Comparative Analysis of Monthly Reports on the Oil Market

1. International Policy and Market Context

Drone attacks on UAE hits fuel tankers

- On 17 January, an attack using missiles and drones set off explosions of three fuel trucks tankers in an industrial district in southwestern Abu Dhabi near storage tanks for the Abu Dhabi National Oil Company (ADNOC). The attacks had minimal impact on the energy market as ADNOC was able to ensure the reliable and uninterrupted supply of products to its local and international customers.

European gas market volatility exposes risks to security of supply

- Natural gas prices pulled back from record levels at the end of December as warmer weather in Asia allowed Europe to source larger volumes of LNG, but gas prices still increased by more than 30 percent in early January amplifying concerns about the cost of heating homes and powering businesses and industry. Regional geopolitical issues threaten security of gas supply exacerbating Europe's energy crisis.

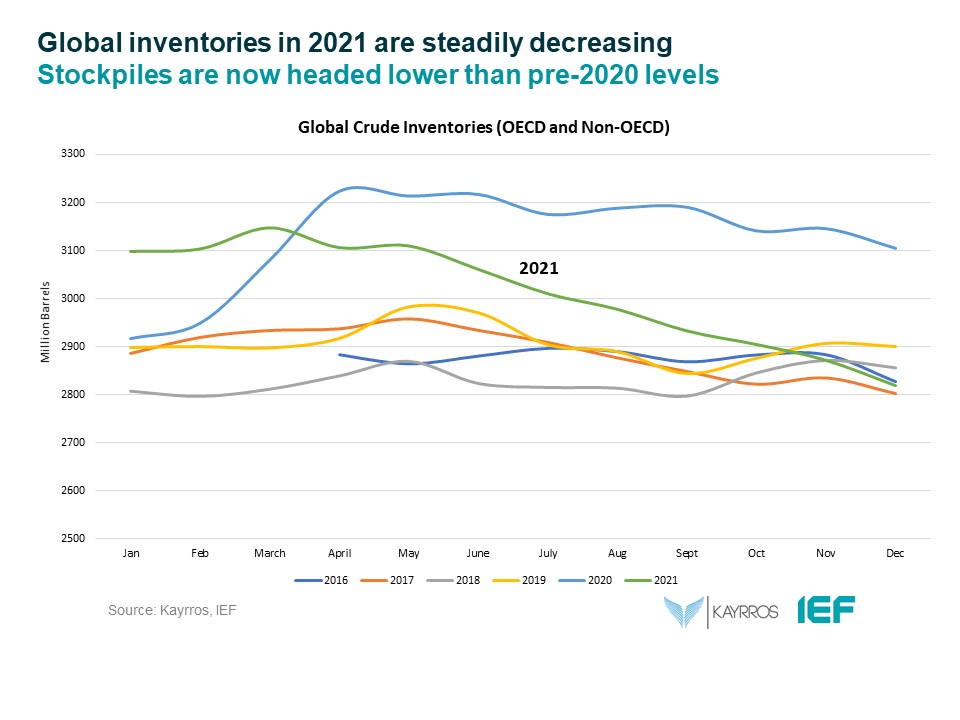

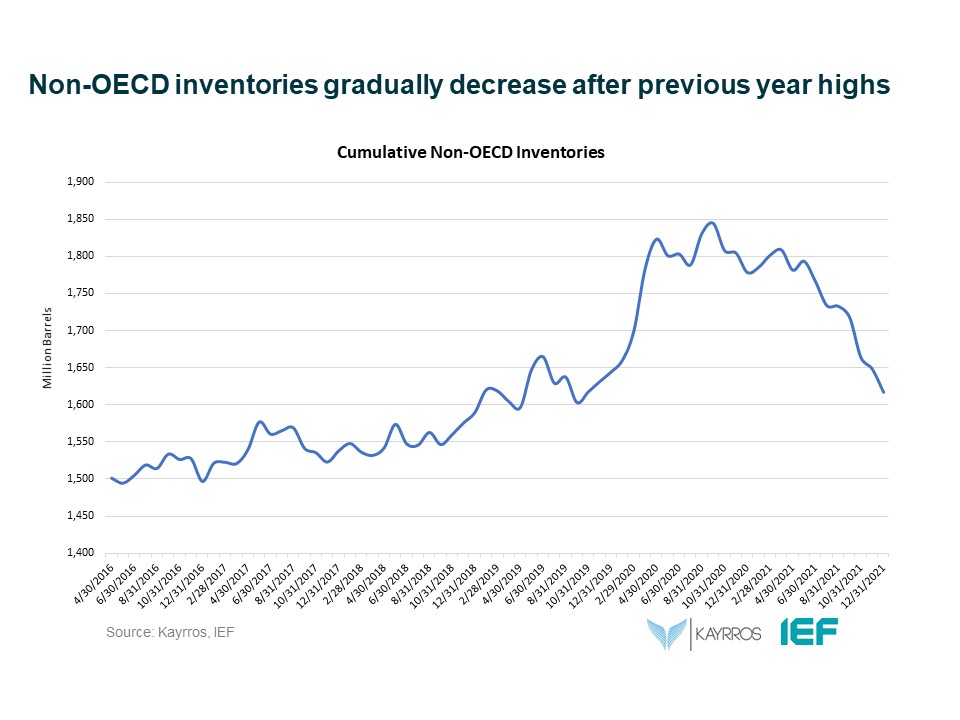

Global oil inventories hit lowest levels since before pandemic driving prices higher

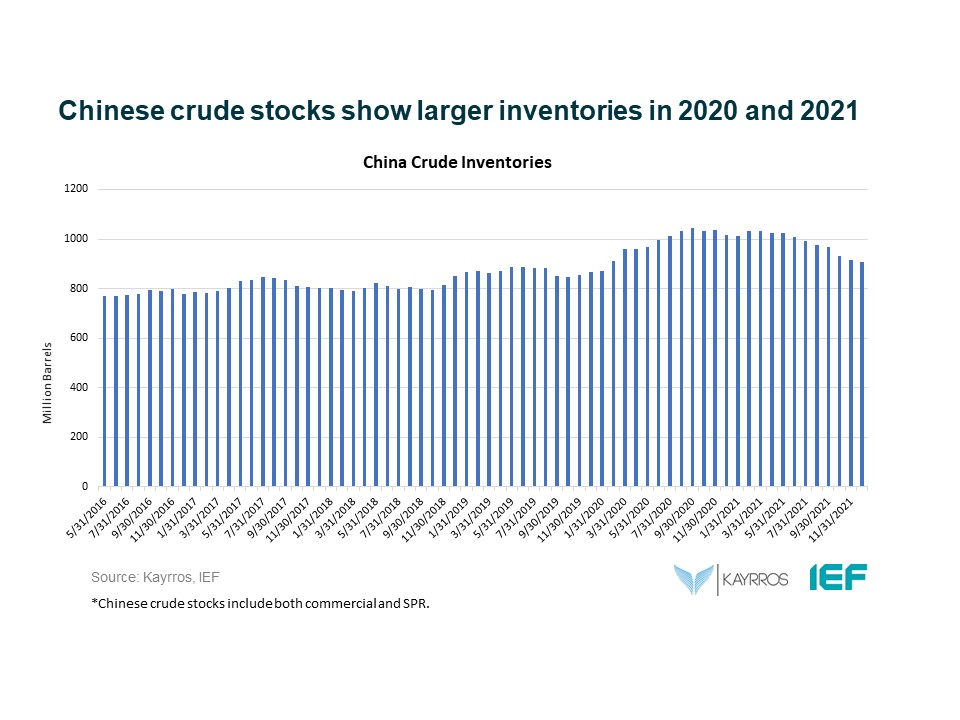

- Global crude inventories fell by about 260 million barrels to reach 2.83 billion barrels as of 9 January which is near the lowest level reached in October 2019. Continued onshore crude stockpile draws were led by declines in China and the U.S over the past year. Lower stockpiles combined with milder concern over the Omicron variant has seen oil prices rise to a seven-year high with Brent and WTI holding above $85 a barrel.

US EIA expects US oil production to set record in 2023

- The US EIA forecasts US shale will drive US production to an average of 12.4 mb/d in 2023 due to high crude prices that will support the production increase. This increase would surpass the current annual high of 12.3 mb/d set in 2019. The projected rise in US output would represent nine consecutive quarters of growth, beginning in the last three months of 2021.

24th OPEC and non-OPEC Meeting reaffirms production adjustments

- On 4 January, OPEC and non-OPEC countries reconfirmed the production adjustment plan and the monthly production adjustment mechanism approved at the 19th OPEC and non-OPEC Ministerial Meeting on 18 July and decided to adjust the monthly overall production by 0.4 mb/d for the month of February 2022. The 25th OPEC and non-OPEC Ministerial Meeting is scheduled for 2 February 2022.

2. Key Points

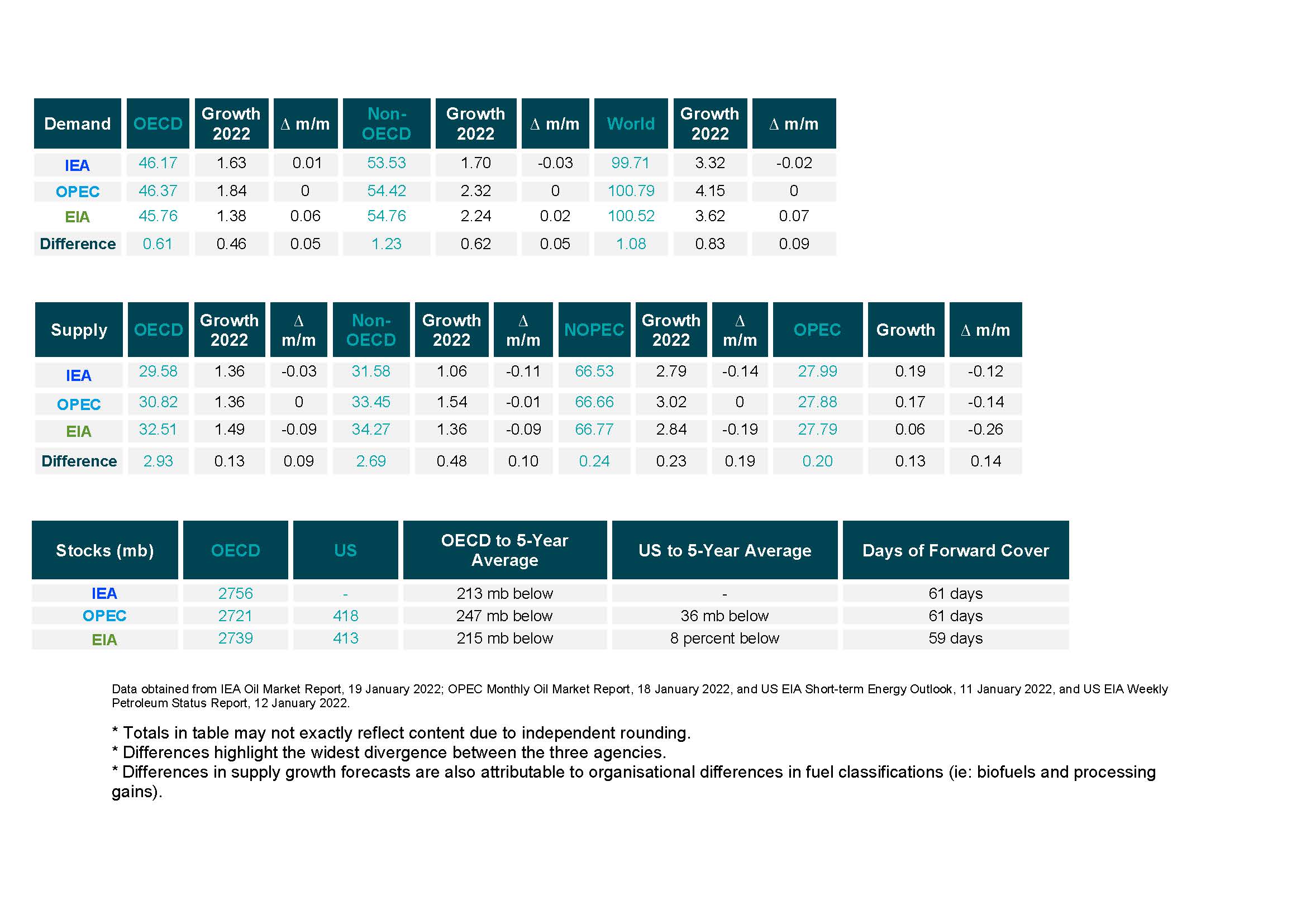

2.1 Demand

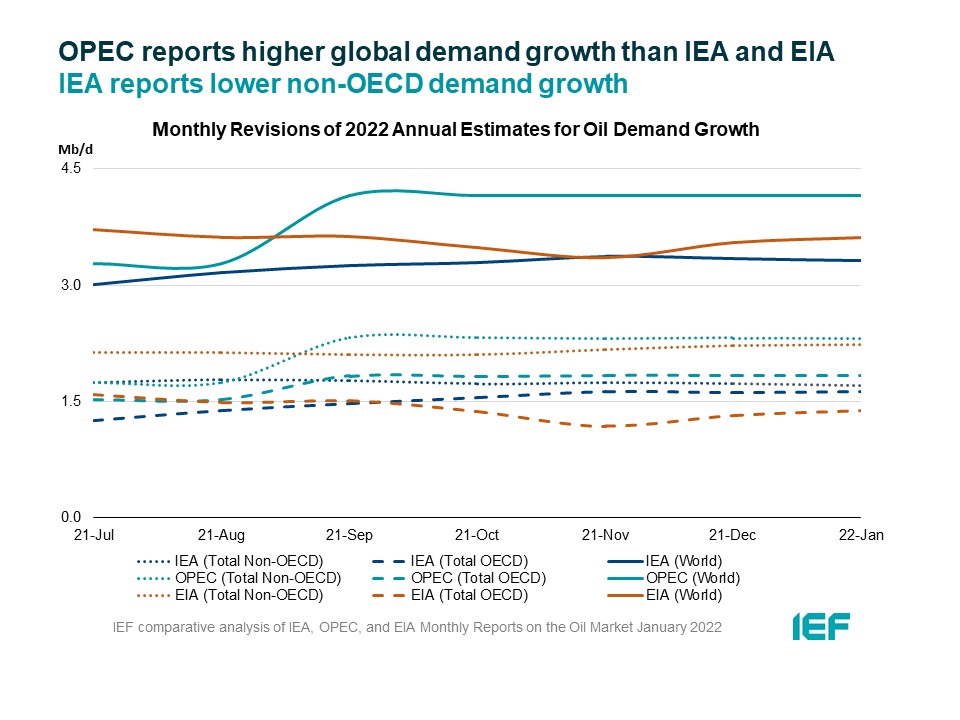

The IEA reports less demand growth than OPEC and IEA in 2022.

- IEA, OPEC, and EIA demand assessments for 2022 issued in January are new outlooks and have no bearing on the year prior.

- IEA reports year-on-year (y-o-y) demand at 3.32 mb/d as the new COVID variant is having less impact on oil consumption.

- OPEC's forecasts a slightly higher y-o-y demand growth of 4.15 mb/d.

- EIA's assessment reports demand growth of 3.62 mb/d. The IEA, OPEC, and EIA estimates for absolute world demand are now 99.71 mb/d, 100.79 mb/d, and 100.52 mb/d for 2022, respectively.

The IEA, OPEC, and EIA forecast growth in OECD and non-OECD demand.

- The IEA reports y-o-y non-OECD demand growth at 1.70 mb/d, while OPEC reports growth at 2.32 mb/d. The EIA's assessment for non-OECD demand growth reaches 2.24 mb/d.

- The IEA's estimate for OECD demand growth 1.63 mb/d for 2022. OPEC reports OECD demand growth at 1.84 mb/d while EIA assesses OECD growth at 1.38 mb/d.

- OPEC/EIA and OPEC/IEA assessments of OECD and non-OECD demand growth differ by 460 kb/d and 620 kb/d, respectively.

2.2 Supply

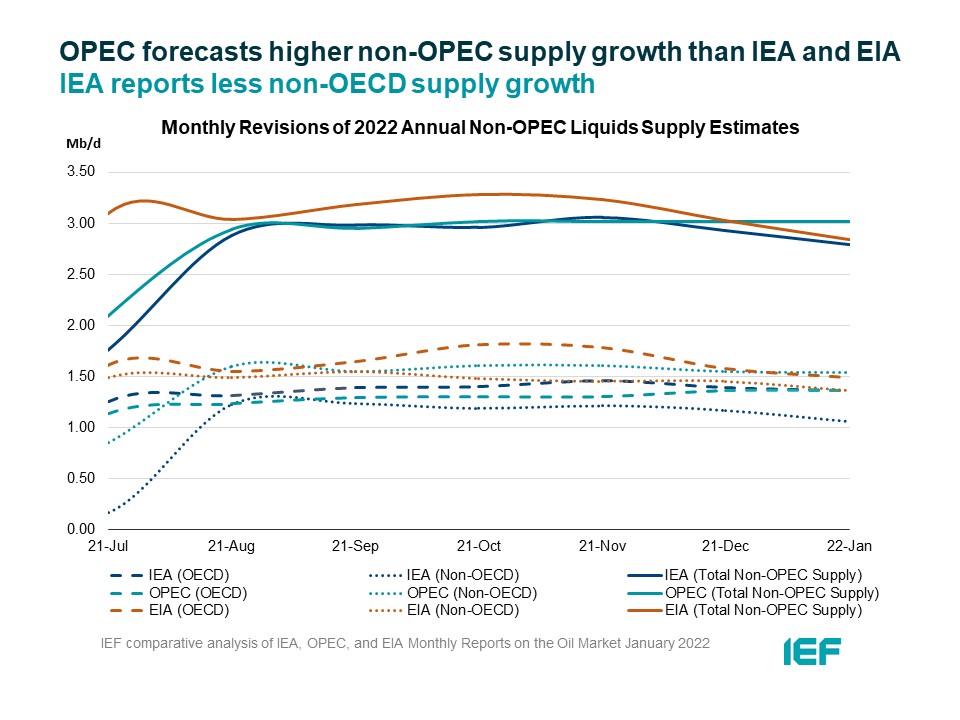

The IEA, OPEC, and EIA forecast non-OPEC supply growth in 2022.

- The IEA's January assessment for non-OPEC supply reaches a growth of 2.79 mb/d while the EIA reports higher supply growth of 2.84 mb/d y-o-y. OPEC reports the highest growth out of the three organizations at 3.02 mb/d. In absolute values, the IEA, OPEC, and EIA estimate non-OPEC supply at 66.53 mb/d, 66.66 mb/d, and 66.77 mb/d, respectively for 2022.

- Both IEA and OPEC estimate OECD oil supply growth this year at 1.36 mb/d, and EIA reports a higher growth of 1.49 mb/d. In absolute terms, the IEA, OPEC, and EIA estimate OECD oil supply at 29.58 mb/d, 30.82 mb/d, and 32.51 mb/d, respectively for 2022. The difference between IEA/OPEC and EIA on OECD supply growth is 130 kb/d.

OPEC reports higher non-OECD supply growth than the IEA and EIA.

- OPEC reports higher non-OECD growth at 1.54 mb/d compared to 1.06 mb/d for the IEA and 1.36 mb/d for EIA.

- In absolute values, the IEA, OPEC, and EIA non-OECD supply estimates are 31.58 mb/d, 33.45 mb/d, and 34.27 mb/d, respectively for 2022 with growth diverging by 480 kb/d.

The IEA, OPEC, and EIA revise OPEC production estimates upwards for December.

- The IEA revised its OPEC production estimate upward by 190 kb/d month-on-month (m-o-m) to reach total production of 27.99 mb/d. OPEC's assessment of its own production was revised upwards by 170 kb/d to 27.88 mb/d. The EIA also increased its assessment by 60 kb/d for total OPEC crude production of 27.79 mb/d.

2.3 Stocks

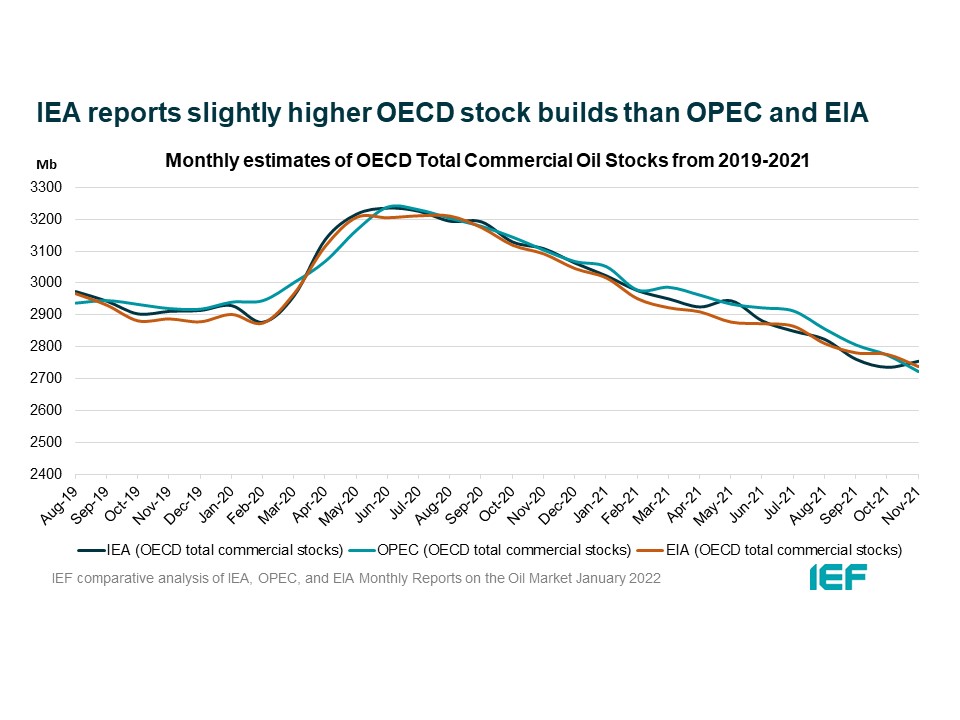

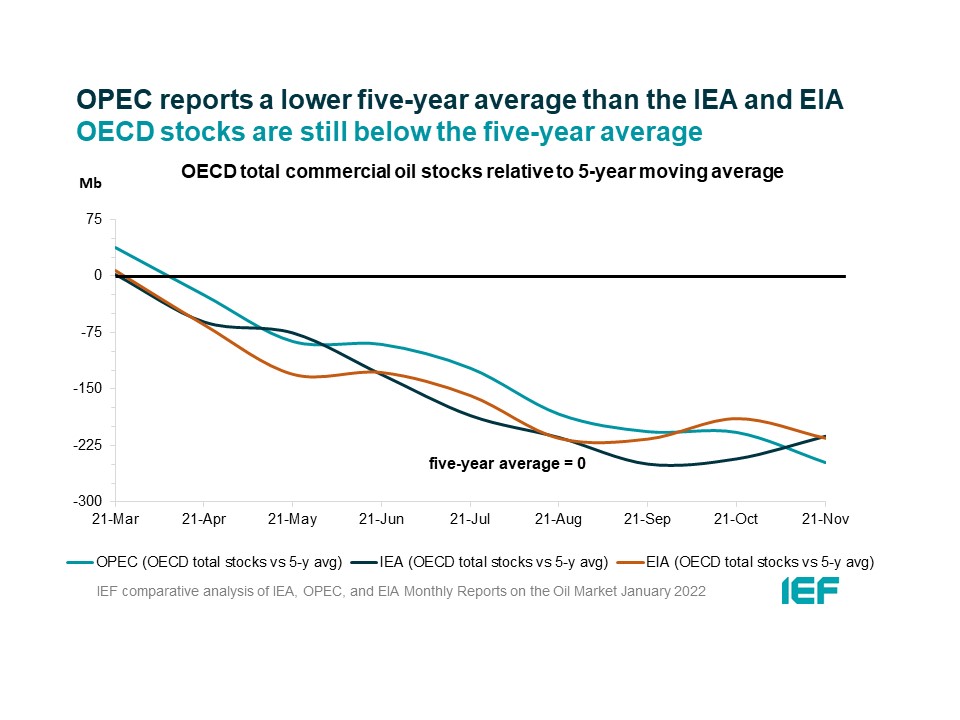

The IEA, OPEC, and EIA continue to display strong alignment on stock figures which are now below the five-year average but still close to or higher than 60 days forward cover.

- The IEA reports OECD stock levels at 2756 mb, which is close to OPEC's assessment of 2721 mb and EIA's assessment of 2739 mb. These are around 200 mb, 247 mb, and 215 mb below the five-year average, respectively.

- According to the IEA, crude oil inventories built by 12 mb while product stocks drew by 17.8 mb. Other oils, including NGLs and feedstocks drew by 0.3 mb. According to OPEC, crude oil stocks built by 9.4 mb while products built by 0.5 mb.

- EIA estimates OECD inventories dropped by 18 mb in November to 2739 mb – 215 mb below the five-year average.

- The widest divergence in inventories is between IEA and OPEC which stands at 35 mb. Total US crude inventories (excluding SPR) amount to about 413 mb, according to the EIA, which is 8 percent below the five-year average for this time of year. OPEC reports US commercial crude oil stocks at about 418 mb and around 36 mb below the five-year average.

2.4 Snapshot (mb/d)

3. Global Analysis

3.1 Demand Data

3.2 Supply Data

3.3 Stock Data

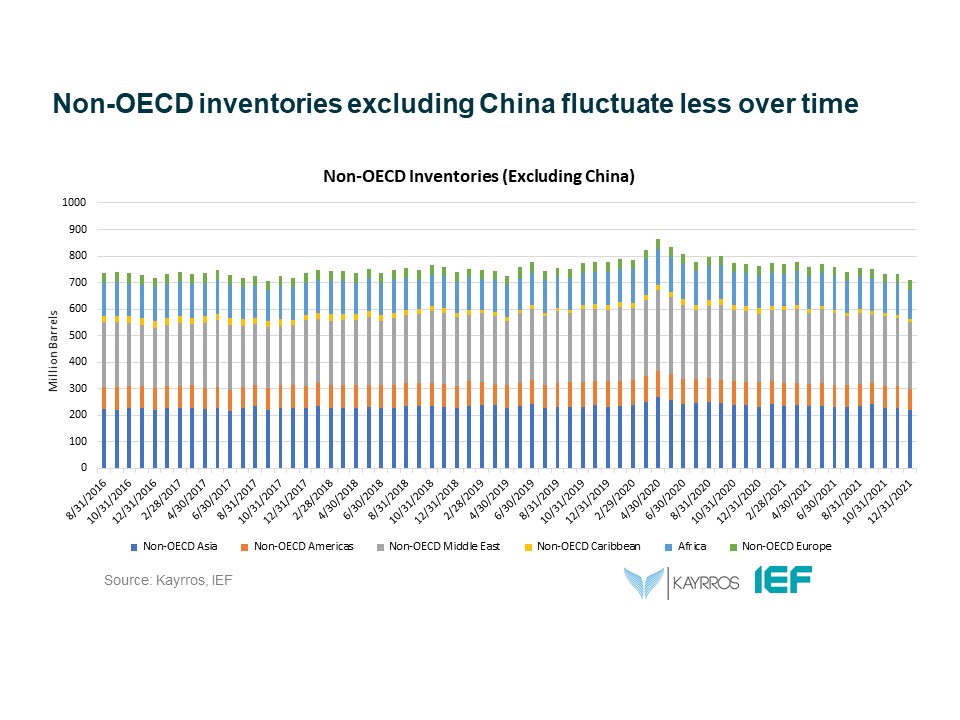

IEF-Kayrros Stock Analysis:

Explanatory Note

The IEF conducts a comprehensive comparative analysis of the short-, medium-, and long-term energy outlooks of the IEA OPEC, and the EIA to inform the IEA-IEF-OPEC Symposium on Energy Outlooks that the IEF hosts in Riyadh as part of the trilateral work programme on a yearly basis.

To inform IEF stakeholders on how perspectives on the oil market of both organisations evolve over time regularly, this monthly summary provides:

- An overview of key events and initiatives in the international policy and market context.

- Key findings and a snapshot overview of data points gained from comparing basic historical data and short-term forecasts of the IEA Oil Market Report, the OPEC Monthly Oil Market Report, and the EIA Short-term Energy Outlook.

- A comparative analysis of oil inventory data reported by the IEA, OPEC, and EIA, and secondary sources in collaboration with Kayrros (added in an updated report on the IEF website).

The International Energy Forum

The International Energy Forum is the leading global facilitator of dialogue between sovereign energy market participants. It incorporates members of International Energy Agency and the Organization of the Petroleum Exporting Countries, and also key players including China, India, Russia and South Africa. The forum's biennial ministerial meetings are the world's largest gathering of energy ministers, where discussions focus on global energy security and the transition towards a sustainable and inclusive energy future. The forum has a permanent secretariat of international staff based in the Diplomatic Quarter of Riyadh, Saudi Arabia. For more information visit www.ief.org.