operators, and increased efficiencies have caused US production to surprise to the upside, yet again.

While the outlook for global supplies is more positive than one or two years ago, there remains significant uncertainty on the demand-side and the pace of the energy transition over the next decade and beyond. The energy transition entails moving towards lower carbon-intensive energy sources, while also catering to growing demand needs. While the electrification of mobility is accelerating, particularly in China, the scale of energy demand growth from demographic and economic factors remains formidable in the developing world.

Just as oil markets have displayed resiliency and flexibility in the past four years, they will need to remain agile through the energy transition and adapt to the evolution of demand and policy changes to ensure the current period is not just a relative calm between storms.

Key Figures

Figure 1 - Upstream Oil & Gas Capex

Download Figure 1

Download Figure 1 Figure 2 - Y/Y Change in Upstream Capex

Download Figure 2

Download Figure 2 Figure 3 - Upstream Oil & Gas Capex Forecast

Download Figure 3

Download Figure 3 Figure 4 - Projected Declines in Conventional Crude Assuming No Additional Drilling

Download Figure 4

Download Figure 4 Figure 5 - Upstream Capex by Region

Download Figure 5

Download Figure 5 About the International Energy Forum

The International Energy Forum (IEF), the global home of energy dialogue, is the trusted and neutral intergovernmental platform for energy dialogue among member states, industry leaders, and experts. Its Ministers represent producing, consuming, and transit countries in every region, at every stage of economic development, and across both established and emerging energy-system supply chains. The IEF advances global energy security through open and inclusive dialogue spanning all fuels, technologies, and systems.

About S&P Global Commodity Insights

For more than 100 years, S&P Global has been a trusted connector that brings together thought leaders, market participants, governments, and regulators to co-create solutions that lead to progress. Vital to navigating Energy Transition, S&P Global Commodity Insights coverage includes oil and gas, power, chemicals, metals, agriculture, and shipping. S&P Global Commodity Insights is a division of S&P Global, the world's foremost provider of credit ratings, benchmarks, analytics, and workflow solutions in the global capital, commodity, and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today.