Comparative Analysis of Monthly Reports on the Oil Market

1. International Policy and Market Context

US introduces strongest-ever emission rules to expand clean transportation

- On 12 April, The US Environmental Protection Agency (EPA) proposed emissions cuts for new cars and trucks through 2032. If standards are met, the EPA projects that EVs could account for 67 percent of new light-duty vehicle sales and 46 percent of new medium-duty vehicle sales in 2032. more stringent rules to reduce greenhouse gas emissions from heavy-duty vehicles including trucks, transit, and haulers will take effect in model year 2027.

China to build west-to-east green hydrogen transmission pipeline

- China's Sinopec will build a pipeline to transfer hydrogen from renewable energy projects in China's northwestern region to cities in its east. The west-to-east hydrogen transmission pipeline will stretch more than 400 km and will have an initial capacity of 100,000 tonnes per year. The project is the country's first green hydrogen transmission line and part of a target to produce 100,000 to 200,000 tonnes of green hydrogen a year and have about 50,000 hydrogen-fueled vehicles by 2025.

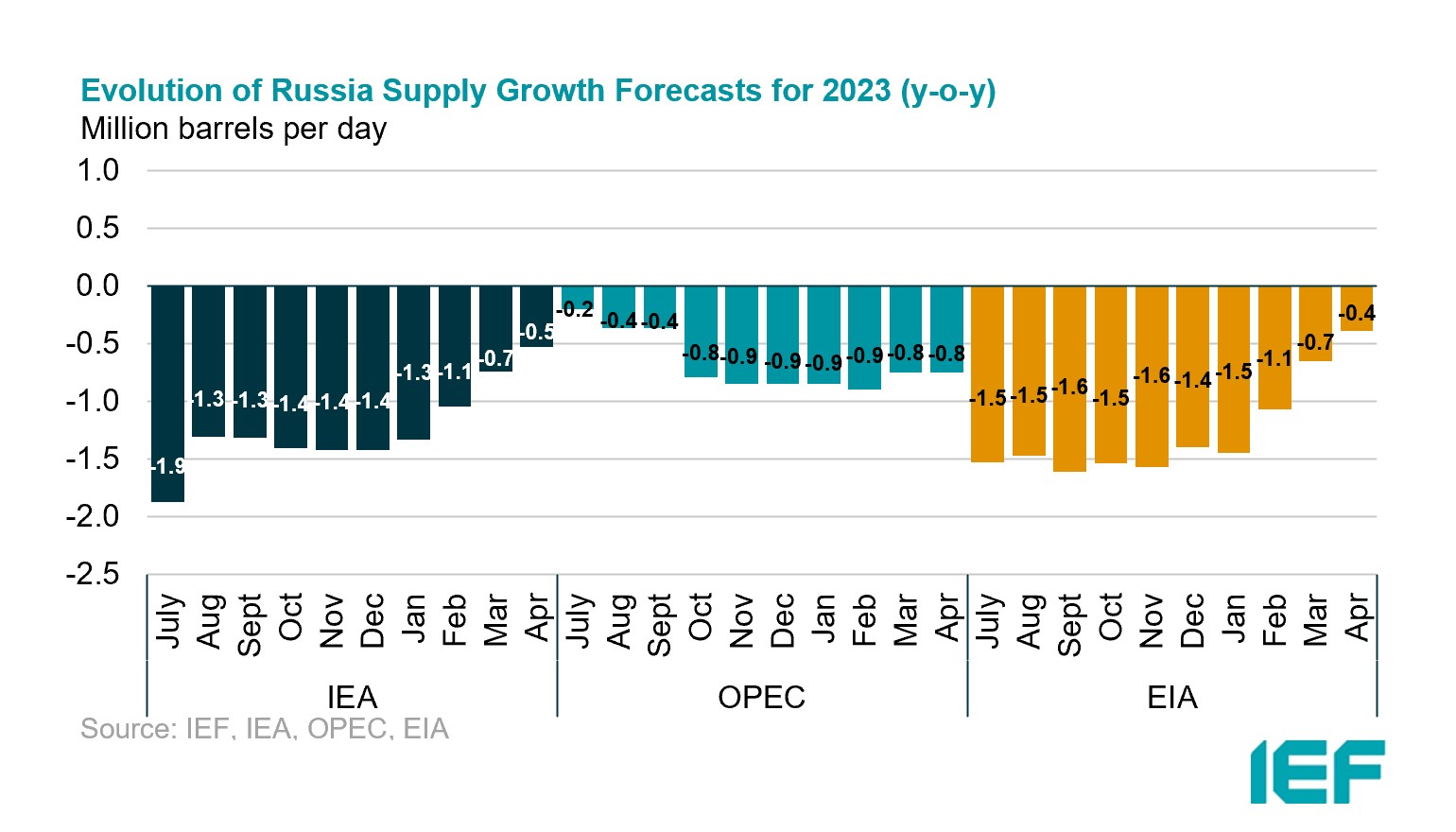

OPEC+ countries announce precautionary output cuts

- On 2 April, OPEC+ countries announced to cut their oil production by about 1.16 mb/d, widening total crude oil production cuts to 3.66 mb/d for 2023. The move is seen as a precautionary measure against recession risks and aims to support the stability of the oil market. Brent crude rose more than 6 percent, to nearly $85 a barrel while WTI crude was up by a similar amount, trading over $80 a barrel. The voluntary cuts start from May and last until the end of the year. The IEA reports that the cuts will push world oil supply down 400 kb/d by end-2023. From March-December, gains of 1 mb/d from non-OPEC+ will fail to offset a 1.4 mb/d decline from the producer bloc.

International Monetary Fund forecasts sharper economic slowdown

The IMF's latest World Economic Outlook forecasts economic growth to fall from 3.4 percent in 2022 to 2.8 percent in 2023, before settling at 3.0 percent in 2024. Advanced economies are expected to see an especially pronounced growth slowdown, from 2.7 percent in 2022 to 1.3 percent in 2023. Global headline inflation in the baseline is set to fall from 8.7 percent in 2022 to 7.0 percent in 2023 on the back of lower commodity prices but underlying (core) inflation is likely to decline more slowly. Inflation's return to target is unlikely before 2025 in most cases.

2. KEY POINTS

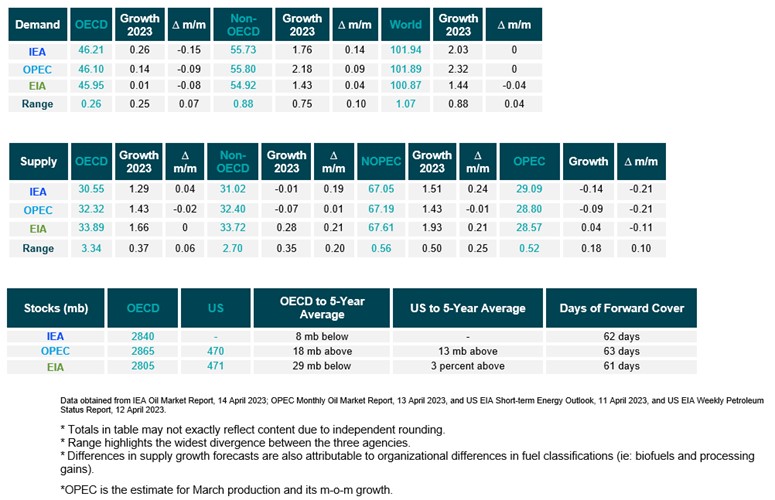

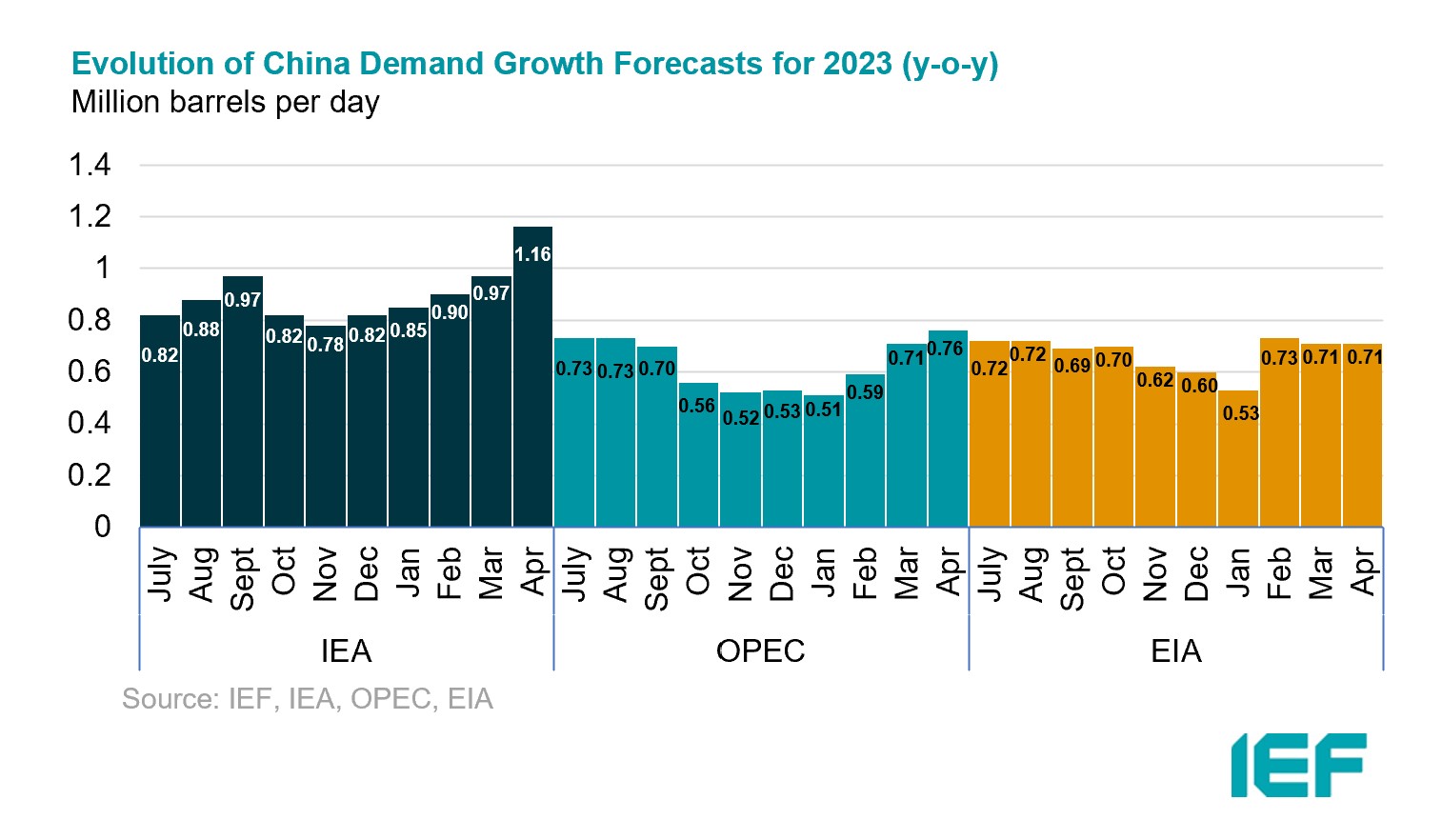

2.1 DEMAND

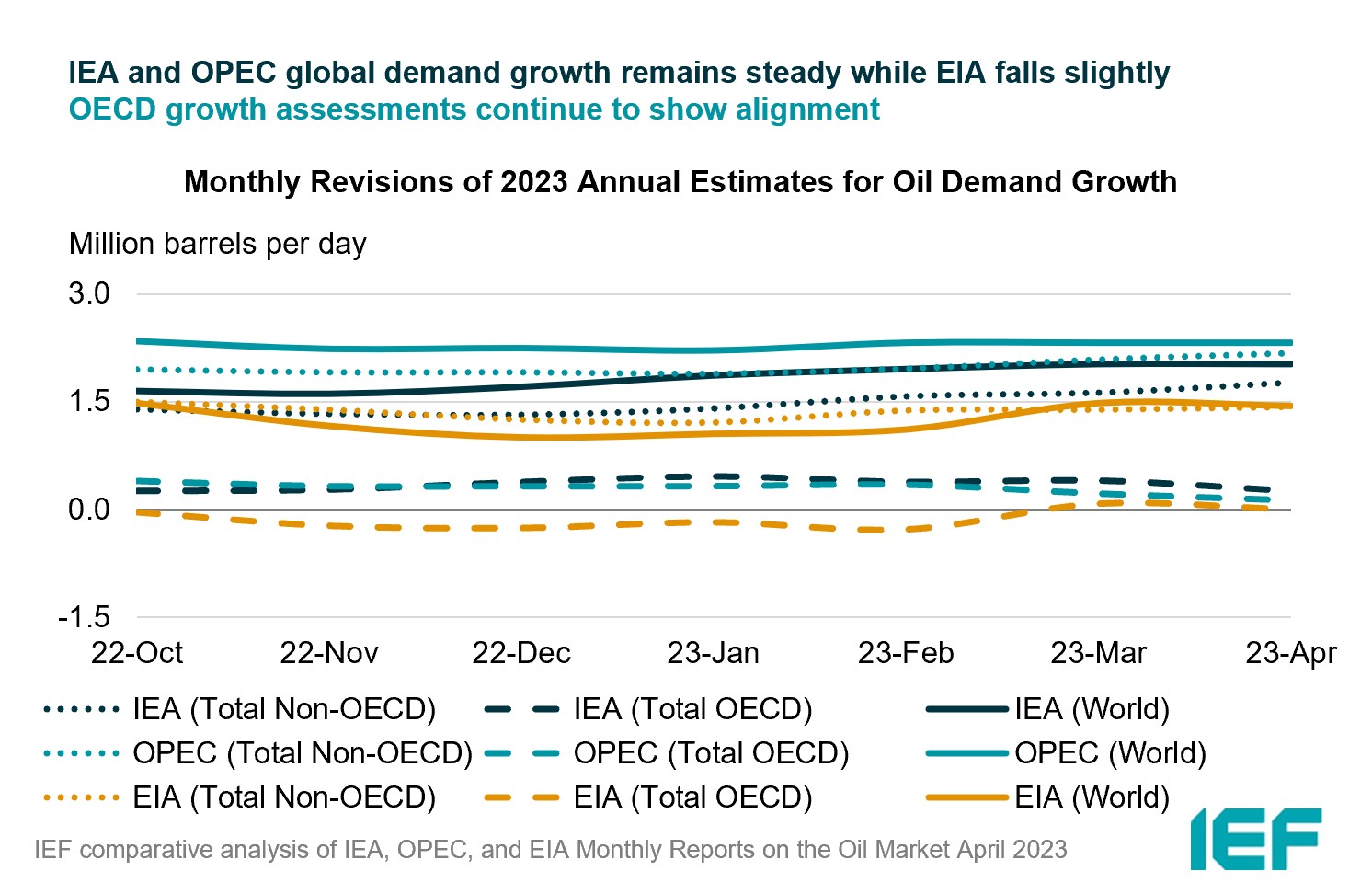

IEA and OPEC demand growth remains steady while EIA estimates fall slightly.

- The IEA and OPEC year-on-year (y-o-y) demand growth assessments for 2023 remains the same at 2.03 mb/d and 2.32 mb/d, respectively.

- The EIA's growth forecast falls by 40 kb/d for a growth of 1.44 mb/d in 2023.

- The IEA, OPEC, and EIA estimates for absolute world demand are now 101.94 mb/d, 101.89 mb/d, and 100.87 mb/d for 2023, respectively.

IEA, OPEC, and EIA OECD demand growth assessments fall.

- The IEA's assessment of y-o-y OECD demand growth rises by 150 kb/d to 0.26 mb/d, while EIA's estimate falls by 80 kb/d to 0.01 mb/d. OPEC's OECD demand growth also falls by 90 kb/d to 0.14 mb/d.

- The IEA, OPEC and the EIA non-OECD demand growth assessments rise by 140 kb/d, 90 kb/d mb/d, and 40 kb/d for a growth of 1.76 mb/d, 2.18 mb/d, and 1.43 mb/d, respectively.

- The largest divergence in OECD and non-OECD demand growth estimates are between the IEA and the EIA at 0.25 mb/d and between the EIA and OPEC at 0.75 mb/d, respectively.

2.2 SUPPLY

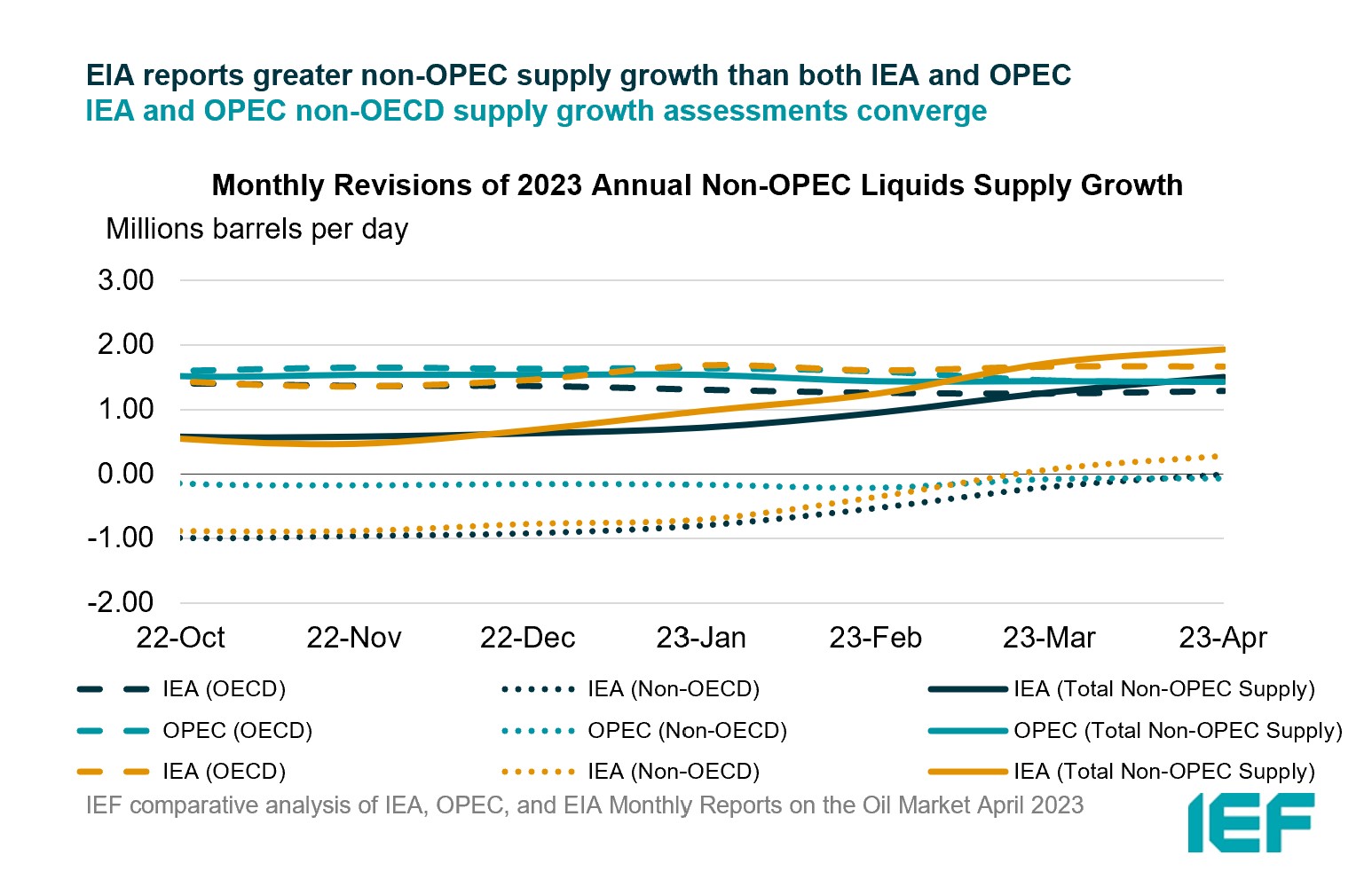

IEA and EIA non-OPEC supply growth assessments rise while OPEC remains steady.

- The IEA's April 2023 assessment for non-OPEC supply rises by 240 kb/d to reach a growth of 1.51 mb/d while OPEC's estimate falls slightly by 10 kb/d at 1.43 mb/d. The EIA's assessment also rises by 210 kb/d for an overall growth of 1.93 mb/d. In absolute values, the IEA, OPEC, and the EIA estimate non-OPEC supply at 67.05 mb/d, 67.19 mb/d, and 67.61 mb/d, respectively for 2023.

- The IEA estimates OECD oil supply growth this year at 1.29 mb/d, OPEC pegs it at 1.43 mb/d, and the EIA reports growth at 1.66 mb/d, an increase of 40 kb/d for the IEA, a decrease of 20 kb/d for OPEC, and no change for the EIA. In absolute terms, the IEA, OPEC, and the EIA estimate OECD oil supply at 30.55 mb/d, 32.32 mb/d, and 33.89 mb/d, respectively for 2023. The largest divergence of OECD supply growth estimates is between the EIA and the IEA at 370 kb/d.

IEA, OPEC, and EIA all report rises in non-OECD supply for 2023.

- The IEA's assessment for non-OECD supply rises by 190 kb/d compared to a decline of 0.01 mb/d in 2023.

- OPEC's non-OECD growth rises slightly by 10 kb/d for a decline of 0.07 mb/d while the EIA revised its non-OECD growth forecast up by 210 kb/d for a growth of 0.28 mb/d.

- In absolute values, the IEA, OPEC, and the EIA non-OECD supply estimates are 31.02 mb/d, 32.40 mb/d, and 33.72 mb/d, respectively for 2023 with the largest divergence in growth estimates between the IEA and the EIA is 0.35 mb/d.

IEA and OPEC report decreases in OPEC production, while EIA reports an increased output in March.

- The IEA reported OPEC production fell by 140 kb/d in March to 29.09 mb/d.

- OPEC showed OPEC production fell month-on-month by 90 kb/d to 28.80 mb/d.

- The EIA assessed OPEC production at 28.57 mb/d, up 40 kb/d month-on-month.

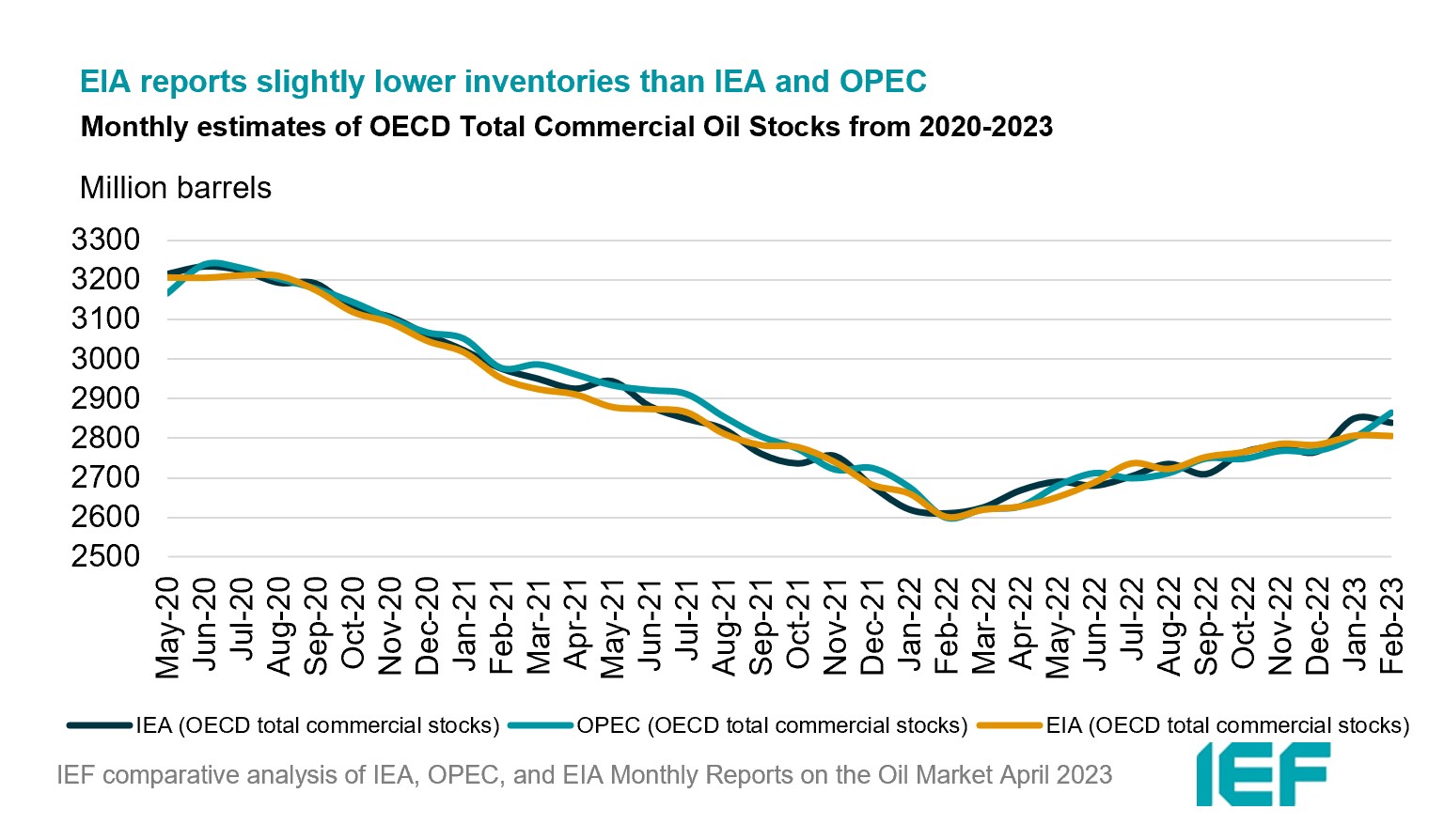

2.3 STOCKS

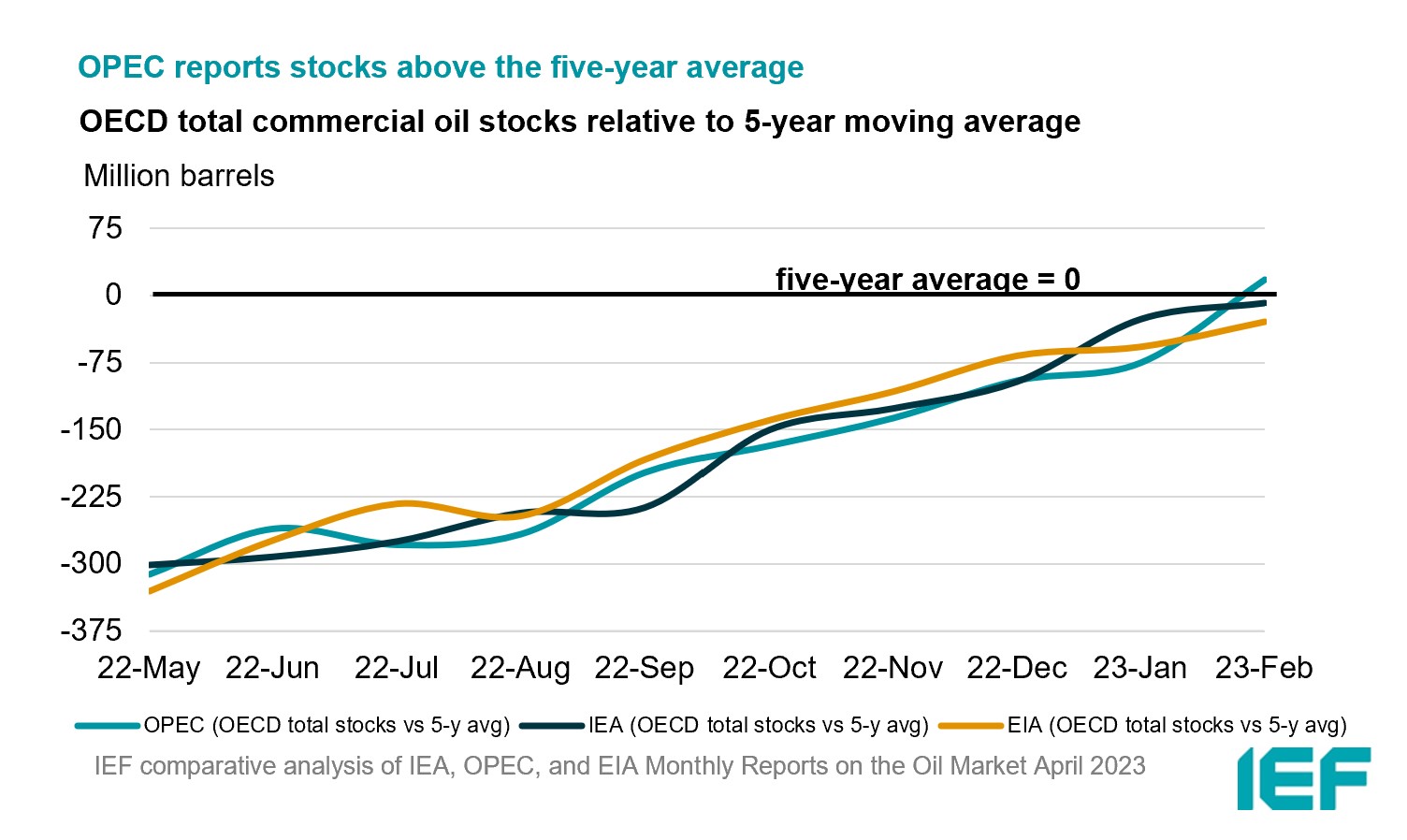

The IEA, OPEC, and EIA continue to display alignment on stock figures with OPEC reporting inventories above the five-year average. The IEA and the EIA report inventories below the five-year average while all agencies see more than 60 days of forward cover.

- The IEA reports OECD stock levels at 2840 mb, which is close to OPEC's assessment of 2865 mb and the EIA's assessment of 2805 mb. These are around 8 mb below, 18 mb above, and 29 mb below the five-year average, respectively.

- According to the IEA, crude oil inventories built by 24.2 mb while product stocks drew by 17.9 mb. Other oils, including NGLs and feedstocks built by 3.3 mb. According to OPEC, crude oil stocks built by 20.9 mb while products drew by 6.8 mb.

- The widest divergence in inventories is between the OPEC and the EIA at 60 mb. Total US crude inventories (excluding SPR) amount to about 471 mb, according to the EIA, which is 3 percent above the five-year average for this time of year.

2.4 SNAPSHOT (mb/d)

3. Global Analysis

Explanatory Note

The IEF conducts a comprehensive comparative analysis of the short-, medium-, and long-term energy outlooks of the IEA, OPEC, and the EIA to inform the IEA-IEF-OPEC Symposium on Energy Outlooks that the IEF hosts in Riyadh as part of the trilateral work programme on a yearly basis.

To inform IEF stakeholders on how perspectives on the oil market of both organisations evolve over time regularly, this monthly summary provides:

- An overview of key events and initiatives in the international policy and market context.

- Key findings and a snapshot overview of data points gained from comparing basic historical data and short-term forecasts of the IEA Oil Market Report, the OPEC Monthly Oil Market Report, and the EIA Short-term Energy Outlook.

- A comparative analysis of oil inventory data reported by the IEA, OPEC, and EIA, and secondary sources in collaboration with Kayrros (added in an updated report on the IEF website).

The International Energy Forum

The International Energy Forum is the leading global facilitator of dialogue between sovereign energy market participants. It incorporates members of International Energy Agency and the Organization of the Petroleum Exporting Countries, and also key players including China, India, Russia and South Africa. The forum's biennial ministerial meetings are the world's largest gathering of energy ministers, where discussions focus on global energy security and the transition towards a sustainable and inclusive energy future. The forum has a permanent secretariat of international staff based in the Diplomatic Quarter of Riyadh, Saudi Arabia. For more information visit www.ief.org.