Comparative Analysis of Monthly Reports on the Oil Market

Wednesday 12 June 2024

Oil Market Context

Key points

Demand

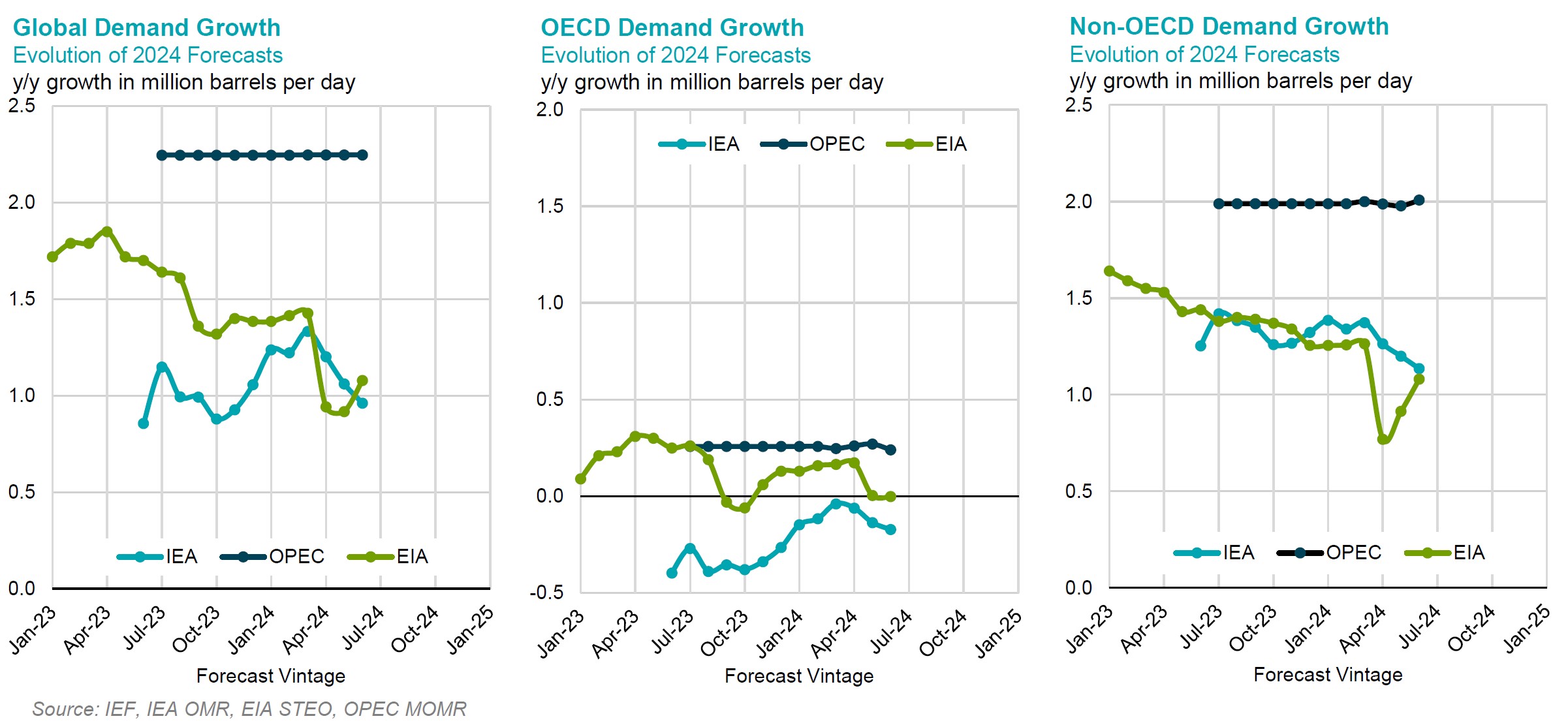

Short-term global oil demand forecasts continue to diverge reflecting growing uncertainty. OPEC projects 2.2 mb/d oil demand growth this year. The IEA and EIA, in contrast, predict 1 mb/d and 1.1 mb/d demand growth for 2024, respectively. The demand growth forecasts of the three organizations for 2025 range from 1.0 mb/d to 1.8 mb/d.

Supply

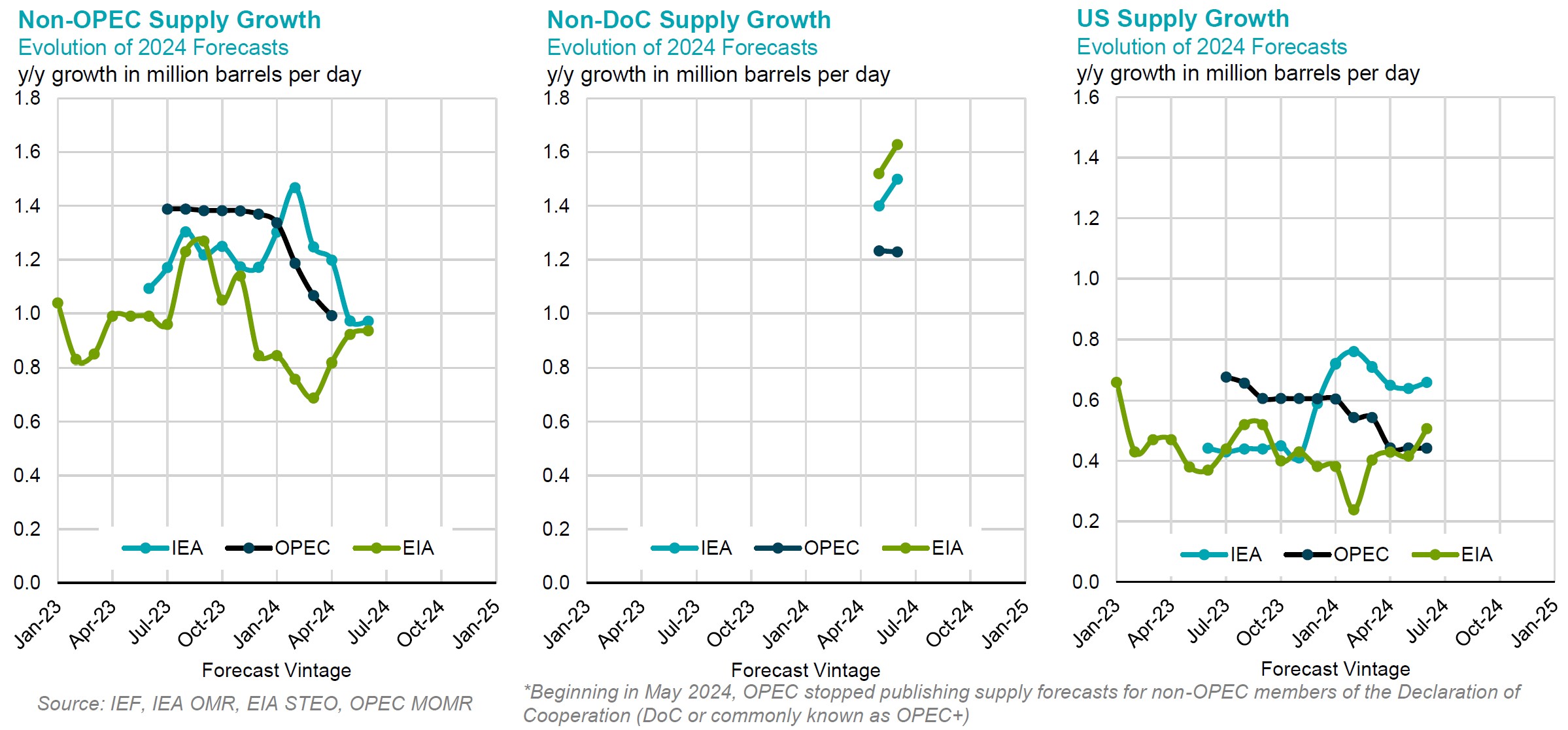

Non-DoC oil supply growth is forecasted to slow slightly from ~2.7 mb/d in 2023 to around 1.4-1.7 mb/d in 2024. The range between the three organizations supply forecasts is 0.4 mb/d in 2025. OPEC predicts non-DoC oil supply will grow by 1.4 mb/d in 2024 and 1.1 mb/d in 2025 driven by the US, Brazil, Canada, and Norway in both years. The EIA has kept their forecasts for non-OPEC supply growth at 2.4 mb/d in 2023 and 1 mb/d this year, accelerating to 1.7 mb/d in 2025, while the IEA revised up its non-OPEC supply forecasts for 2023, 2024 and 2025 by 0.1 mb/d.

Policy

The 37th OPEC and non-OPEC Ministerial Meeting took place on Sunday, June 2nd. Seeking to maintain oil market stability, the OPEC+ group agreed to extend the additional voluntary 2.2 mb/d cut until the end of September and then incrementally phase out this cut every month, subject to market conditions, from October 2024 until September 2025. Other collective official cuts and voluntary measures by individual members, amounting to 3.66 mb/d, were extended until the end of 2025. Total cuts still amount to 5.86 mb/d, currently.

Market responses appear to anticipate a gradual increase in supply from October. However, a multitude of mixed signals given by diverging global demand growth forecasts, macroeconomic indicators and interest rate policies cast uncertainty on how market conditions will evolve.

Risks

Supply chain disruptions, caused by conflict, geopolitical tensions, major accidents or maintenance have elevated energy security risks. A shutdown of a Norwegian gas pipeline to the EU, lead Northwest European gas prices to spike. Maintenance at a gas field in the East Mediterranean aggravated gas market shortages in the region.

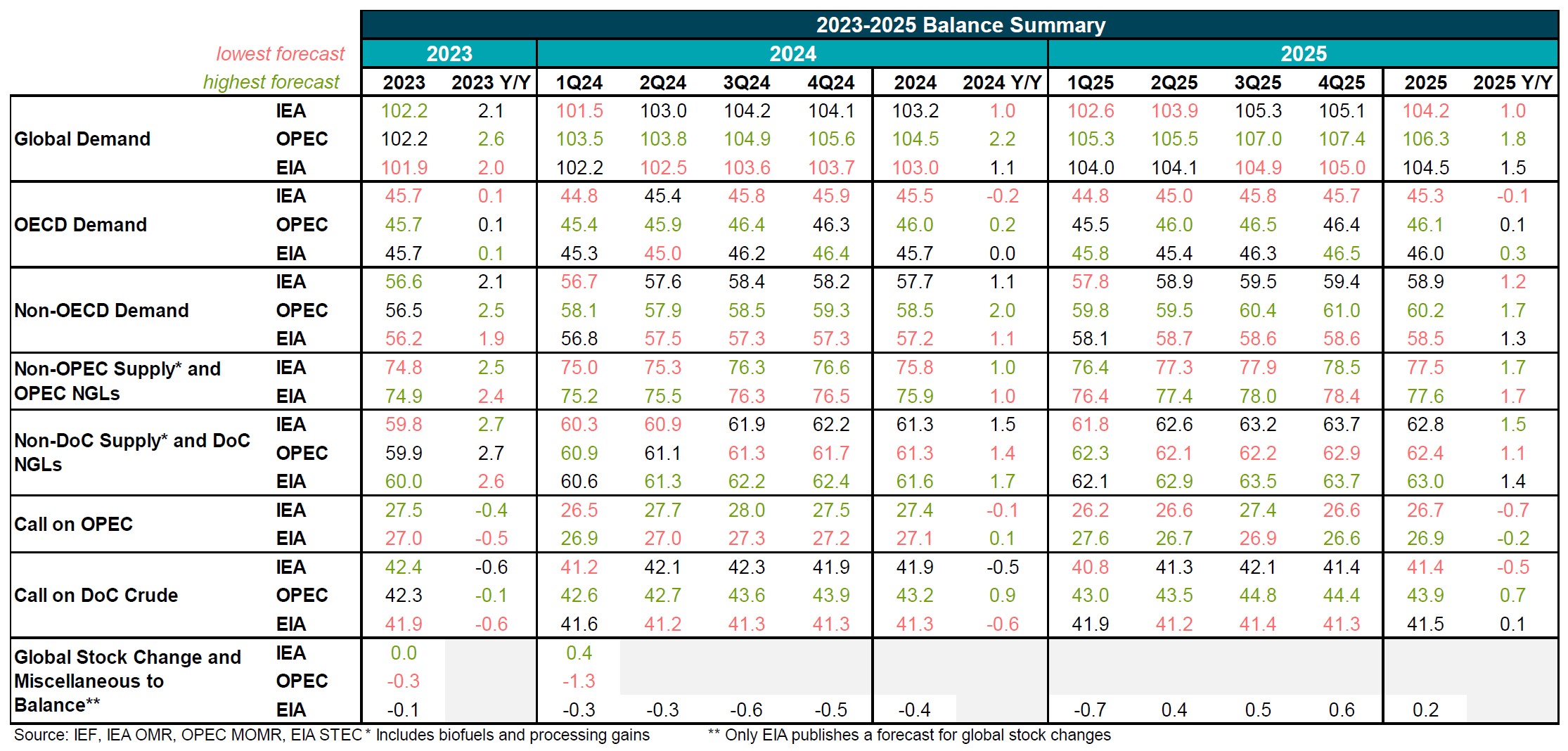

Summary of 2023-2025 Balances

- The divergence in global demand forecasts is shrinking marginally compared to previous months across IEA, EIA and OPEC assessments, with a range of approximately 1.2 mb/d projected for 2024, and a range of 0.8 mb/d expected for 2025.

- IEA and EIA have kept their forecasts for non-OPEC supply at ~2.4 mb/d in 2023 to 1 mb/d this year, accelerating to 1.7 mb/d in 2025.

- IEA and EIA see the Call on DoC falling in 2024 by 0.5-0.6 mb/d, while OPEC continues to see a significant increase of 0.9 mb/d y/y.

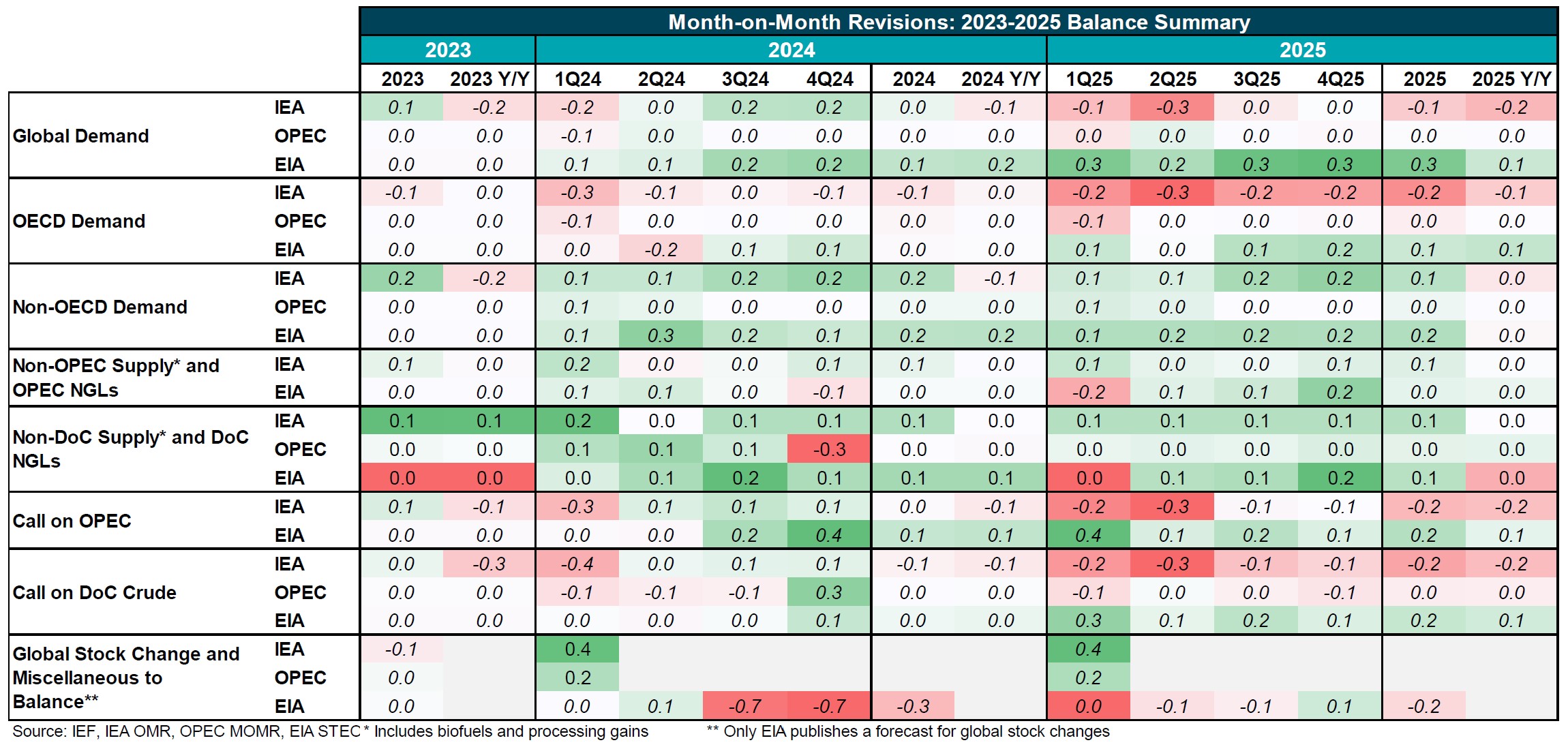

- OPEC released their forecasts with almost no change in global demand assessments, in comparison to last month's estimates. EIA revised up their forecasts for the second half of this year and next year while IEA revised their forecasts down by 0.1 mb/d in 2024 y/y and 0.2 mb/d in 2025.

- The EIA revised to its Q3 and Q4 2024 global demand forecast up by 0.2 mb/d and revised up the full year 2024 by 0.1 mb/d. The 2025 demand growth forecast shows also an upward revision of 0.3 mb/d.

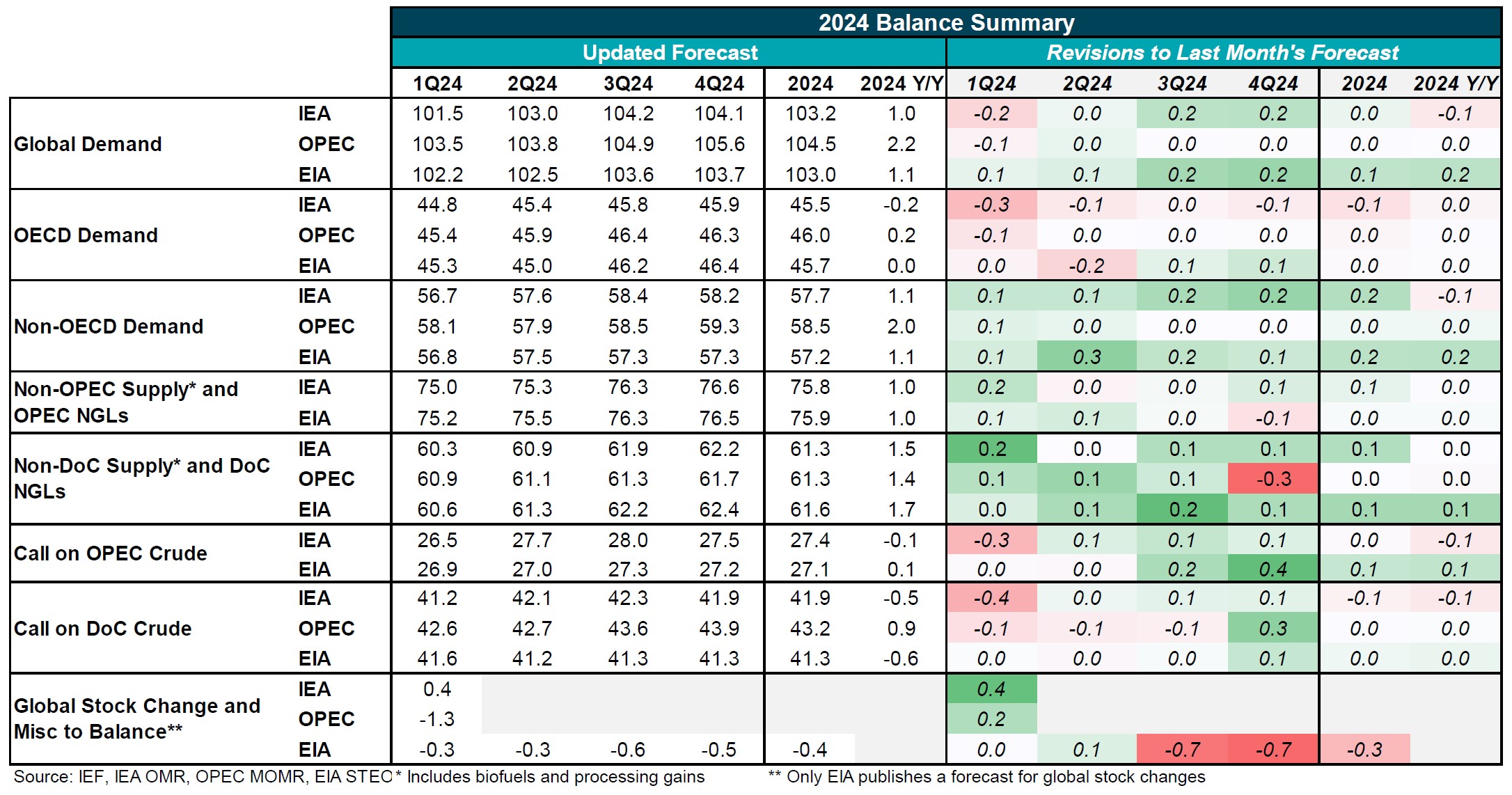

2024 Outlook Comparison

Summary of 2024 Balances and Revisions

- OPEC's 2024 global demand growth forecast remains largely unchanged this month and is still more than two times higher than that of the IEA and EIA, largely due to a stronger non-OECD demand outlook.

- OPEC revised downward their Non-DoC supply by 0.3 mb/d the 4Q 2024, while EIA and IEA revised upward by 0.1 mb/d.

Evolution of 2024 Annual Demand Growth Forecasts

- While OPEC has left its demand growth assessments unaltered, the EIA's 2024 global demand growth forecast shows a modest upward revision, based on a relatively stable position for OECD demand and a more significant upward revision to non-OECD demand.

- IEA lowered its global demand growth for a third consecutive month.

Evolution of 2024 Annual Non-OPEC Supply Growth Forecasts

- The EIA's year-on-year growth in non-OPEC supply has been revised higher for a third consecutive month, yet it remains below IEA's.

- EIA sees the strongest 2024 non-DoC growth at more than 1.6 mb/d.

- The IEA's forecast for US supply growth is still approximately 1.5 times those projected by OPEC and up to 150,000 b/d higher than those projected by EIA.

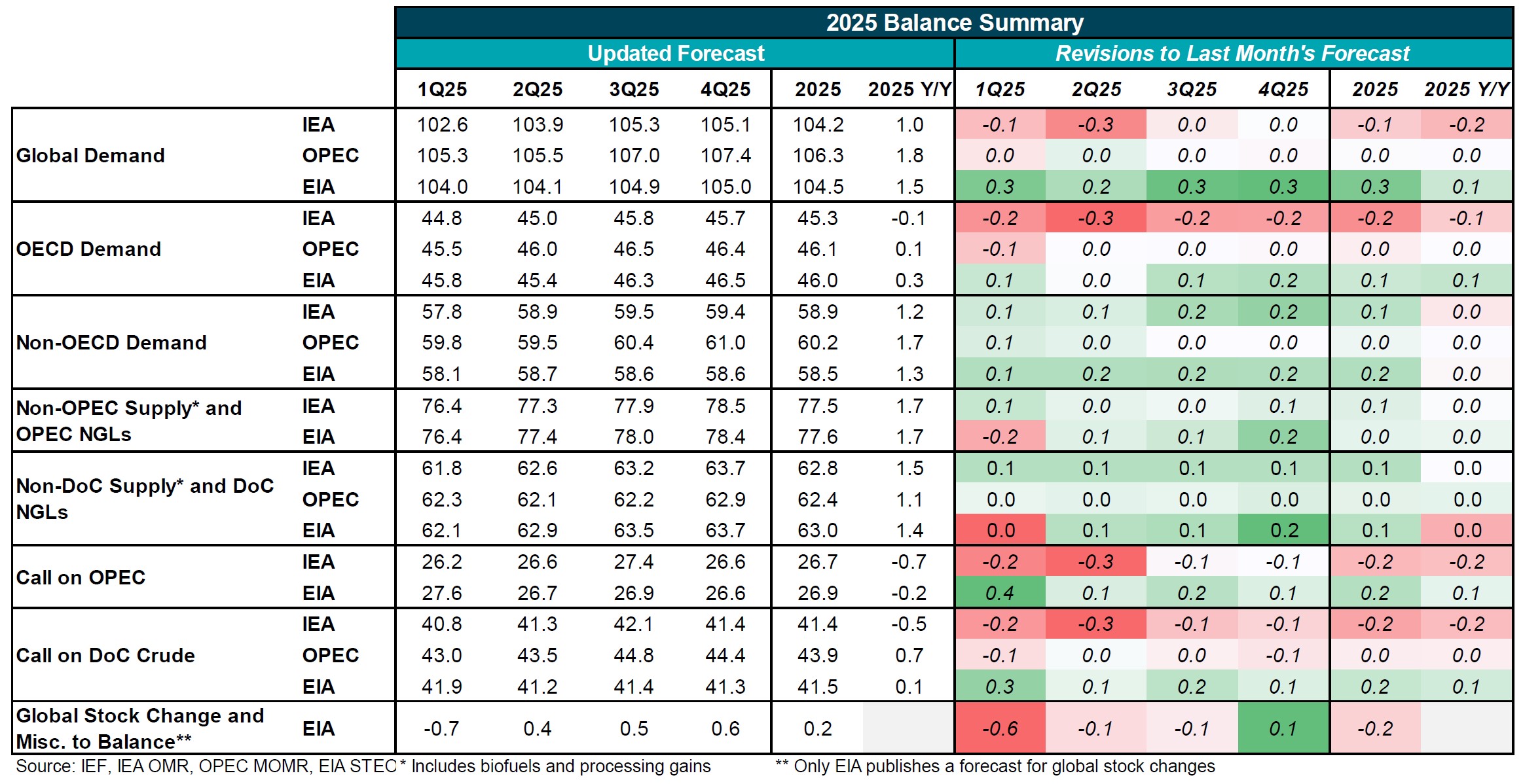

Summary of 2025 Balances and Revisions

- The divergence in global oil demand forecasts among major agencies remains striking. OPEC's estimate for global demand levels is still approximately 2 million mb/d higher compared to the IEA and EIA projections.

- The EIA has made an upward revision to global demand with an increase of 0.3 mb/d m/m.