What's the Target for Carbon Sequestration and How Do We Get There?

Carbon capture, utilization and storage (CCUS) is acknowledged as a critical element of climate action, helping to offset hard-to-abate emissions from heavy industry, aviation and other sectors. But the world’s current CCUS capacity is a fraction of what it needs to be to fulfil its potential. Here’s the scale of that challenge.

The Paris Agreement of 2015 aims to keep global average temperature rises to 2°C and ideally to within 1.5°C, a target that requires the world to reach net-zero greenhouse gas emissions by 2050. According to the IEA, meeting this net-zero 2050 target means reaching 1.7Gt CO2 capture capacity by 2030, including 1,150Mt CO2 per year in industry and power transformation alone: 370 Mt CO2 in industrial applications and 775Mt CO2 in fuel transformation. At present, the annual CO2 capture capacity from industrial and power facilities is just 40Mt CO2.

Although the consensus around the importance of CCUS in climate action has spurred its expansion - with momentum behind incorporating it into industrial 'hubs' like the Alberta Carbon Trunk Line - the current pipeline of projects falls far short of what is needed to meet climate goals.

How are we doing?

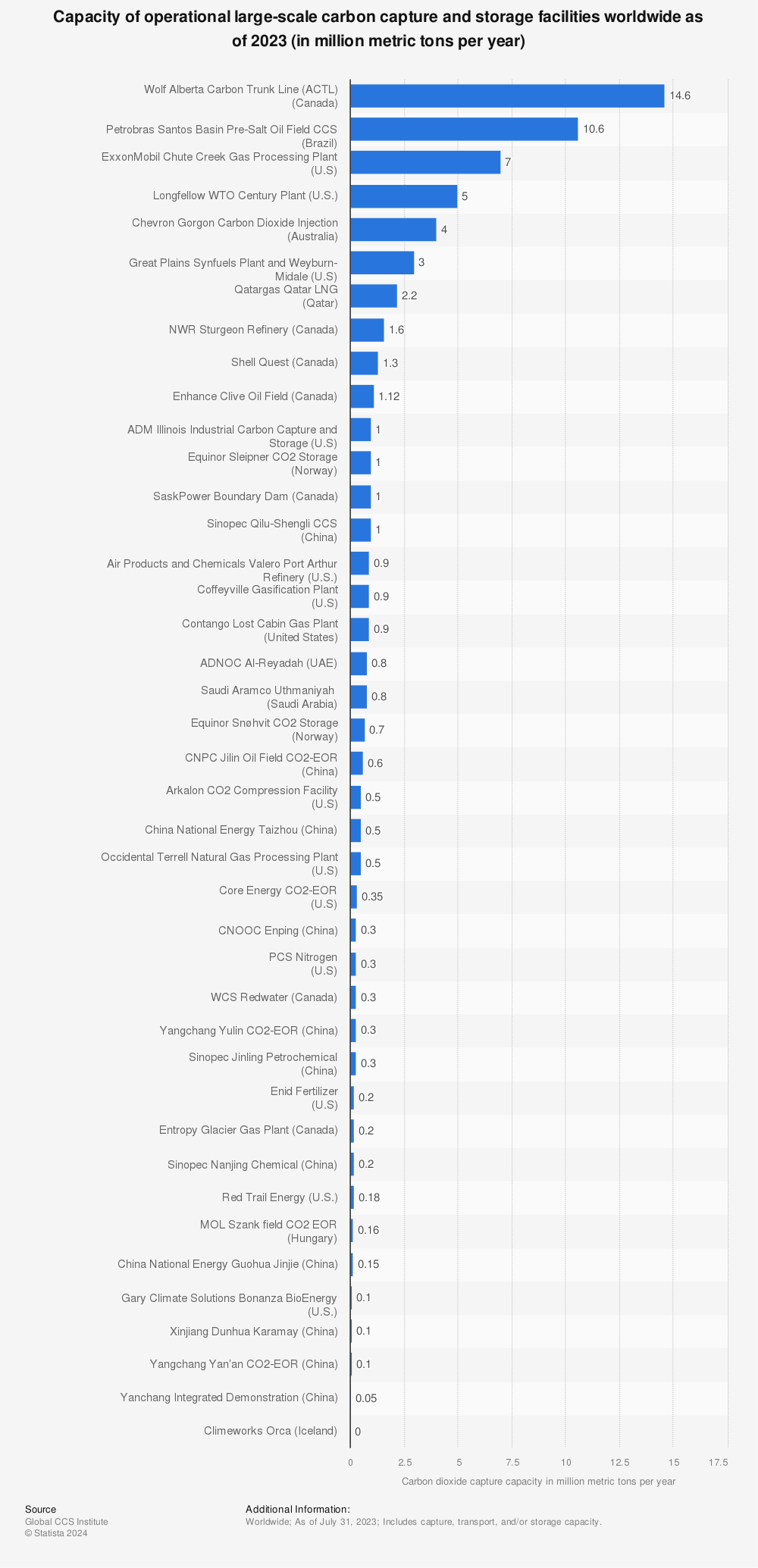

In 2021, there were 27 fully operational CCUS facilities, with many at earlier stages of deployment. The largest is ExxonMobil's Shute Creek Gas Processing Plant in Wyoming, which has storage capacity of 7 MtCO2 per year.

Although CCUS deployment has so far been limited, there is reason to be hopeful - the start of this decade marked an unprecedented spike in CCUS investment, with more than 100 new CCUS facilities announced in 2021 alone. According to estimates from the Global CCS Institute, capacity in development reached 111Mt CO2 per year in September 2021, a 48 percent increase on the year before. There are now 135 commercial CCUS facilities in the project pipeline, mainly in the US, and spanning sectors such as cement, steel, hydrogen, direct air capture (DAC) and power generation.

Recent analysis by the Global CCS Institute identified 'networks' – local clusters of CO2 emission sources that share transport and storage infrastructure – as the most low-risk and cost-effective approach to CCUS. In particular, sharing costs can reduce the economic barriers that otherwise prevent small-scale emitters from employing CCUS. This approach is gaining traction, including in Canada's Alberta Carbon Trunk Line and Norway's Longship Project.

Meanwhile, pilot and demonstration projects are exploring other approaches in the pursuit of commercial viability. Japan is exploring CCUS technology and safety with its Tomakomai CCS Demonstration Project. In the UK, Drax Power Ltd is operating two pilot bioenergy with carbon capture and storage (BECCS) facilities at its North Yorkshire power station. It's part of what is hoped will become the world's first net-zero industrial cluster by 2040, using a purpose-built CO2 and hydrogen pipeline network.

The trillion-dollar challenge

For CCUS to fulfil its promise, current momentum in CCUS investment must be maintained. To an extent, costs and risk can be kept as low as possible by focusing on CCUS networks, which have the potential to be more efficient than standalone facilities. However, there is no denying that the scale of the challenge is vast - and will require vast investment. The Global CCS Institute estimates that scaling up CCUS capacity will require US$665-1,280bn in capital investment by 2050.

In September 2021 an IEF Dialogue Insight Report on Strategies to Scale Carbon Capture, Utilization and Storage found that CCUS deployment must reach at least 5.6 Gigatons (Gt) of CO2 by 2050 to meet the Paris Agreement and UN Sustainable Development Goals.

Realizing this investment will require powerful incentives, as such a large capital requirement is beyond what governments are willing to pay in the relatively short timeframe required. Governments can help by guaranteeing a reliable source of revenue for CCUS projects and mandating specialist financial bodies to provide an alternative to the conventional corporate finance model.