Comparative Analysis of Monthly Reports on the Oil Market

Friday 17 May 2024

Oil Market Context

Dynamics in the Oil Market: From Geopolitical Risks to Supply Cuts and Price Movements

Brent front month prices have fallen by nearly $7 over the past month to ~$83/bbl as money managers shed bullish positions amid economic concerns and despite continued elevated geopolitical risk. Fund managers have been net sellers of petroleum derivatives for the past four consecutive weeks and, in the week ending on May 7, there was the largest net sale of crude futures and options in more than a year.

The market remains concerned about global economic growth with persistent inflation and the US Fed's decision to keep interest rates steady. There is also growing concern about fragile diesel demand following a mild winter in the northern hemisphere and a slowdown in industrial activity in Europe and Asia. Refining margins for diesel have halved from early-February’s levels and European and US diesel futures markets have been trading in contango since mid-April.

However, there have also been some positive signals for oil demand over the past month. The IMF revised up its global GDP forecast for 2024 in mid-April. Additionally, China’s 1Q24 headline GDP came in at 5.3% y/y, exceeding analysts' expectations of 4.6%. China’s oil imports in April were up more than 5.4% y/y.

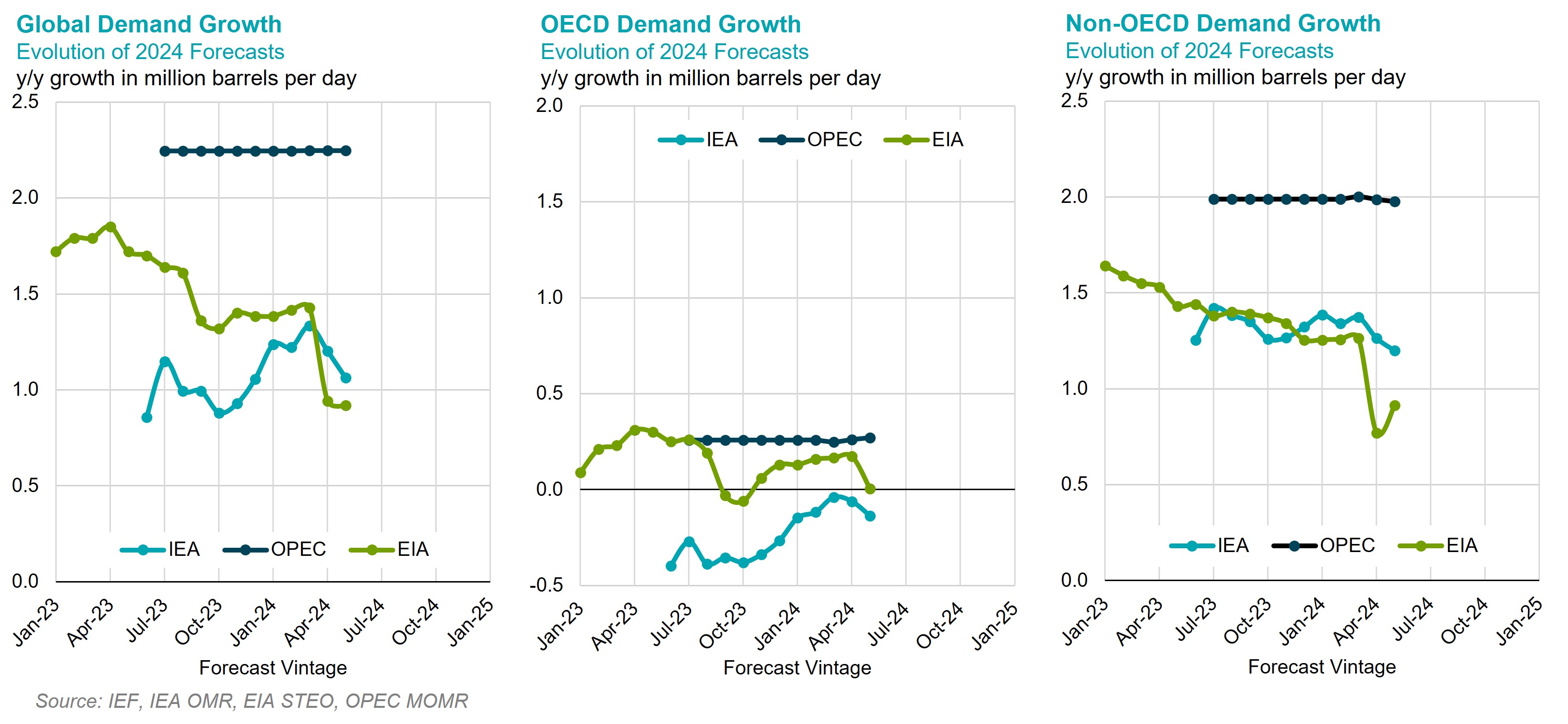

The uncertainty in global demand continues to be reflected in the short-term oil demand forecasts, with OPEC projecting 2.2 mb/d, compared to IEA's 1.1 mb/d and EIA's 0.9 mb/d.

On the supply side, OPEC+ is currently withholding ~5.8 mb/d from the market through collective official cuts and voluntary measures. The group will meet on June 1st to review its existing production policy and current market fundamentals. Bloomberg surveyed 30 analysts and traders in early-May and showed that 26 of the participants expect all current production cuts to remain in place into the second half of the year. However, OPEC+ is not expected to make a policy decision until the meeting date.

Significant Updates in EIA’s Short-Term Energy Outlook (STEO)

Beginning this month, EIA offered increased granularity in the STEO, including and expanded breakout and detailed information on OPEC+ production and differentiation between global crude oil production and other liquids production.

Significant Updates in OPEC’s Monthly Oil Market Report (MOMR)

Beginning in May 2024, OPEC stopped publishing supply forecasts for non-OPEC members of the Declaration of Cooperation (DoC or commonly known as OPEC+). As a result, OPEC no longer publishes a total non-OPEC production forecast. This comparative analysis report has been adjusted to account for these changes and will use non-DoC figures to enable comparation across all three forecasters.

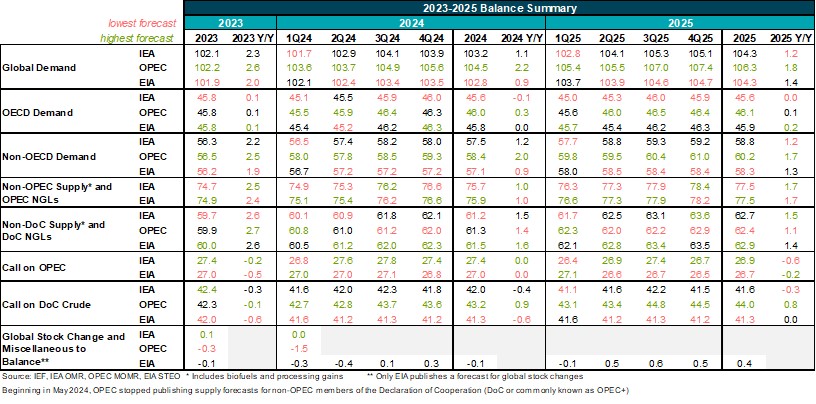

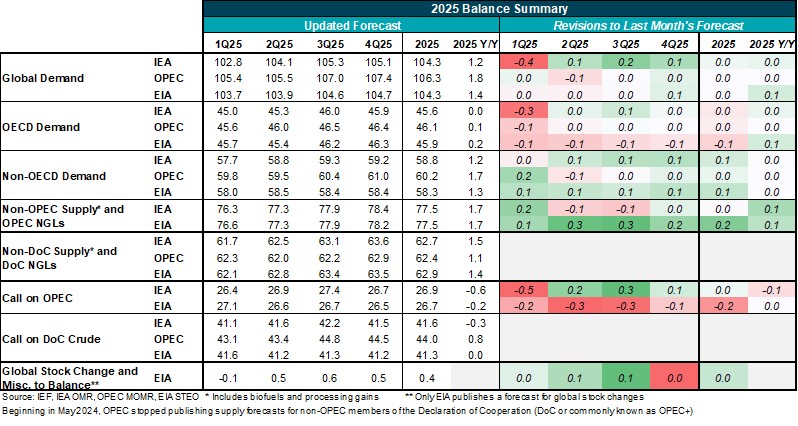

Summary of 2023-2025 Balances

- The divergence in global demand is widening compared to previous months across IEA, EIA and OPEC, with a range of approximately 1.3 million barrels per day (mb/d) projected for this year, and a range of 0.6 mb/d expected for the following year.

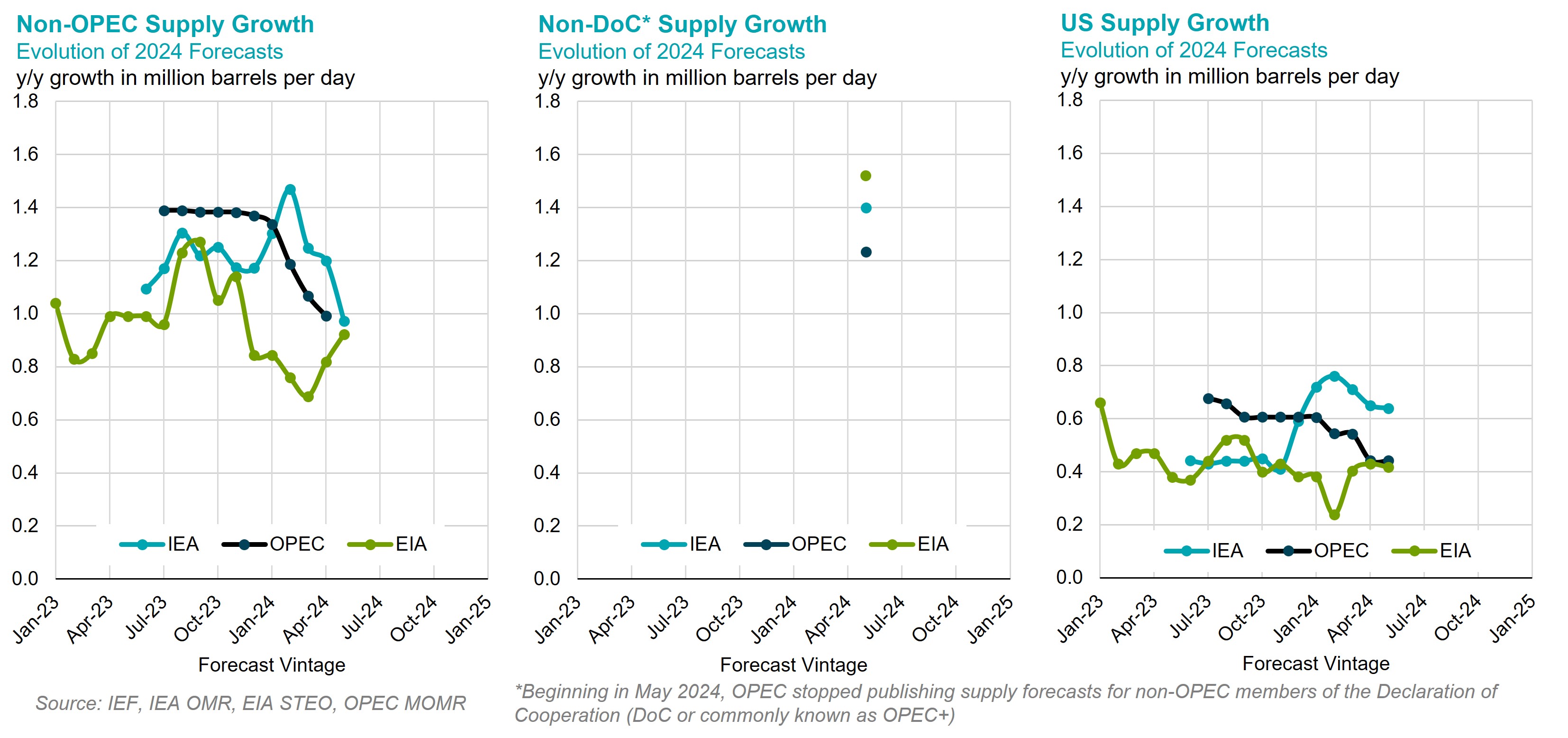

- Non-OPEC supply is projected to slow from ~2.4 mb/d in 2023 to 1 mb/d this year, before accelerating to a 1.7 mb/d in the following year. As of May 2024, OPEC has discontinued publishing supply forecasts for non-OPEC members that are part of the Declaration of Cooperation (DoC), more commonly referred to as OPEC+.

- IEA and EIA see the Call on DoC falling this year by 0.4-0.6 mb/d while OPEC continues to see a significant increase of 0.9 mb/d y/y

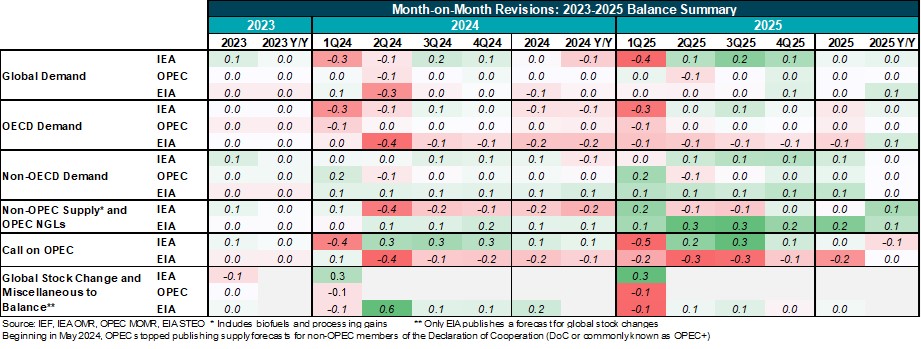

- EIA, OPEC, and IEA revised down their 1Q24 demand estimates for OECD countries this month, despite annual demand projections remaining relatively stable. The EIA and OPEC's revisions were primarily driven by lower US estimates, while the IEA lowered its estimate for Europe.

- The EIA revised to its Q2 2024 global demand forecast down by 0.3 mb/d and revised down the full year 2024 by 0.1 mb/d. However, the 2025 demand growth forecast shows an upward revision of 0.1 mb/d.

- Both IEA and EIA have revised their forecasts for Non-OPEC supply growth upwards by 0.1 mb/d for next year.

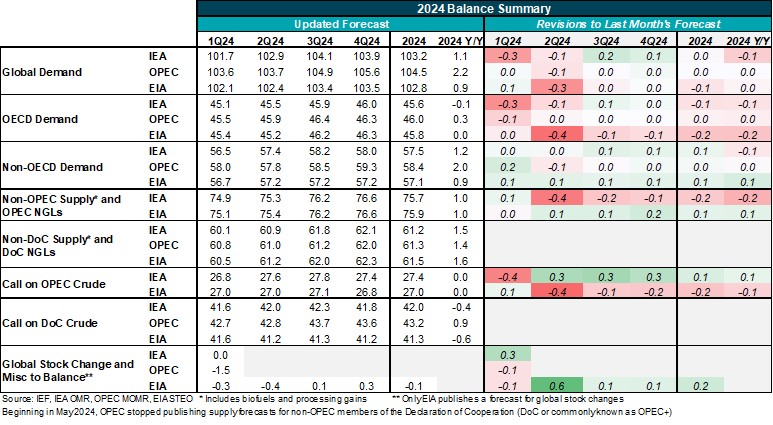

Summary of 2024 Balances and Revisions

- OPEC's 2024 global demand growth forecast remains largely unchanged this month and is more than two times higher than that of the IEA and EIA, largely due to a stronger non-OECD demand outlook.

- The EIA upwardly revised its non-OPEC supply forecast for 2024 by 0.1 mb/d on a stronger Canadian forecast. In contrast, the IEA has revised its non-OPEC supply forecast downward by 0.2 mb/d on a lower Brazil outlook.

Evolution of 2024 Annual Demand Growth Forecasts

- EIA's 2024 global demand growth forecasts remain relatively stable, with a downward revision to OECD demand being offset by an upward revision to non-OECD demand.

- IEA lowered its global demand growth for a second consecutive month.

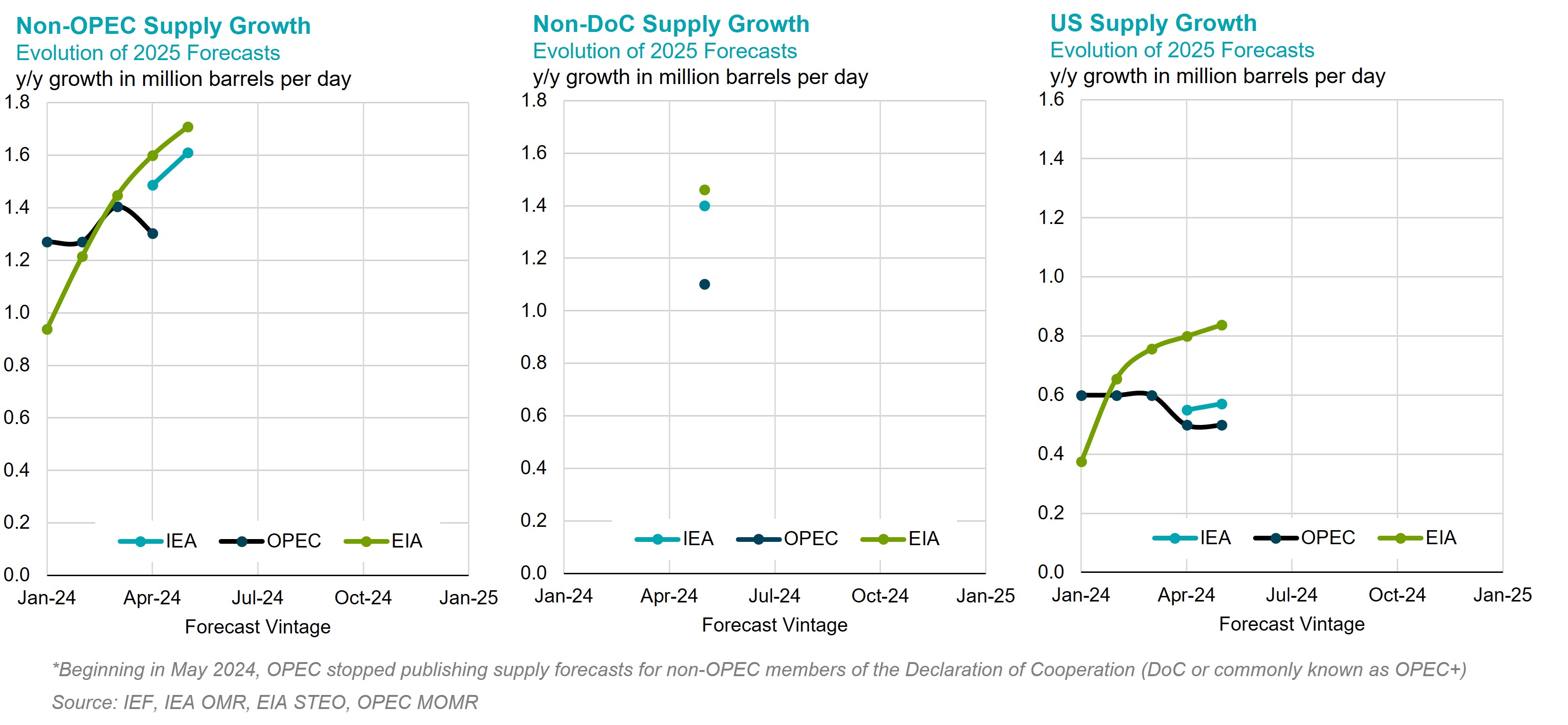

Evolution of 2024 Annual Non-OPEC Supply Growth Forecasts

- The EIA's year-on-year growth in non-OPEC supply has been revised higher for a second consecutive month, yet it remains below IEA’s.

- EIA sees the strongest 2024 non-DoC growth at 1.6 mb/d despite have the weakest US supply forecast.

- The IEA's forecasts for the US’s supply growth are equivalent to approximately 1.5 times those projected by the EIA and OPEC.

Summary of 2025 Balances and Revisions

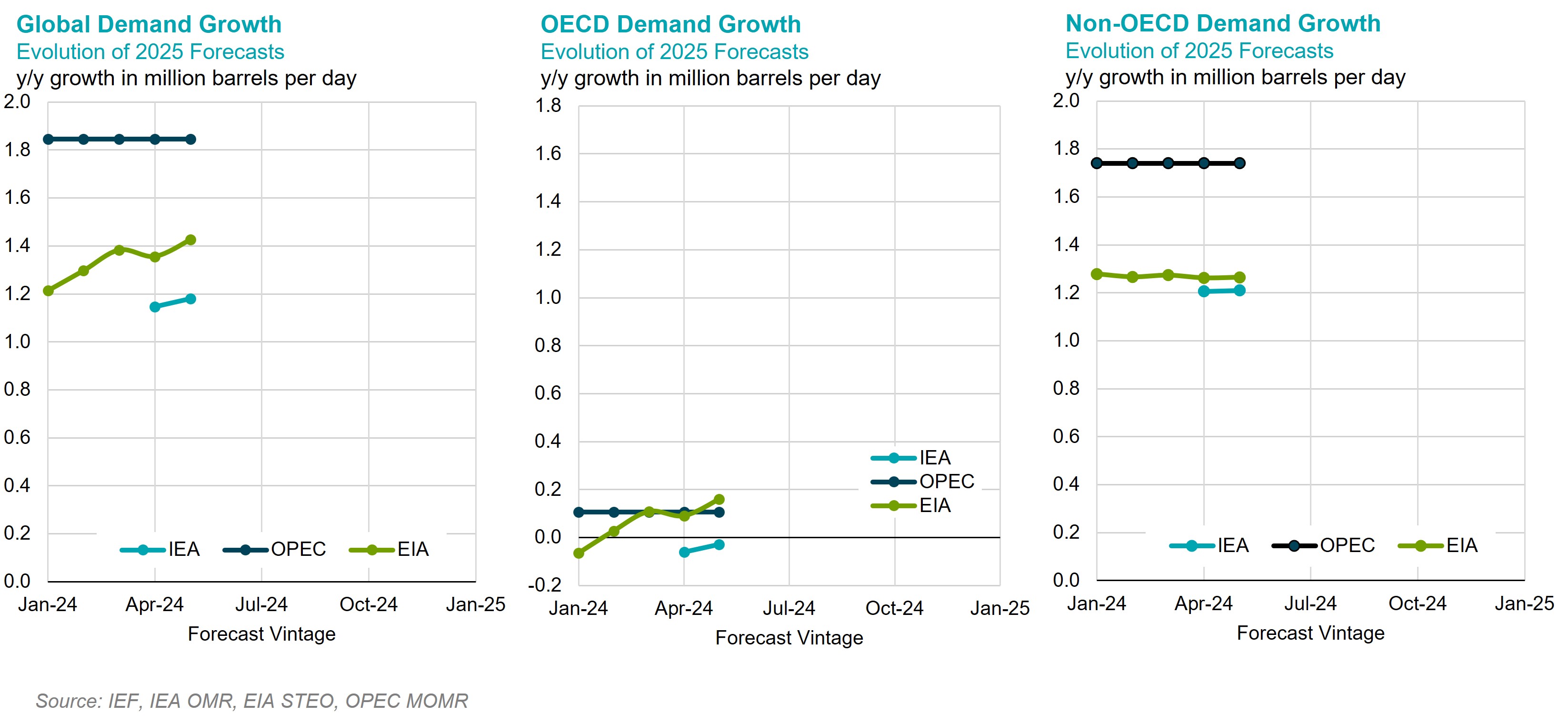

- The divergence in global oil demand forecasts among major agencies remains striking. OPEC's estimate for global demand levels is still 2 million mb/d higher compared to the IEA and EIA projections.

- The EIA has made a major upward revision to non-OPEC supply levels, particularly driven by revisions in supply forecasts from Canada, Guyana and others.

Evolution of 2025 Annual Demand Growth Forecasts

- OPEC's 2025 global demand growth forecast is 0.6 mb/d higher than the IEA's, due to OPEC's higher projections for demand growth in the Middle East and other non-OECD regions.

- IEA sees OECD demand contracting this year and in 2025.

Evolution of 2025 Annual Non-OPEC Supply Growth Forecasts

- For the fourth consecutive month, the EIA has revised upward its 2025 forecast for Non-OPEC supply growth. The EIA now projects nearly 0.1 mb/d stronger growth compared to IEA forecasts.

- EIA's forecast for the US oil supply growth is 0.34 mb/d stronger that developed by OPEC.