Comparative Analysis of Monthly Reports on the Oil Market

1. International Policy and Market Context

Global economic recovery at risk

- The IEA has lowered its 2022 GDP forecast marginally to 3.4 percent and OPEC reduced its GDP growth forecast for 2022 from 4.2 to 3.9 percent in this month's reports. GDP growth downgrades by international financial institutions and economic forecasters for 2022 amount to an on average 1.0 percentage point reduction so far compared to forecasts made at the end of 2021. Energy and commodity price spikes and supply chain problems have pushed inflation to new record highs in April. Pressure on central banks to protect savings and act on the cost-of-living crisis with assertive interest rate hikes risks restraining the global economic recovery.

China COVID-19 lockdowns and US-IEA oil stock release temper oil prices

- A wave of COVID-19 outbreaks spurred lockdowns across many regions of China, including Shanghai. Brent crude prices settled below the $100 barrel mark on April 11th for the first time since mid-March. Other factors cited as reasons for oil's decline was the U.S. announcement on 31 March to release 1 million barrels per day for the next six months — amounting to a Strategic Petroleum Reserve draw of a 180 million barrels. The International Energy Agency agreed to a second collective action on 1 April. In total, 240 mb will be made available to the market over the next half year – the largest stock release in oil market history.

EU announces ban on Russian coal imports

- On 7 April, the European Union announced a fifth package of sanctions in response to Russia's invasion of Ukraine. Besides sanctioning individuals and restricting shipping, this includes a ban on Russian coal imports from August onwards. The phase-out of EU imports of Russian coal is the cornerstone measure of the package which affects a quarter of Russian coal exports.

OPEC and IEA assessments call for dialogue

- On 31 March, OPEC+ countries reconfirmed production policies approved at the 19th OPEC and non-OPEC Ministerial Meeting on 18 July 2021 and agreed to increase its overall monthly production by 432 kb/d in May 2022. The IEA observed that output from the alliance's 19 members with quotas rose by 40 kb/d month-on-month in March, well below the planned 400 kb/d increase, and 1.5 mb/d below their target. OPEC has removed the IEA from its secondary sources signaling reduced confidence in IEA data assessments and the need for dialogue.

2. Key Points

2.1 Demand

The IEA expects lower demand growth than OPEC and the EIA in 2022.

- IEA's demand growth assessment for this year falls by 240 kb/d to 1.87 mb/d year-on-year (y-o-y) due to economic uncertainties caused by a resurgence of COVID-19 cases and new lockdowns in China and the war in Ukraine.

- OPEC's y-o-y forecast falls for the first time since September 2021 by 480 kb/d for total growth of 3.67 mb/d.

- EIA's assessment falls by 710 kb/d for a growth of 2.42 mb/d this year. The IEA, OPEC, and EIA estimates for absolute world demand are now 99.37 mb/d, 100.50 mb/d, and 99.80 mb/d for 2022, respectively.

The IEA, OPEC, and the EIA differ on non-OECD demand growth in 2022.

- The IEA's assessment of y-o-y non-OECD demand growth falls by 170 kb/d to 0.68 mb/d, while OPEC's estimate falls by 450 kb/d to 1.81 mb/d. EIA non-OECD demand growth falls by 500 kb/d to 1.19 mb/d.

- The IEA's estimate for OECD demand growth falls by 70 kb/d to 1.19 mb/d for 2022 while OPEC's projection falls by 40 kb/d for a growth of 1.86 mb/d. EIA revises OECD demand growth down by 210 kb/d to 1.22 mb/d this year.

- The biggest difference in OECD and non-OECD demand growth estimates is between IEA and OPEC differing by 670 kb/d and 1.13 mb/d, respectively.

2.2 Supply

The IEA's estimate of non-OPEC supply growth falls slightly and remains substantially lower in 2022 than OPEC and EIA.

- The IEA's April assessment for non-OPEC supply falls by 50 kb/d to reach a growth of 0.76 mb/d while OPEC's estimate falls by 320 kb/d for a growth of 2.70 mb/d. The primary driver of the divergence in IEA and OPEC non-OPEC production forecasts is Russia. The EIA's assessment falls by 650 kb/d for an overall growth of 2.02 mb/d. In absolute values, the IEA, OPEC, and the EIA estimate non-OPEC supply at 64.47 mb/d, 66.26 mb/d, and 65.91 mb/d, respectively for 2022.

- The IEA estimates OECD oil supply growth this year at 1.52 mb/d, OPEC pegs it at 1.60 mb/d, and EIA reports growth at 1.71 mb/d, a decrease of 160 kb/d, an increase of 240 kb/d, and a decrease of 160 kb/d, respectively. In absolute terms, the IEA, OPEC, and the EIA estimate OECD oil supply at 29.72 mb/d, 31.01 mb/d, and 32.76 mb/d, respectively for 2022. The difference between estimates by the IEA and the EIA of OECD supply growth is 190 kb/d.

The IEA forecasts a decline for non-OECD supply in 2022 while OPEC and the EIA continue to see growth.

- The IEA's assessment for non-OECD supply falls by 110 kb/d for a total decline of 0.97 mb/d compared to last month's assessment of a 0.81 mb/d decline.

- OPEC and the EIA also substantially revised down their forecasts by 560 kb/d and 490 kb/d estimating non-OECD supply growth at 0.99 mb/d and 0.31 mb/d, respectively.

- In absolute values, the IEA, OPEC, and the EIA non-OECD supply estimates are 29.53 mb/d, 32.86 mb/d, and 33.15 mb/d, respectively for 2022 with the highest divergence in growth estimates between the IEA and OPEC at 1.96 mb/d.

The IEA and OPEC revise OPEC production estimates upwards while the EIA revises downwards.

- The IEA increased its OPEC production estimate for March upward by 60 kb/d month-on-month (m-o-m) to reach total production of 28.54 mb/d. OPEC also revised its assessment of its OPEC production upwards by 60 kb/d to 28.56 mb/d. The EIA decreased its assessment by 360 kb/d with total OPEC crude production reaching 28.22 mb/d.

2.3 Stocks

The IEA, OPEC, and EIA continue to display strong alignment on stock figures which are below the five-year average and now below 60 days forward cover.

- The IEA reports OECD stock levels at 2611 mb, which is close to OPEC's assessment of 2599 mb and EIA's assessment of 2601mb. These are around 321 mb, 334 mb, and 321 mb below the five-year average, respectively.

- According to the IEA, crude oil inventories built by 0.1 mb while product stocks drew by 42.6 mb. Other oils, including NGLs and feedstocks built by 0.2 mb. According to OPEC, crude oil stocks built by 0.7 mb while products drew by 23.5 mb.

- The EIA estimates OECD inventories dropped by 33 mb in February to 2660 mb – 321 mb below the five-year average.

- The widest divergence in inventories is between the IEA and OPEC at 12 mb. Total US crude inventories (excluding SPR) amount to about 412 mb, according to the EIA, which is 14 percent below the five-year average for this time of year.

2.4 Snapshot (mb/d)

3. Global Analysis

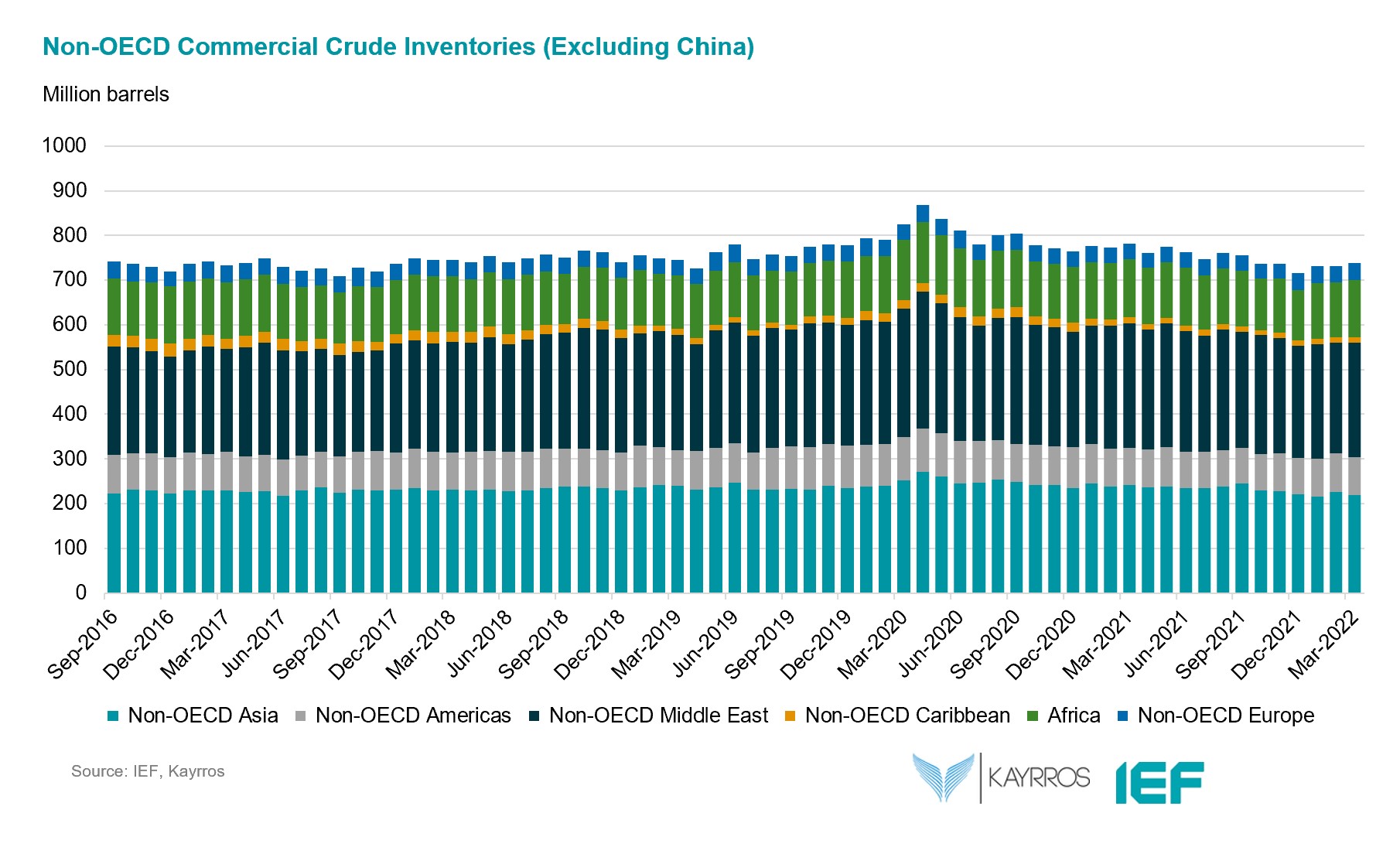

IEF-Kayrros Stock Analysis:

Explanatory Note

The IEF conducts a comprehensive comparative analysis of the short-, medium-, and long-term energy outlooks of the IEA, OPEC, and the EIA to inform the IEA-IEF-OPEC Symposium on Energy Outlooks that the IEF hosts in Riyadh as part of the trilateral work programme on a yearly basis.

To inform IEF stakeholders on how perspectives on the oil market of both organisations evolve over time regularly, this monthly summary provides:

- An overview of key events and initiatives in the international policy and market context.

- Key findings and a snapshot overview of data points gained from comparing basic historical data and short-term forecasts of the IEA Oil Market Report, the OPEC Monthly Oil Market Report, and the EIA Short-term Energy Outlook.

- A comparative analysis of oil inventory data reported by the IEA, OPEC, and EIA, and secondary sources in collaboration with Kayrros (added in an updated report on the IEF website).

The International Energy Forum

The International Energy Forum is the leading global facilitator of dialogue between sovereign energy market participants. It incorporates members of International Energy Agency and the Organization of the Petroleum Exporting Countries, and also key players including China, India, Russia and South Africa. The forum's biennial ministerial meetings are the world's largest gathering of energy ministers, where discussions focus on global energy security and the transition towards a sustainable and inclusive energy future. The forum has a permanent secretariat of international staff based in the Diplomatic Quarter of Riyadh, Saudi Arabia. For more information visit www.ief.org.